AfrAsia Bank Limited and its Group Entities

Annual Report 2015

page 160

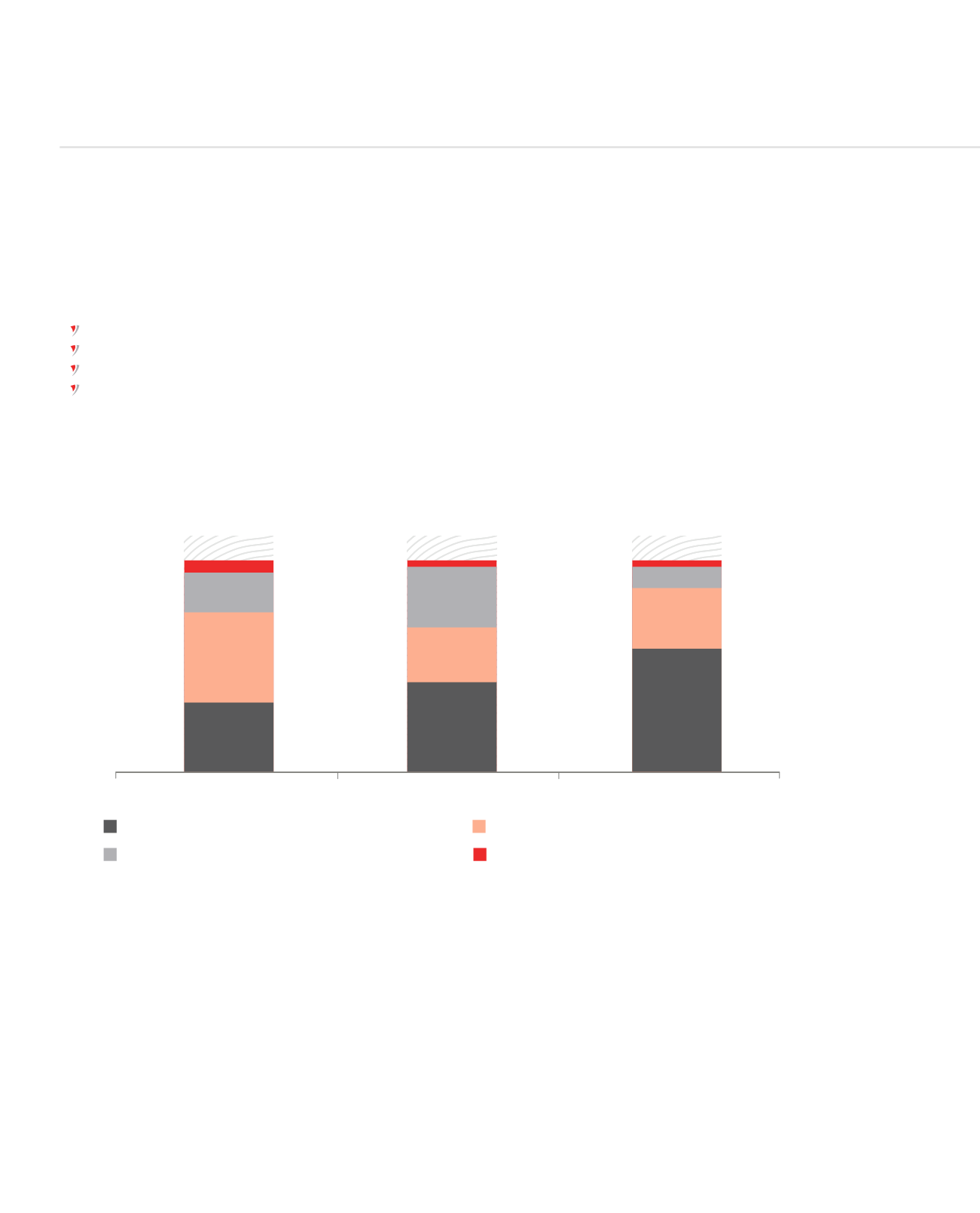

Asset mix

The Bank’s total assets increased by 56% to MUR 73bn over the year under review. The assets mix remained well diversified, maintaining an

acceptable risk return profile and focusing on the quality of the portfolio. The main components of the Bank’s total assets include:

cash and balances with the Central Bank and due from banks of MUR 43,9bn,

customer loans and advances of MUR 21,7bn,

financial investments held-for-trading and held-to-maturity of MUR 7,0bn,

other assets of MUR 713m.

The growth in the Bank’s customer loans and advances remained quite steady from last year, with 25% growth across both segments. Such growth

was done in a relatively disciplined manner focusing on credit quality. The Bank’s loan to deposit ratio was at 32% at the end of June 2015.

100%

80%

60%

40%

20%

0%

2013

2014

2015

Cash and interbank balances

Financial investments HTM & HFT

Loans and advances

Other assets

2

19

45

34

2

18

37

43

1

9

30

60

Deposits

On the liabilities side, customer confidence in the Bank can be noted with its customer deposits increasing by 63% to reach MUR 67bn by

the end of June 2015, across both Segments A and B. This increase of MUR 26bn over last year reflects the privileged and collaborative

relationship the Bank has with its customers.

MANAGEMENT DISCUSSION AND ANALYSIS (CONTINUED)

ASSETS MIX (%)