AfrAsia Bank Limited and its Group Entities

Annual Report 2015

page 102

On an annual basis, the Bank performs a complete review of all its processes and its procedures across all the areas of operation to mitigate

the risk arising from the fast growing operations. Each subsidiary, business unit and resource area is now responsible for the day-to-day

monitoring of its operational risks and for reducing and preventing losses caused by operational risks. To that end, all Heads of Department

have participated in this review and each department has nominated an Operational Risk Business Coordinator (ORBC) who works closely

with risk management. Procedures and processes have been updated accordingly and action plans designed for each area.

The review conducted during the financial year ended June 2015 showed that risk ranges from ‘low’ to ‘low to medium’. The overall results

were unchanged from last financial year end. Additional controls have been put in place and additional staff have been recruited as well as

restructuring of some departments happened in financial year 2014 to ensure higher controls.

Department

Average Rating

Strategic Development/AIL

C

Credit & Risk Management

C

Domestic Sales

C

Treasury

C

Finance

C

Marketing

C

Global Business

C

Human Resources

C

Information Technology

C

Administration

C

Business Operations

C

A - High

B - Medium to High

C - Low to Medium

D - Low

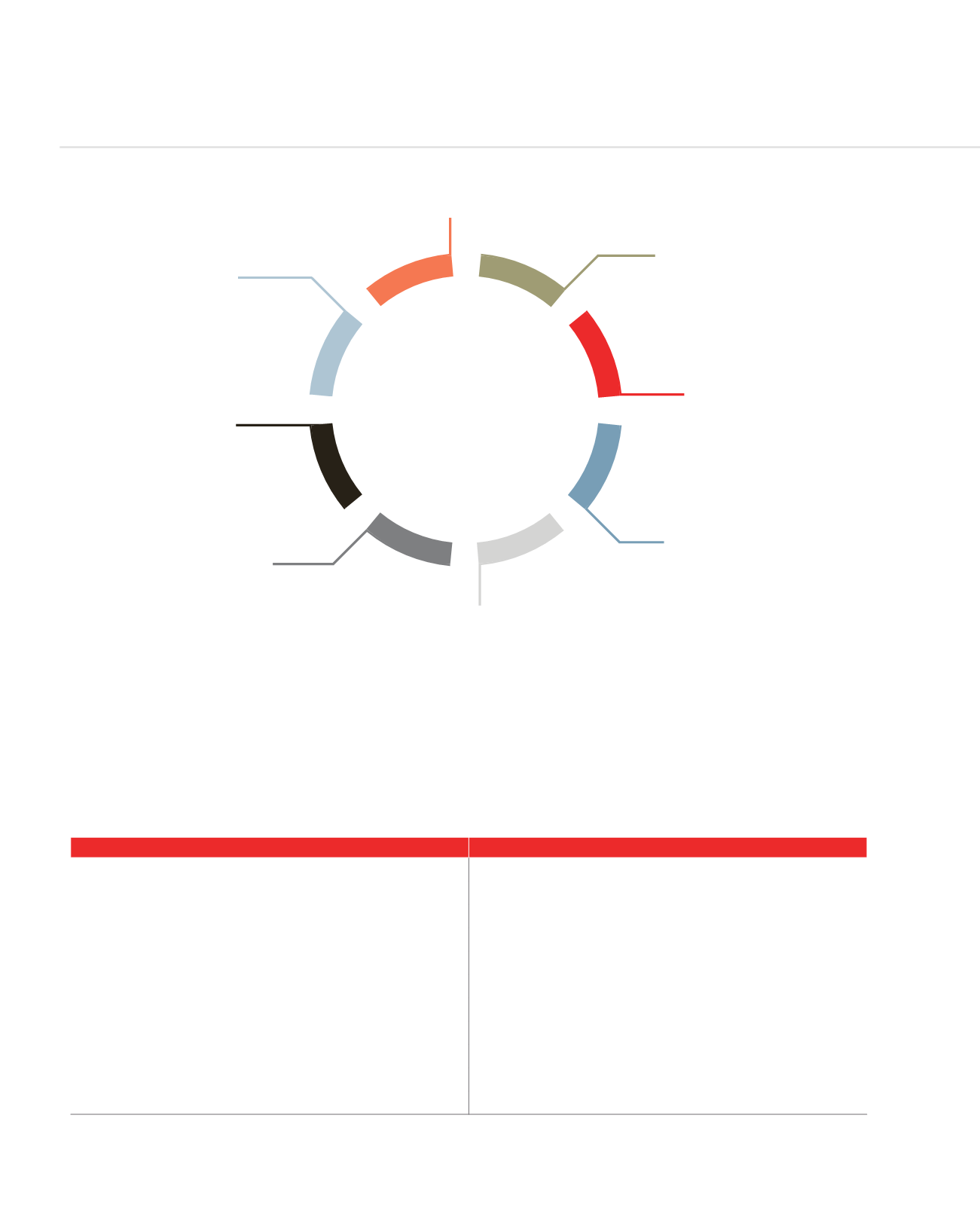

OPERATIONAL RISK

MANAGEMENT

Action

Plan

Senior

Management

Risk

Management

Policies and

Procedures

Department

Training

Risk

Assessment

Reporting

Business

Unit

RISK MANAGEMENT REPORT (CONTINUED)