AfrAsia Bank Limited and its Group Entities

Annual Report 2015

page 98

the funding stems mainly from clients’ current accounts, time deposits and saving accounts; and

the impact of interest rate fluctuations on the Bank’s Net Interest Income (NII) over a one year period is limited. The most significant

sensitivities for NII are for a further decrease of MUR rate and an increase Federal Reserves Bank. See Note 38(d) for Interest Rate Risk

Analysis.

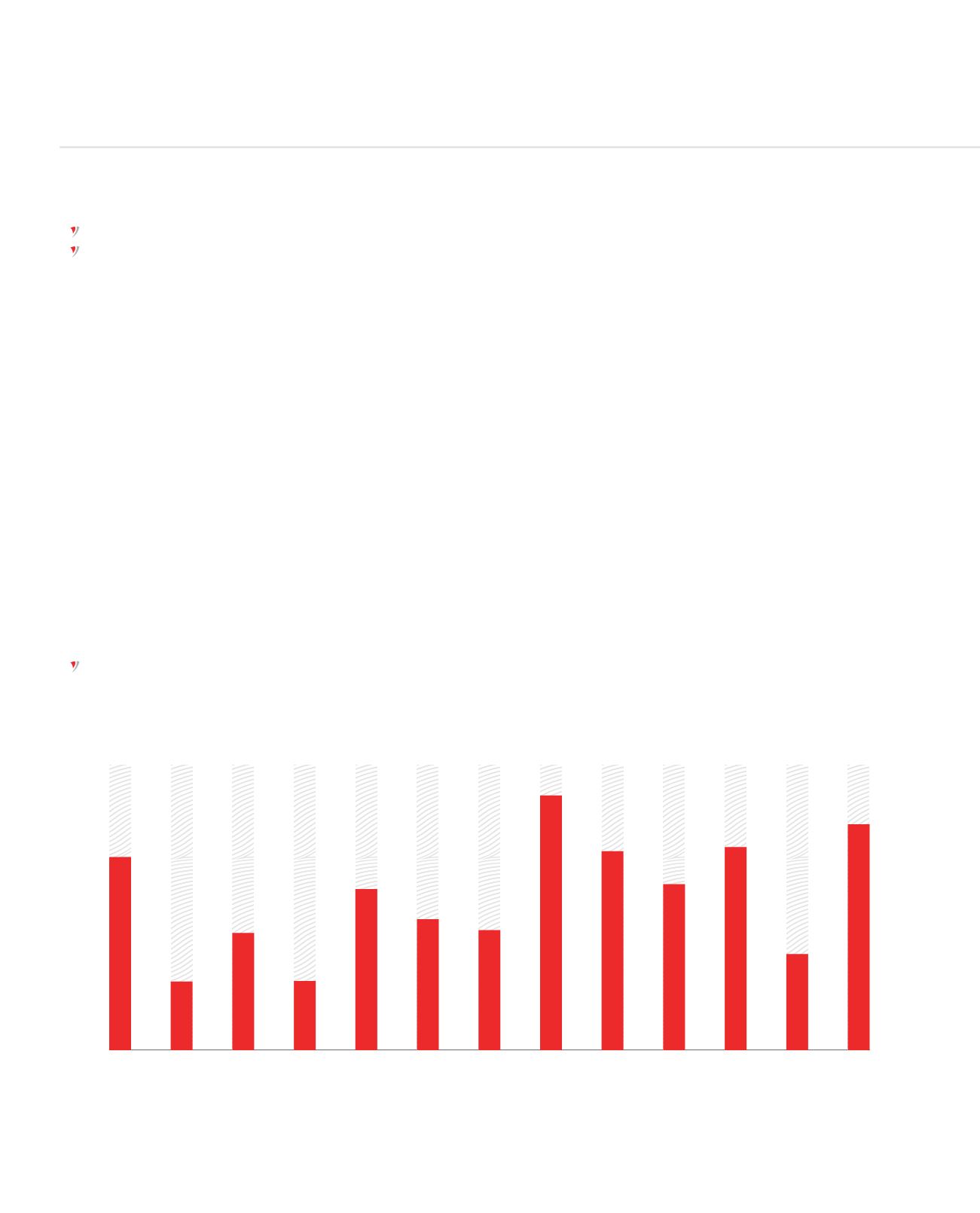

CURRENCY RISK

Currency risk or foreign exchange risk is defined as the risk that the value of the Bank’s foreign currency positions may be adversely

affected by movements in foreign exchange rates.

The Bank does not actively take foreign exchange risk in its core deposit taking and lending operations.

However, the Bank services clients’ activity in products across foreign exchange and structured foreign exchange products and acting as

a market maker dealer for corporate and institutional clients does require the management of “open positions” from foreign exchange

transactions with these counterparties.

These positions are monitored daily according to prudential trading limits that have been delegated to dealers by the Board Risk Management

Committee on intra-day and overnight open exposures. Transactions are mostly micro hedged or back-to-back with other banks.

The following observations can be made with regards to the Bank’s currency risk:

the Bank’s net open, either overbought/oversold, position against the Mauritian Rupee has been no more than 15% of Tier I capital,

throughout the financial year ended 30 June 2015, which is in compliance with the Bank of Mauritius requirements.

FOREIGN EXCHANGE EXPOSURE FROM JUNE 2014 to JUNE 2015 on a monthly basis

June-14

July-14

August-14

September-14

October-14

November-14

December-14

January-15

February-15

March-15

April-15

May-15

June-15

0

2

4

6

8

10

12

14

16

10.82%

3.86%

6.66%

3.91%

9.06%

7.37%

6.83%

14.48%

9.34%

11.40%

5.45%

12.67%

11.31%

RISK MANAGEMENT REPORT (CONTINUED)