AfrAsia Bank Limited and its Group Entities

Annual Report 2015

page 91

All loans and advances are categorised as neither past due nor impaired; past due but not impaired; or impaired, which includes

restructured loans.

A loan is considered past due when the borrower has failed to make a payment when due under the terms of the loan contract.

The impairment allowance includes allowances against financial assets that have been individually impaired and that are subject

to collective impairment.

Loans neither past due nor impaired consist predominantly of loans that are performing.

In carrying out credit transactions, AfrAsia Bank Limited strives not only to improve its volume growth, but also keeps in mind the

quality of its loan portfolio.

As at 30 June 2015, 94% of the Bank’s asset book (excluding Credit Cards) was in the range AA+ to B, thus, reflective of investment

grade status of the borrowers. The remaining 6% were either sub-investment grade (facilities being on the watchlist where there

are arrears and borrowings classified as non-performing).

Total Non-Performing Assets (including credit cards NPA of MUR 7,401,921) were at MUR 1,148,133,743 representing 5.20% of

total asset book. This has increased from last financial year from 2.66%. The Bank has classified as NPA few large corporates over

this financial year.

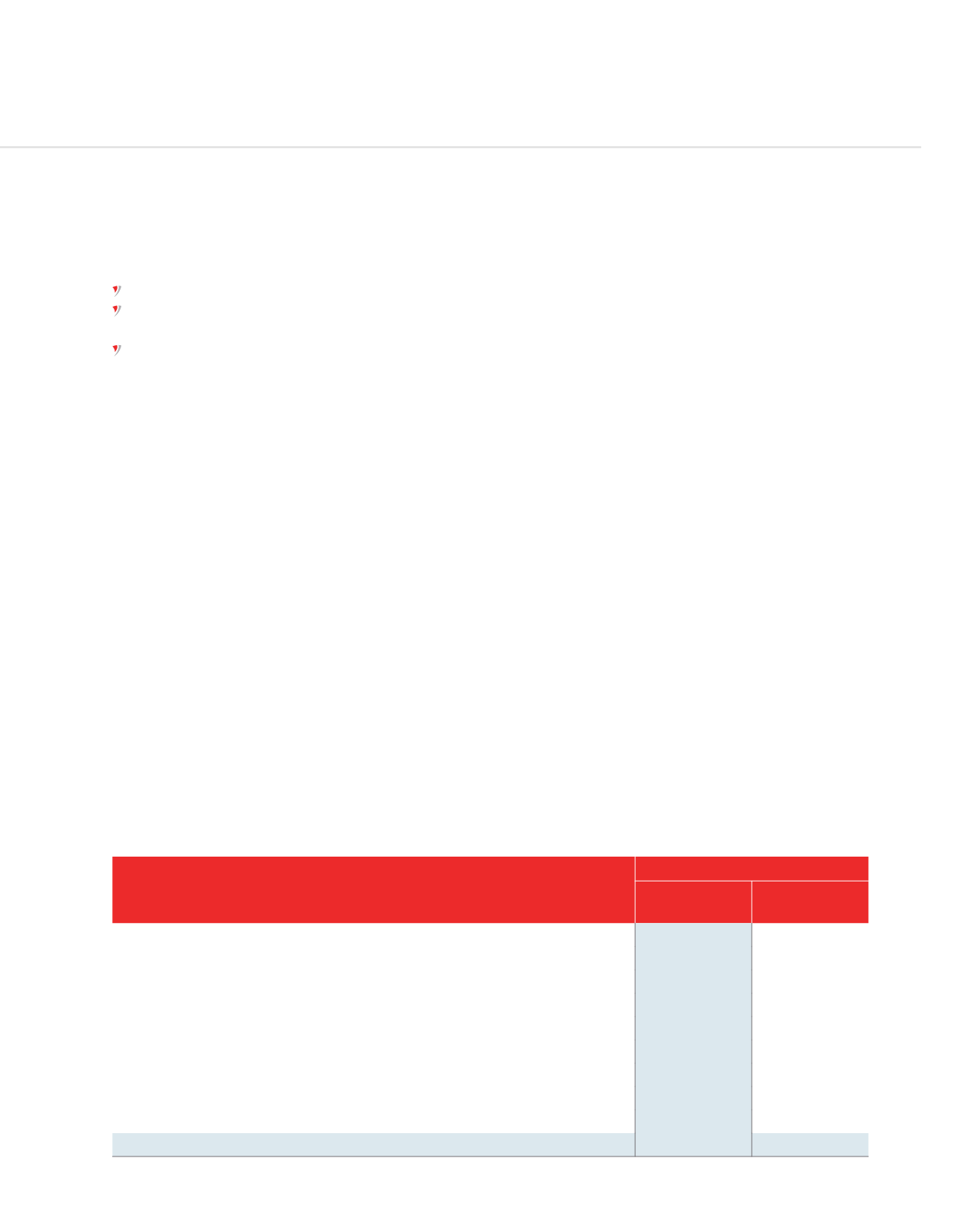

CREDIT EXPOSURE

The Bank manages portfolios for individual industries by determining the credit appetite and limit for each industry on the basis

of total exposure, credit quality and industry outlook. The portfolio monitoring and reporting system enables the Group to manage

portfolios and to focus on specific industries and business units.

Exposure risk arises due to the over-dependency on a particular sector of the economy, geographical area, industry and currency.

Exposure for a single party or a group is managed through sector limits with monitoring and approval on a monthly basis to the MCC

and BRC.

The Bank’s key portfolio concentrations by industry are set out below:

SECTOR

OUTSTANDING BALANCE

30 June 2015

(MUR’000)

30 June 2014

(MUR’000)

Financial and Business Services

3,856,234

2,670,704

Tourism

2,800,971

2,097,708

Construction, Infrastructure and Real Estate

2,288,266

2,329,744

Manufacturing

2,636,013

2,669,042

Commerce

1,803,152

1,659,370

Individuals (incl. Credit Cards)

1,847,212

1,548,075

Others

5,772,814

3,813,644

Agriculture and Fishing

927,736

675,507

Information, Communication and Technology

161,460

190,606

Total Exposure

22,093,857

17,654,400