AfrAsia Bank Limited and its Group Entities

Annual Report 2015

page 93

CONCENTRATION OF RISK / LARGE EXPOSURES

The Bank of Mauritius Guidelines on Credit Concentration (revised November 2013) restrict the granting of credit facilities to

non-financial institutions and other related parties, to:

a maximum exposure to any single customer of 25%;

a maximum exposure to a related group of companies to 40% of the Bank’s capital base;

in aggregate, any individual exposure of 15% above the Bank’s capital base shall not exceed 600% of its capital base.

The key focus of the Bank’s macro credit risk management approach is to avoid any undue concentrations in its credit portfolio,

whether in terms of counterparty, group, portfolio, product, country, sovereign, or currency. The Bank has always kept its large

exposures within these limits. For instance, our concentration ratio of large exposures above 15% was 139% as at 30 June 2015, well

within the regulatory limit of 600% as shown below:

CAPITAL BASE AS AT 30 JUNE 2015

MUR’000

Tier I

4,016,507

Tier II

896,799

Capital Base

4,913,306

Total Large Exposures (15% above)

6,833,167

% Large exposure v/s Capital Base (Limitation 600%)

139%

The Bank’s portfolio management supports a comprehensive assessment of concentrations within its credit risk portfolio for

provision of subsequent risk mitigating actions and diversification across various geographical boundaries, sectors, borrower groups

and products, with the main objectives of maximising shareholder value. To manage industry risk, the Bank also prepares economic

and industry reports, which are submitted to the Board Risk Committee, that highlight industry developments and risks to the Bank’s

credit portfolio. These reports are used to define strategies for both our industry portfolio and individual counterparties within the

portfolio.

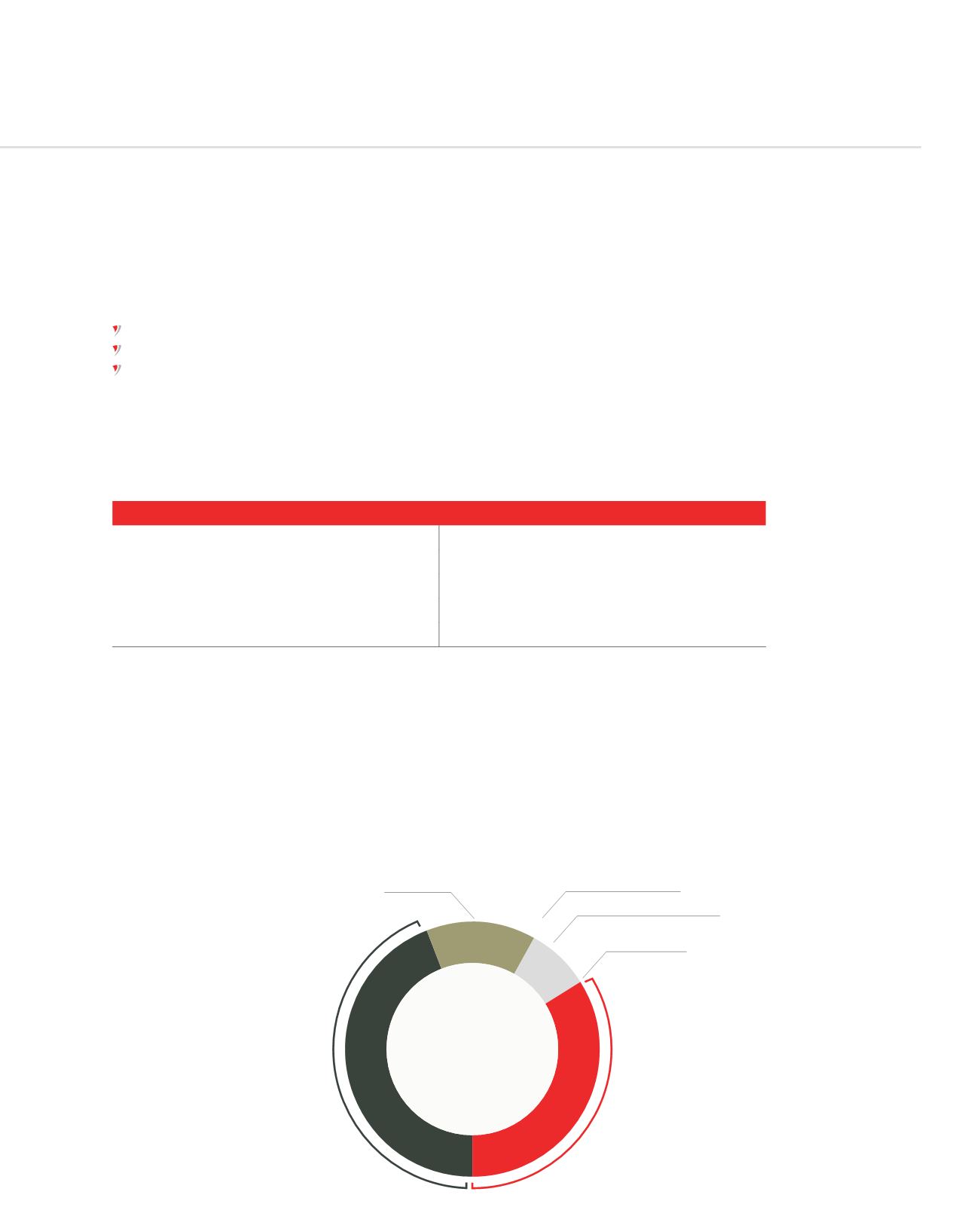

COUNTRY RISK

Mauritius

34%

Other

44%

France

0%

India

14%

United States

of America

0%

United Kingdom

8%