AfrAsia Bank Limited and its Group Entities

Annual Report 2015

page 161

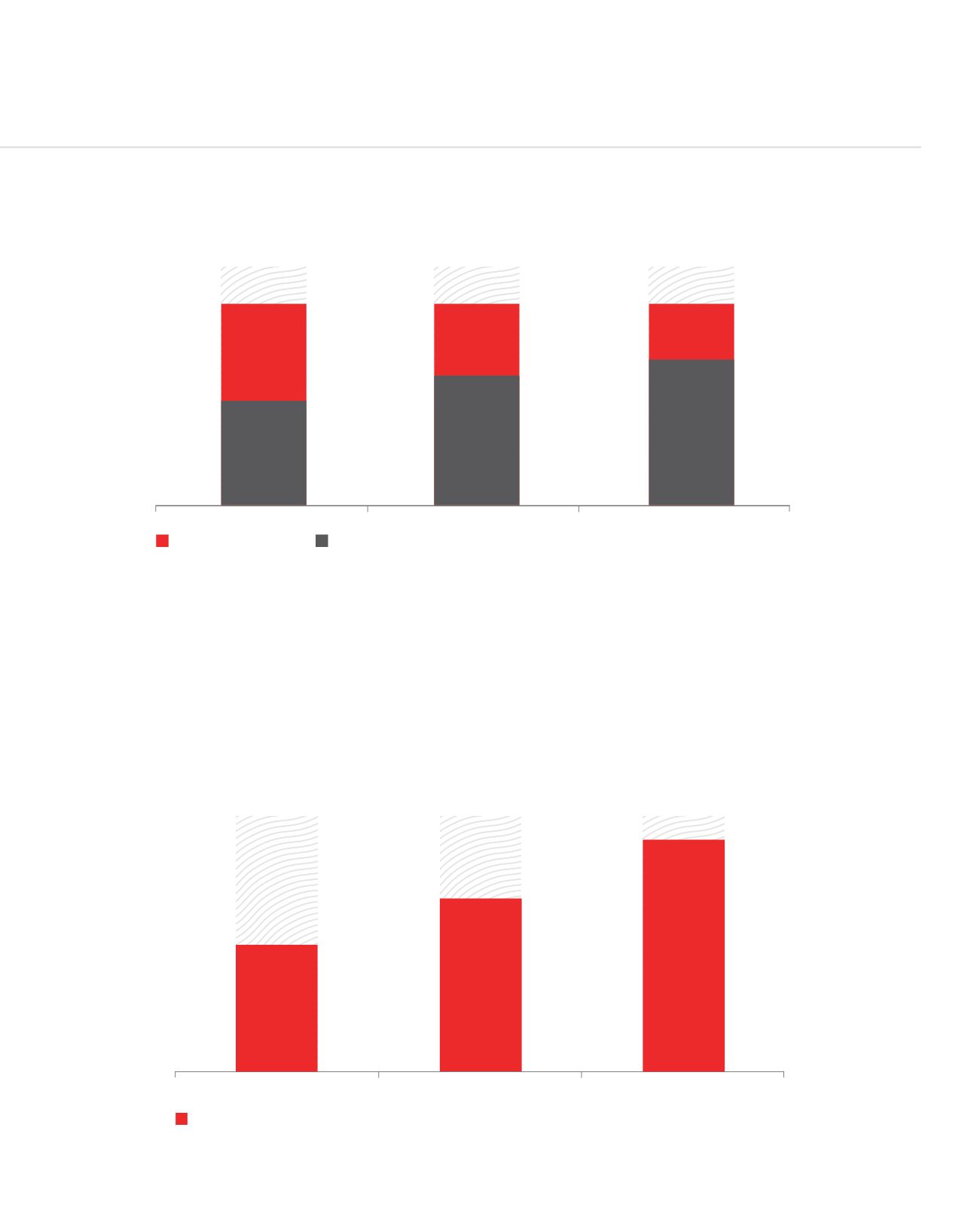

46

54

36

64

100%

80%

60%

40%

20%

0%

2013

Segment A

2014

2015

Segment B

27

73

Capital Resources

The Bank’s capital base was strengthened with the coming on board of a shareholder of international renown namely, the National

Bank of Canada which, as at June 2015, became the Bank’s 2

nd

largest shareholder with a 17.5% stake. Capital adequacy ratio of

13.7%, under Basel III also reflected a well-positioned statement of financial position. Of note, the Bank fully recognised its Class A

shareholders’ entitlement to their dividends according to the terms and conditions of the Class A shares programme memorandum

and paid its Ordinary shareholders an amount of MUR 1.65 per share during the year ending June 2015.

TOTAL CAPITAL UNDER BASEL

3,500

4,500

5,000

4,000

3,000

2,500

2,000

1,500

1,000

500

0

2013

2014

2015

Shareholders’ fund (MUR ‘m)

2,698

3,497

4,913

CAR = 12.5%

CAR = 13.1%

CAR = 13.7%

DEPOSITS (%)