AfrAsia Bank Limited and its Group Entities

Annual Report 2015

page 153

ACM caters to the needs of High Net Worth Individuals (HNWIs) through its comprehensive portfolio management service which

encompasses investment advisory and monitoring to assist clients in meeting their financial goals on both a discretionary and non-

discretionary basis, and by providing access to global markets, various asset classes and innovative products.

Under its CIS Manager licence, ACM manages seven in-house funds and strives to cater for different risk profiles by having each CIS

focus on a different region and by offering both equity and bond funds. ACM also has a long history in constructing and managing

pension portfolios and delivering consistent above average returns.

ACM continues to pursue its expansion while endeavouring to offer quality service to clients.

Financial highlights

Financial performance during the year ended 30 June 2015 remained healthy with Profit after Tax increasing by 84% year-on-year,

backed by a commendable growth of 49% in Assets under Management (AUM).

Leveraging on its product offering, extensive experience in delivering superior investment return and strong in-house investment

capabilities, ACM has successfully grown its business both in terms of assets under management and bottom line over the last three

years. The growth witnessed by ACM has accelerated over the last 2 years. Along with growing the business, it strived to maintain a

sustainable and diversified source of income.

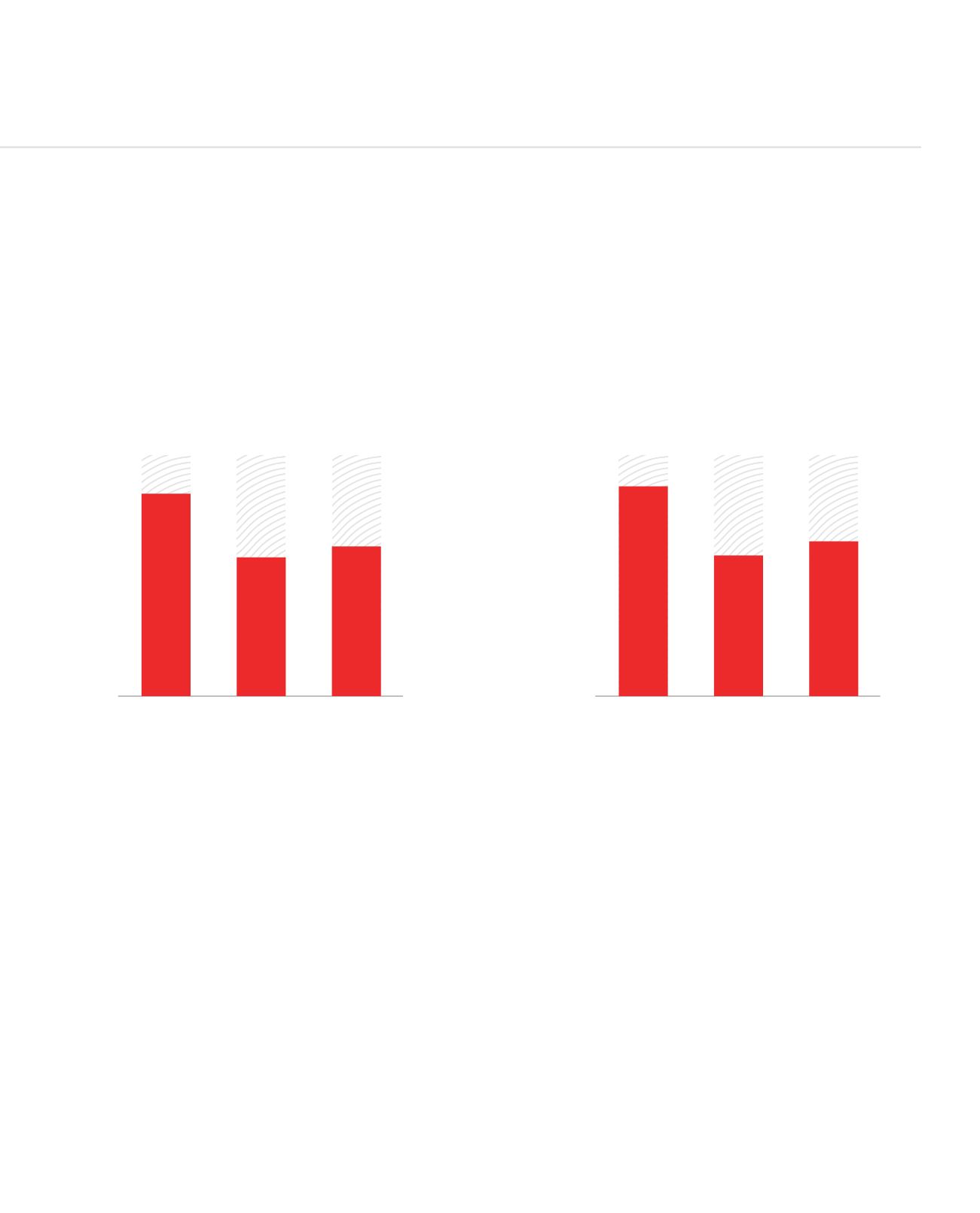

For the period June 2012 - June 2015, ACM has registered a growth of 114% and 187% in AUM and Revenue, respectively. Profit after

Tax witnessed a growth of 414% for the corresponding period. The Company’s Return on Equity and Return on Capital Employed have

averaged 86% and 103% respectively over the last three years.

RETURN ON EQUITY (%)

RETURN ON CAPITAL EMPLOYED (%)

June-13

June-14

June-15

106%

73%

78%

June-13

June-14

June-15

128%

86%

95%