AfrAsia Bank Limited and its Group Entities

Annual Report 2015

page 96

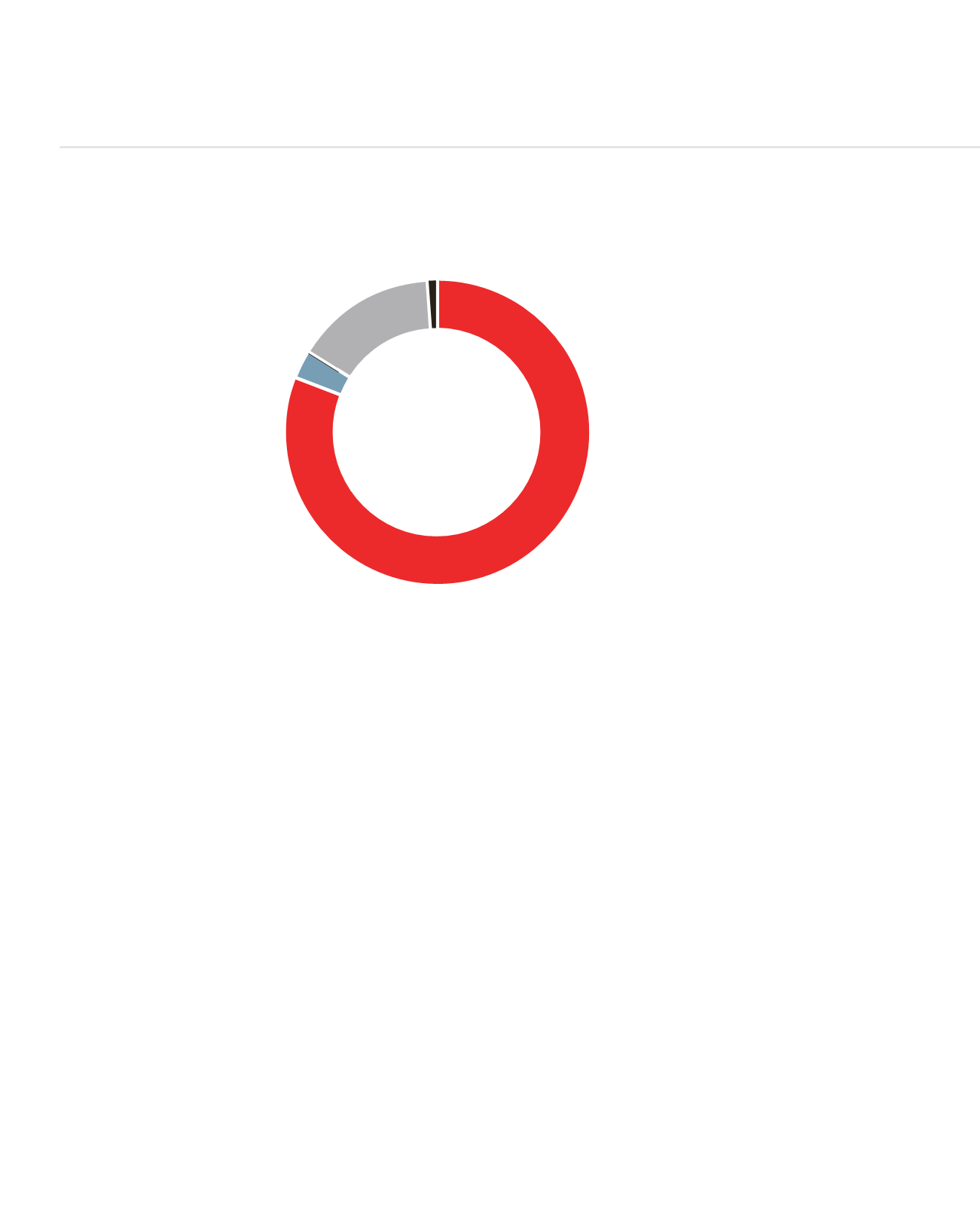

COLLATERAL COVER

Where a claim on counterparty is secured against eligible collateral, the secured portion of the claim is weighted according to the risk weight

of the collateral and the unsecured portion against the risk weight of the counterparty. To mitigate counterparty risk, the Bank also requires

closeout netting agreements. This enables the Bank to net the positive and negative replacement values of contracts if the counterparty

defaults. The Bank’s policy is to promote the use of closeout netting agreements and mutual collateral management agreements with an

increasing number of products and counterparties in order to reduce counterparty risk.

As an indication, claims secured by cash which has been netted off against exposure are 3% of the asset book, whilst 1% of total asset book

was for claims on banks.

MARKET AND LIQUIDITY RISK

Asset And Liability Committee

The objective of the Asset and Liability Committee is to ensure that the Bank’s overall asset and liability structure and market risk including

liquidity, currency and interest rate risks are managed within the prudential limits and targets delegated by its Board Risk Committee and in

accordance with the Guidelines set by the Bank of Mauritius.

On a monthly basis, the Asset and Liability Committee (ALCO) reviews the risk ratios and limits for these areas wherein the Bank has exposure

together with sensitivity analysis/stress tests done to monitor impact of potential changes in interest rates or currency movements.

The Bank’s Board Risk Committee delegates the implementation and monitoring of the Bank’s ALCO strategy, policies and procedures to

management. ALCO, is composed of some of the Executive Committee members and meets at least once monthly to review the ALCO risk

ratios, financials and other relevant information.

A sub-committee of the ALCO is the Treasury Committee; the main purpose of which is to monitor on a weekly basis the Bank’s liquidity

position and decide on its investment in Government securities and bank placements.

Cash Security

3%

Tangible Assets

81%

Unsecured Loans

and Advances

15%

Claims on Bank

1%

RISK MANAGEMENT REPORT (CONTINUED)