AfrAsia Bank Limited and its Group Entities

Annual Report 2015

page 95

Risk team analyses the following elements:

the short and long term Economic Risk: the aim is to assess the degree to which the country approximates the ideal of non-inflationary

growth, contained fiscal and external deficits, and manageable debt ratios. The analysis takes into account GDP growth, unemployment,

inflation, real interest rates, exchange rates, the fiscal balance, the current account balance, external debt and a number of other

structural factors; and

the short and long term Political Risk: the political risk assessment compares the state against a theoretical ideal state, essentially a

liberal state and a homogenous society in terms of ethnicity and income equality, with the premise that democracies are more able to

contain and manage direct threats to the political system and offer a template for greater long-term stability.

LIMITS

An appropriate structure of limits is set for each individual country exposure.

The determination of limits is based on the following:

the overall strategy and commercial opportunities;

the relation with Bank’s capital base;

the perceived economic strength and stability of the borrowing country;

the degree of perceived risk; and

the diversification of the Bank’s international lending and investment portfolio.

The Board of Directors validates the structure and value of the limits.

The Bank’s operations are performed strictly within the approved limits

CREDIT RISK MITIGATION

As a fundamental credit principle, the Bank does not generally grant credit facilities solely on the basis of the collateral provided.

All credit facilities are also based on the credit rating, source of repayment and debt servicing ability of the borrower. Collateral is

taken whenever possible to mitigate the credit risk. The collateral is monitored on a regular basis with the frequency of the valuation

depending on the liquidity and volatility of the collateral value enforcement. Legal certainty of enforceability and effectiveness is

another technique used to enforce the risk mitigation.

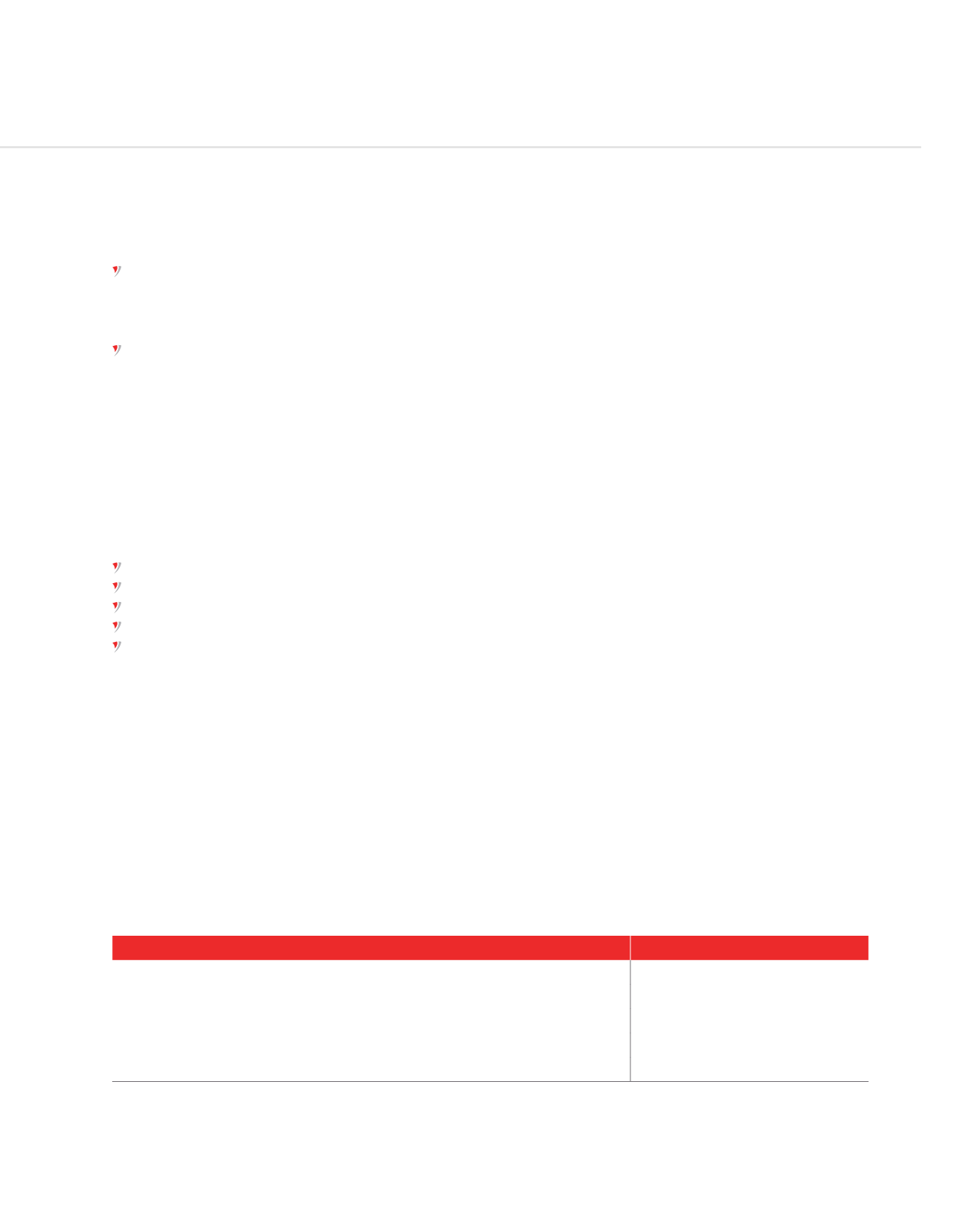

COLLATERAL CHART

MUR’000

Cash Security

738,896

Unsecured Loans and Advances

3,281,990

Claims on Bank

282,795

Tangible Assets

17,790,175

Total Loans and Advances

22,093,857