AfrAsia Bank Limited and its Group Entities

Annual Report 2015

page 155

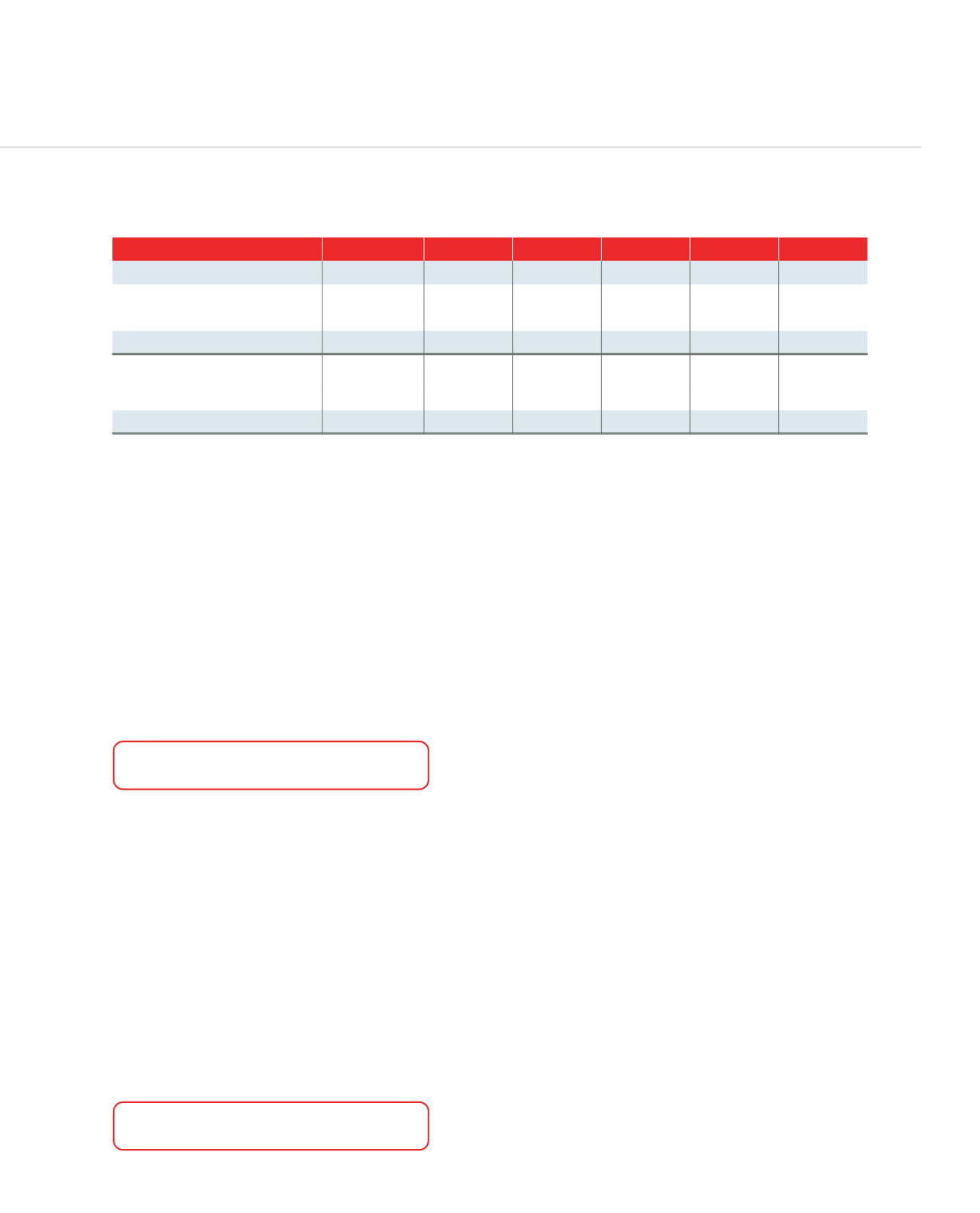

* Fund performance prior to the launch date has been back-tested based on the fund’s investment strategy

** AfrAsia Parthers Fund was launched in April 2015, and only 3-months’ performance is available to-date

ACM has continued to build its product offering and in this respect, the Company has teamed up with several renowned asset

management houses. ACM maintains regular contact with these fund managers via conference calls and shared access to

their research database, thereby enhancing the portfolio management expertise of ACM and assisting in delivering appreciable

performance.

Looking Forward

ACM has come a long way since its major restructuring over the last quarter of 2013 and has reached its cruising speed. With the

team now fully integrated and continued synergy with the AfrAsia Group, ACM seeks to conquer new market ground and maintain

its reputation in providing innovative investment solutions.

AFRASIA CORPORATE FINANCE

AfrAsia Corporate Finance (ACF) is a niche, independent corporate finance adviser; providing clients with innovative structuring

and financial solutions. The AfrAsia Corporate Finance Team based in Johannesburg, South Africa, consists of Marisa Meyer and

Llewellyn Gerber; together they bring nearly three decades of experience.

Collectively, Marisa and Llewellyn have broad and deep experience in a variety of disciplines, ranging from Investment banking,

Capital Raise and Tax Advisory to Debt Capital Markets, Valuations and Fairness Opinions as well as M&A advisory.

ACF has been instrumental in prepping, executing and delivering on many strategic and multifaceted business transactions. Their

approach to partner with their clients rather than acting solely as advisors, coupled with their experience, connections and skillset,

means they are able to provide their clients across the African continent with a range of appropriate solutions, all the while offering

them the satisfaction that all their business requirements will be met.

ACM FUNDS

LAUNCH DATE CURRENCY 6-MONTHS 1-YEAR 3-YEARS 5-YEARS

BOND FUNDS

ACM Global Bond Fund*

20-Nov-13

USD

-0.67%

-2.23%

9.06%

17.85%

Barclays Global Aggregate Index

-3.08%

-7.09%

-2.40%

10.80%

Alpha

2.41%

4.86%

11.46%

7.05%

ACM High Yield Fund

29-Jun-12

MUR

3.14%

7.05%

20.39%

N/A

AfrAsia Savings Rate + 2%

2.59%

5.28%

16.90%

N/A

Alpha

0.55%

1.77%

3.49%

N/A

AFRASIA CAPITAL MANAGEMENT AFRASIA CORPORATE FINANCE