AfrAsia Bank Limited and its Group Entities

Annual Report 2015

page 158

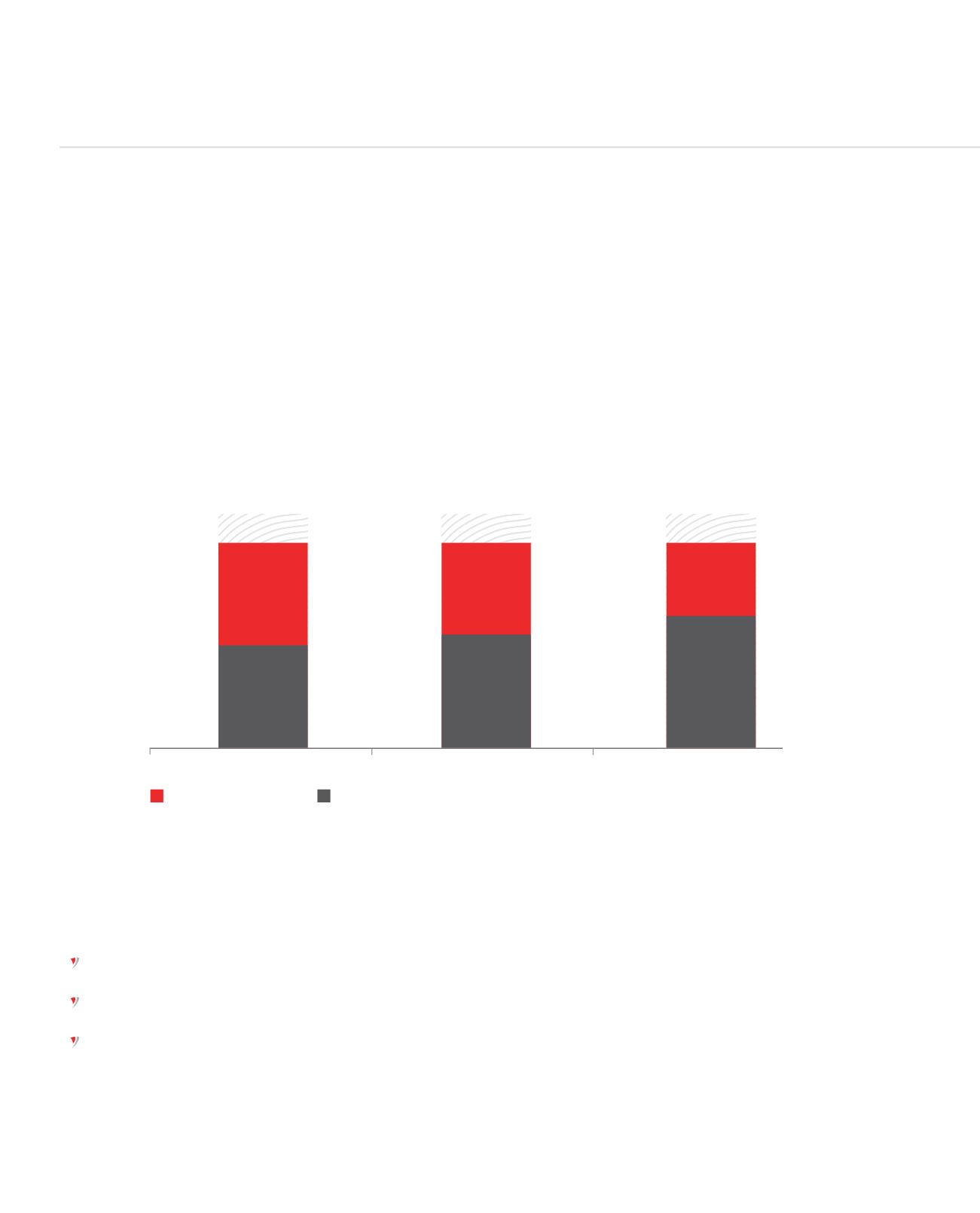

REVENUE GROWTH

Net Interest Income

Despite a volatile global economic environment coupled with conflicting interest rate direction, on a year-over-year basis, AfrAsia Bank

Limited reported a steady growth in its net interest income from MUR 659m to MUR 861m in the year under review. This growth can be

noted across both Segment A and B, that is 18% and 40%, from 2014 to 2015.

Interest income earned from customer loans and advances of MUR 1.1bn constitute the major part of the Bank’s total interest income at

70% and total interest income represents a growth of 19% over the previous year. Conversely, the Bank paid MUR 749m as interest expense

for the year, with the major part attributed to interest paid to customer deposits of MUR 663m. This represents an increase of 10% over

the previous year.

Non-Interest Income

The Bank’s non-interest income grew year-over-year to reach MUR 786m for the 12 months ended June 2015. The 3 main components of

same are as follows:

fee income, which is mainly attributed to fees earned from loans, grew by 34% from 2014 to 2015, with a net fee of MUR 213m for the

year under review.

net gain on financial investments held-for-trading and foreign exchange gain income was strong, recording an increase of almost 92%

over the previous year.

of note, out of the MUR 102m from “other operating income”, MUR 45m is attributed to dividends received from its subsidiaries.

54

46

43

57

100

80

60

40

20

0

2013

Segment A

2014

2015

Segment B

39

61

MANAGEMENT DISCUSSION AND ANALYSIS (CONTINUED)

NET INTEREST INCOME (%)