AfrAsia Bank Limited and its Group Entities

Annual Report 2015

page 100

Products limits

Dealers can only transact in products that have been approved by Board Risk Committee;

Product limits are tightly monitored by the Treasury Back Office.

Forex Exposure limits

Foreign exposure is monitored daily and a report is sent to the Bank of Mauritius every day;

Overall currency exposure may not exceed 15% of Tier 1 Capital and single currency limit is set at 10% of Tier 1 Capital.

LIQUIDITY RISK

Liquidity risk is the risk of not being able to meet cash flow requirements when they fall due and at a reasonable price.

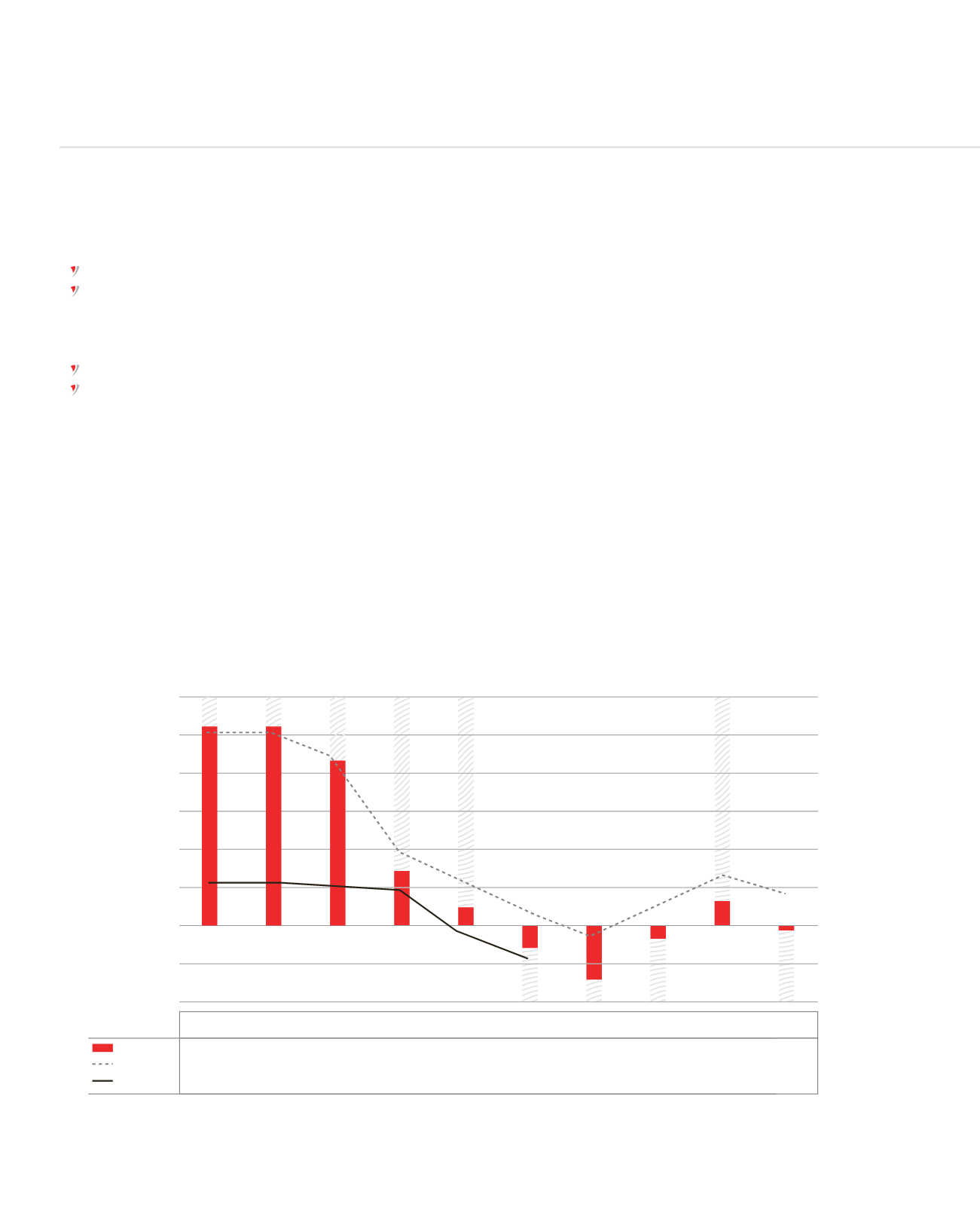

The Bank’s Net Funding Ratio (“NFR”) analysis requires the building of a maturity ladder to determine any fund excess or shortage at

selected maturity dates on a day-to-day basis and on a much longer period. The Bank has, in this respect, prudently set its NFR Gap in line

with the guideline on Liquidity Risk Management issued by the Bank of Mauritius. No excess is recorded as at 30 June 2015.

15,000,000

20,000,000

25,000,000

30,000,000

30 %

40 %

20 %

10 %

0 %

-10 %

-20 %

10,000,000

-10,000,000

5,000,000

-5,000,000

0

GAP Rs (000)

NFR Ratio

1 Day

26,842,069

34.01%

2%

2-7 Days

26,702,879

33.83%

2%

8-14 Days

22,239,506

28.17%

1%

15 Days to

1 Month

7,343,358

9.30%

1%

1-3

Months

2,367,223

3.00%

-10%

3-6

Months

-2,924,207

-3.07%

-15%

6-12

Months

-7,166,044

-9.08%

1-3 years

-1,861,587

-2.36%

>3 years

3,058,656

3.87%

Non Maturity

Items

-228,125

0.29%

Cum Gap

NFR Ratio

BoM Limits

LIQUIDITY GAP ANALYSIS: MUR + FCY

JUNE 2015

RISK MANAGEMENT REPORT (CONTINUED)