AfrAsia Bank Limited and its Group Entities

Annual Report 2015

page 159

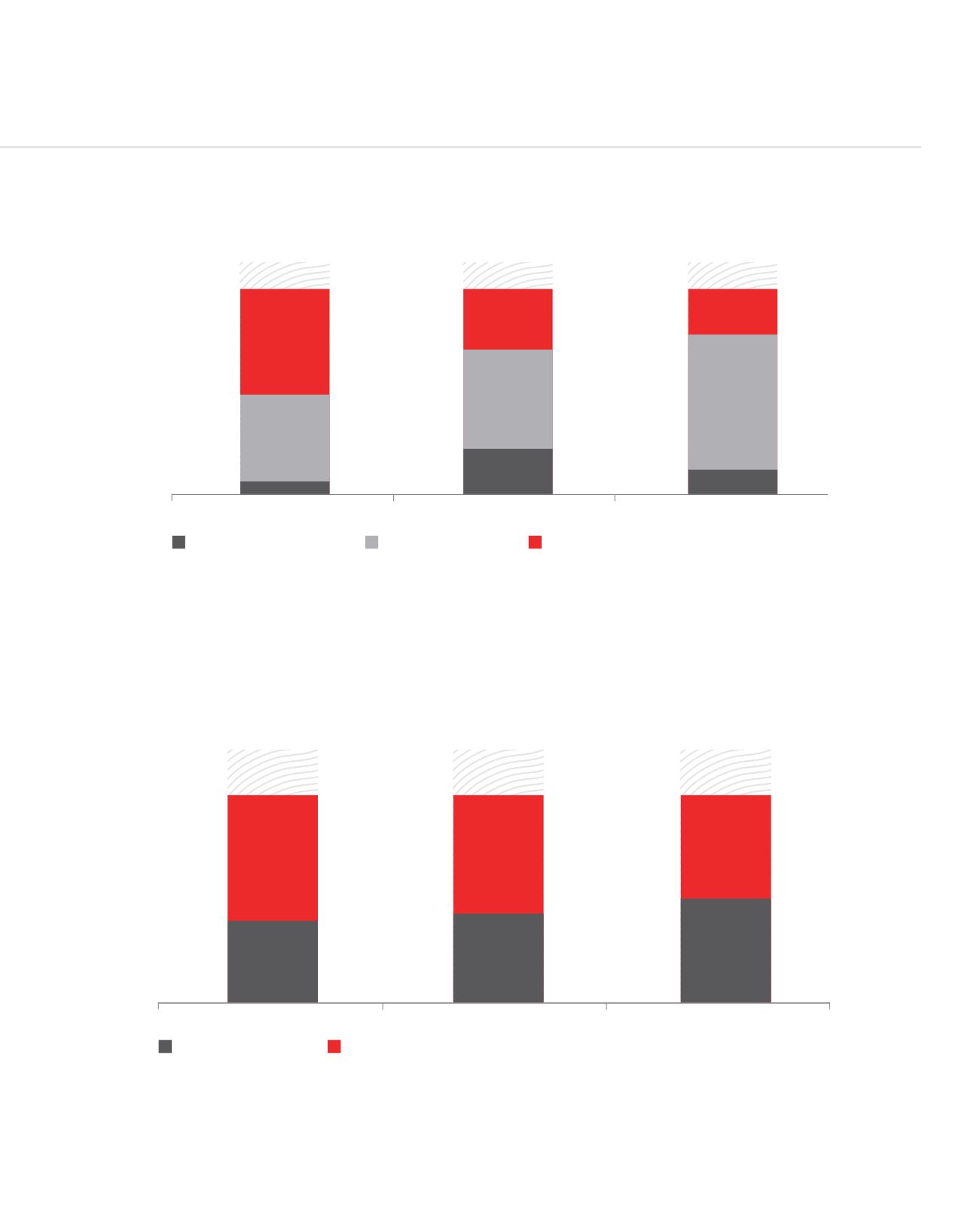

Cost Control

While maintaining a well-managed cost control policy which resulted in a drop in the cost to income ratio from 42% to 36% between

2014 and 2015, the Bank, in parallel, continued to recognise the importance of investing in its brand, both locally and internationally,

its human and intellectual capabilities, resources and IT infrastructure, for the year 2014/15, MUR 294m was invested in staff costs

and MUR 296m in other overheads.

The Bank also fully provided for its remaining exposure on its Zimbabwean investment, which was closed due to persisting liquidity

challenges in Zimbabwe during the year under review. Such an exposure has affected the statement of profit or loss and other

comprehensive income of the Bank by MUR 707m during the year.

52

45

3

31

47

22

100

80

60

40

20

0

2013

2014

2015

Other operating income

Net trading income

Net fee income

27

60

13

61

39

58

42

100

80

60

40

20

0

2013

Other overheads

2014

2015

Personal expenses

50

50

OVERHEADS (%)

NON-INTEREST INCOME (%)