AfrAsia Bank Limited and its Group Entities

Annual Report 2015

page 157

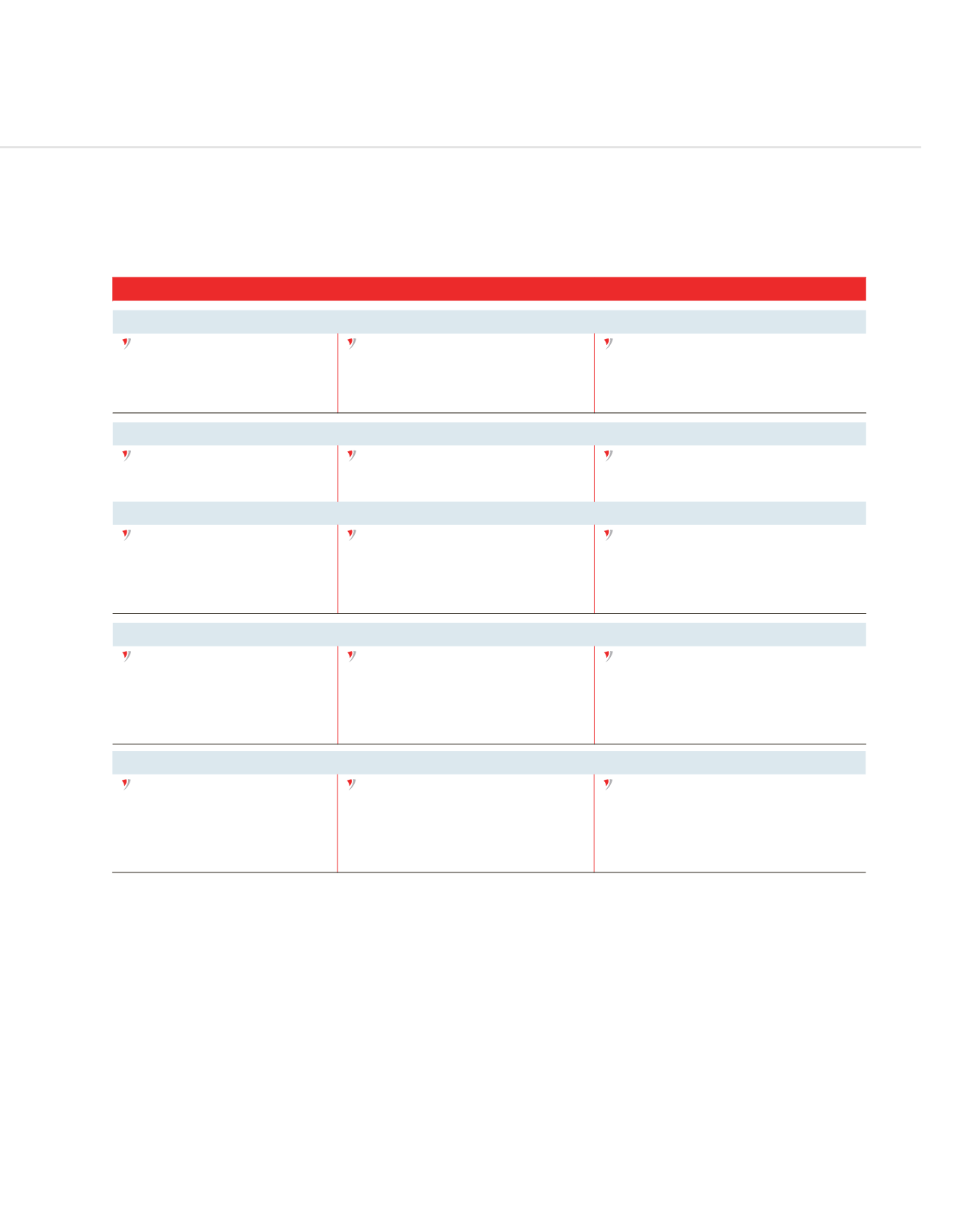

CURRENT YEAR PERFORMANCE AGAINST OBJECTIVES AND FUTURE GROWTH

(CONTINUED)

OBJECTIVES FOR 2014/15

PERFORMANCE FOR 2014/15

OBJECTIVES FOR 2015/16

Statement of Financial Position – Deposits Growth

Deposits are to continue their rising

trend to reach MUR 44,3bn.

The Bank realised a noticeable growth in

its customer deposits base to reach

MUR 66,9bn by the end of June 2015, that

is, a growth of 63%.

While maintaining its existing customer base

and gaining on market share, the Bank aims

to increase its deposit base to MUR 77,1bn by

the end of June 2016.

Statement of Financial Position – Asset Quality

Non-performing loans are expected

to return to 1% of gross loans.

Non-performing loans as a percentage

of gross loans amounted to 5.2% by June

2015.

The Bank expects its non-performing loans to

be 2.9% of its gross loans.

Statement of Financial Position – Capital Management

Capital adequacy ratio is expected

to remain above the regulatory

requirement of 10%. New Basel III

ratios will be implemented during

the year.

The Bank remained well capitalized and

achieved a capital adequacy ratio of 13.7%

under Basel III.

The Bank will achieve a capital adequacy

ratio above the minimum regulatory capital

requirements under the Basel III provisions.

Performance Ratio – Return on Average Equity

Return on average equity for the

Bank is targeted to be above 19.33%

The Bank’s return on average equity stood

at 6.5% for the year under review. This is

lower than the target due to “exceptional”

negative impact resulting from the

impairment of its overseas subsidiary.

Return on average equity for the Bank is

targeted to be above 20%.

Performance Ratio – Cost to Income

Cost control was expected to

bring a cost to income ratio of

under 50%.

Well monitored cost control policy along

with increased income contributed in a

conservative cost to income ratio of 36%.

The Bank will continue to maintain a cost

control policy while continuing to invest in

core resources.