AfrAsia Bank Limited and its Group Entities

Annual Report 2015

page 92

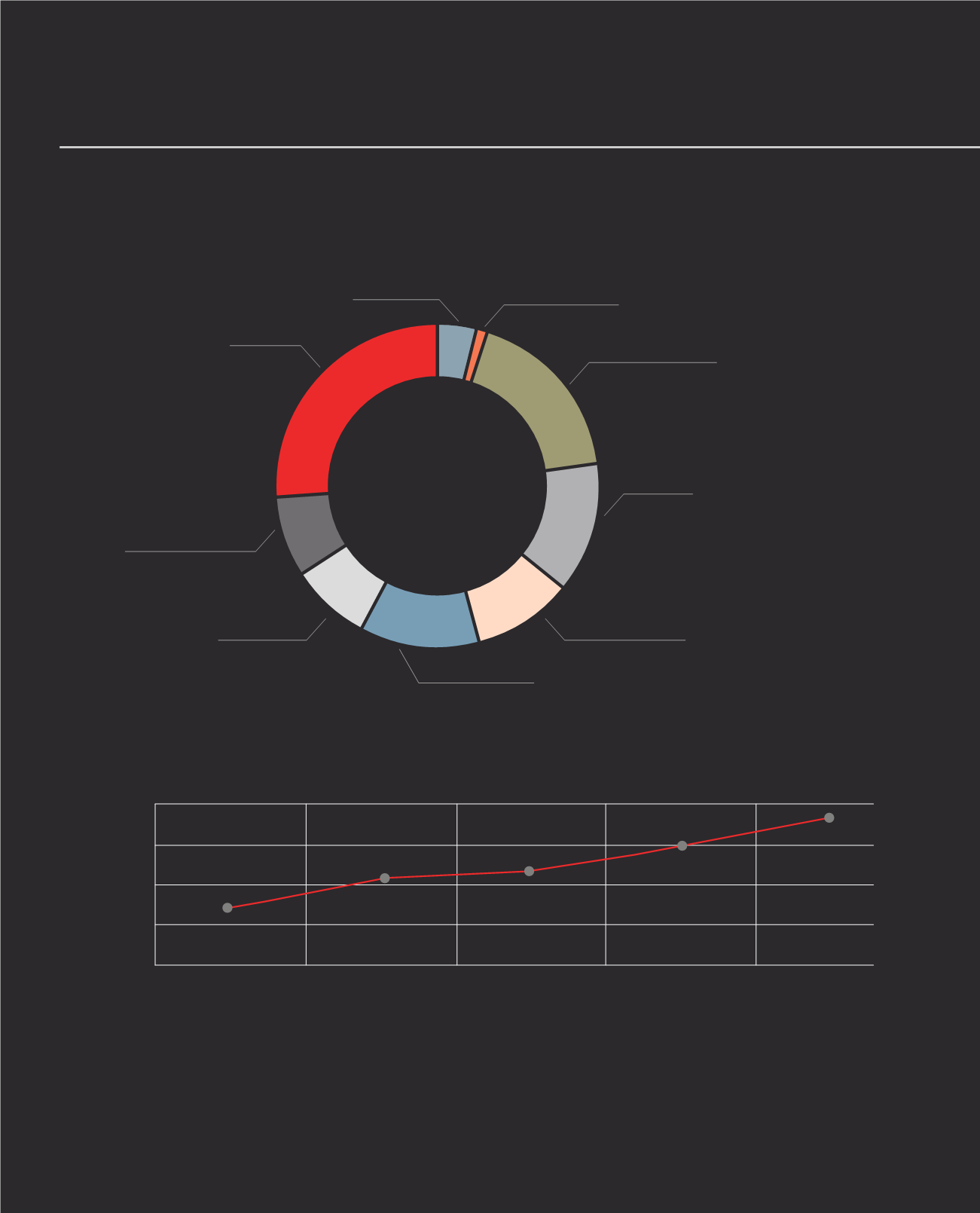

Others

26%

Agriculture and

Fishing

4%

Information,

Communication

and Technology

1%

Financial and

Business Services

18%

Construction,

Infrastructure

and Real State

10%

Manufacturing

12%

Commerce

8%

Tourism

13%

Individuals

(Incl. Credit Cards)

8%

UTILISATION LEVEL

OUTSTANDING BALANCE - PAST 5 YEARS

During the Financial Year 2014/15, AfrAsia Bank Limited has taken active steps in prudently managing its exposures and ensuring that its

loan book is judiciously diversified, while periodically conducting stress tests to assess the resilience of its portfolio in case of unfavourable

events. Over the years, the Bank has been keeping close attention to its credit concentration to ensure it meets regulatory requirements.

24,000,000

18,000,000

12,000,000

6,000,000

June 2011

June 2012

June 2013

June 2014

June 2015

0

8,610,253

12,870,185

14,090,031

17,654,400

22,093,857

RISK MANAGEMENT REPORT (CONTINUED)