AfrAsia Bank Limited and its Group Entities

Annual Report 2015

page 156

FINANCIAL HIGHLIGHTS – YEAR UNDER REVIEW

AfrAsia Bank Limited (The Bank) closed its 8

th

financial year ending 30 June 2015 reporting a satisfactory Net Profit after Tax of MUR 175m,

while maintaining a solid statement of financial position consolidating its capital base and gaining on market share across all its core

business segments of:

C

orporate and Investment Banking

Global Business

Private Banking and Wealth Management

Treasury

Despite a volatile global economic environment coupled with conflicting interest rate direction, on a year-over-year basis, AfrAsia Bank

Limited reported a steady growth in its net interest income from MUR 659m to MUR 861m in the year under review, along with net fee

income growth of 34% as compared to the same period in the last year. Net trading income growth was strong, with an increase of almost

92% over the previous year. The Bank also fully provided for its remaining exposure on its Zimbabwean investment, which was closed due

to persisting liquidity challenges in Zimbabwe during the year under review. Such an exposure has affected the statement of profit or loss

and other comprehensive income of the Bank by MUR 707m during the year.

On the assets side, the Bank successfully grew its loan book by MUR 4,3bn across both segments while maintaining a relatively conservative

overall loan to deposit ratio of 32%, reflecting its objective of meeting credit demand while maintaining assets quality in its loan portfolio.

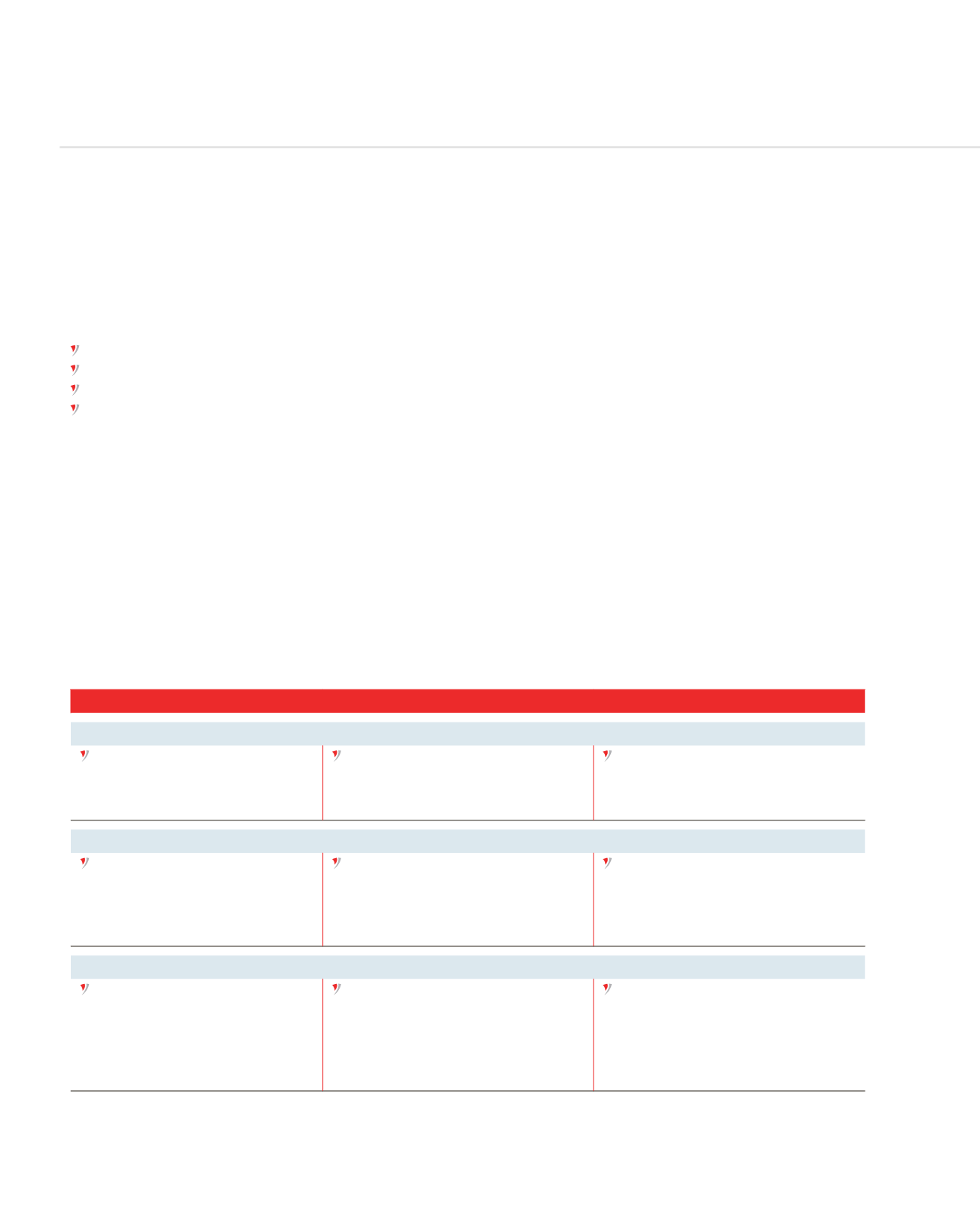

CURRENT YEAR PERFORMANCE AGAINST OBJECTIVES AND FUTURE GROWTH

OBJECTIVES FOR 2014/15

PERFORMANCE FOR 2014/15

OBJECTIVES FOR 2015/16

Statement of Comprehensive Income – Operating Income

Budgeted operating income

for 2014/15 stands at MUR 1,3bn,

main contributor being

Net Interest Income

Objective has been successfully realised with

an operating income of MUR 1,6bn for the

financial year 2014/2015.

The Bank’s aim is to achieve an operating

income of at least MUR 1,9bn for 2015/16.

Statement of Comprehensive Income – Operating Expenses

Operating expenses are expected to

remain as low as MUR 653m with an

increase of 31% from actual expenses.

Well-managed operating expenses were kept

within MUR 590m for the year under review.

While continuing to invest in IT infrastructure,

premises and human resources, operating

expenses are expected to remain as low as

MUR 768m, that is, an increase of 30% from

2014/15.

Statement of Financial Position – Loans and Advances

Loans and Advances are expected to

stand at MUR 22,1bn.

Slightly under its forecast, customer loans

and advances reached MUR 21,7bn by the

end of the financial year.

The Bank will seek to increase its very

conservative current loans-to-deposits ratio

from 32% in 2015 to reach 43% in 2016, that

is, with an aim to achieve customer loans and

advances of MUR 32,9bn by the end of June

2016.

MANAGEMENT DISCUSSION AND ANALYSIS (CONTINUED)