AfrAsia Bank Limited and its Group Entities

Annual Report 2015

page 154

Developments over the financial year

Since it was wholly acquired by AfrAsia Bank Limited, ACM

has been on the path of a major restructuring venture.

The headcount has increased to 20 as at 30 June 2015, with a team

of 10 investment specialists backed by the Operations and Finance

teams.

In line with its usual innovative streak, ACM has launched a new CIS –

AfrAsia Partners Fund - to cater for investors looking for “patrimonial

investment solutions”. The Fund also addresses the need of investors

looking for an all-rounder fund, that is, an investment vehicle that

holds a selection of funds encompassing equity securities, equity

related securities, and fixed-income instruments of companies

worldwide, to generate capital appreciation.

Drawing on the expertise and experience of the investment

team, ACM has managed to successfully steer its funds amidst

accrued volatility in the financial markets over the past year with

performances as shown below:

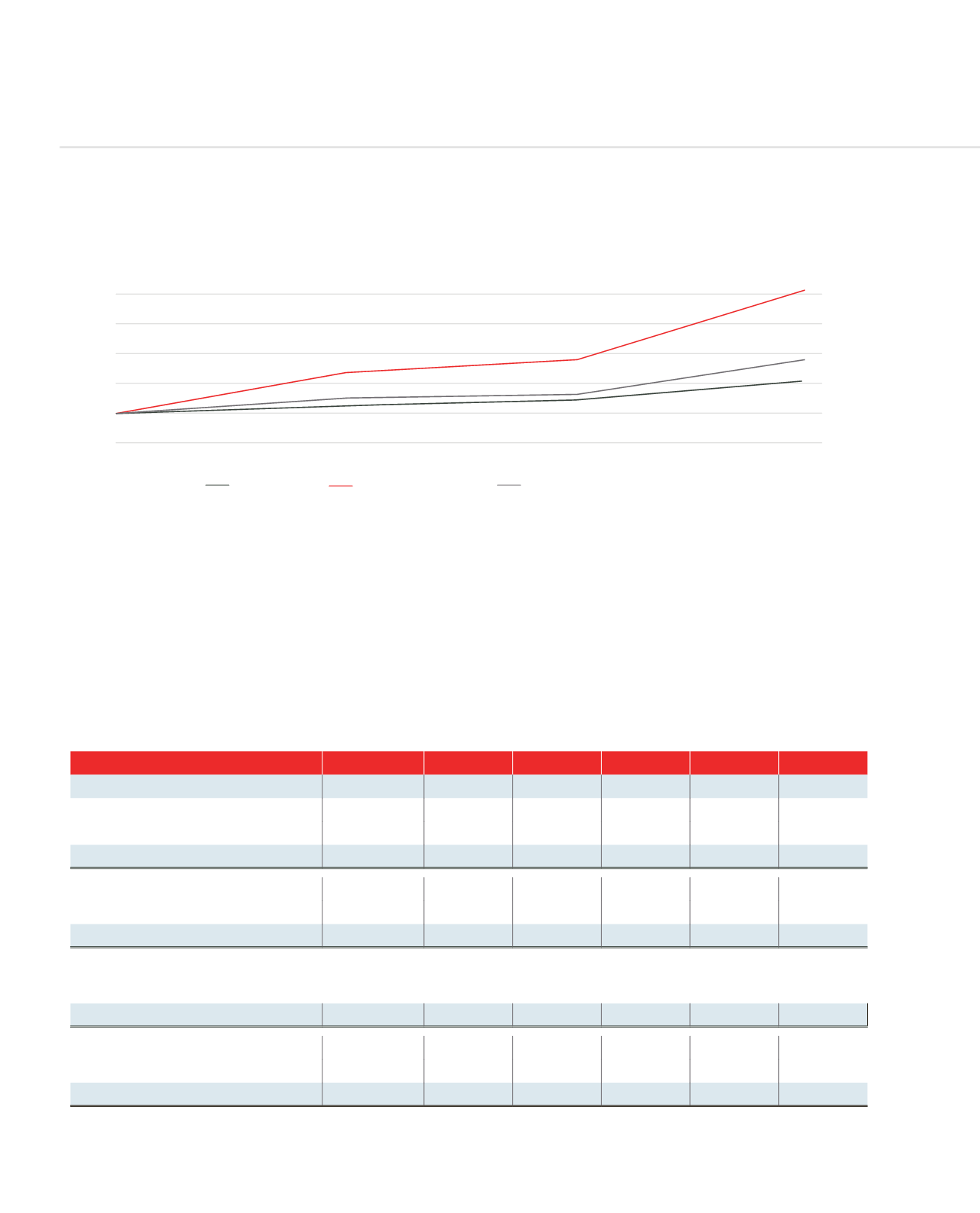

CUMULATIVE GROWTH IN REVENUE, AUM AND PROFIT AFTER TAX

ACM FUNDS**

LAUNCH DATE CURRENCY 6-MONTHS 1-YEAR 3-YEARS 5-YEARS

EQUITY FUNDS

ACM Aussie Growth Fund

1-Jun-00

AUD

5.45%

2.91%

36.33%

25.92%

ASX 200

0.89%

1.17%

33.32%

26.91%

Alpha

4.57%

1.73%

3.01%

-0.98%

ACM European Fund

1-May-05

EUR

13.59%

15.13%

39.18%

48.08%

Eurostoxx 2000

10.44%

10.69%

48.23%

52.63%

Alpha

3.15%

4.44%

-9.06%

-4.55%

ACM India Focus Fund

1-Jan-11

USD

8.28%

36.33%

82.45%

N/A

BSE 200 ($ adjusted)

1.41%

5.57%

44.56%

N/A

Alpha

6.87%

30.75%

37.89%

N/A

ACM Global Equity Fund*

21-May-13

USD

1.53%

2.65%

35.81%

72.16%

MSCI AC World

1.53%

-1.22%

35.69%

57.88%

Alpha

0.00%

3.87%

0.12%

14.28%

* Fund performance prior to the launch date has been back-tested based on the fund’s investment strategy

** AfrAsia Parthers Fund was launched in April 2015, and only 3-months’ performance is available to-date

MANAGEMENT DISCUSSION AND ANALYSIS (CONTINUED)

0%

100%

200%

300%

400%

500%

600%

June-12

June-13

June-14

June-15

100%

237%

280%

514%

287%

167%

151%

124%

144%

214%

Aum

Profit after tax

Revenue