AfrAsia Bank Limited and its Group Entities

Annual Report 2015

page 101

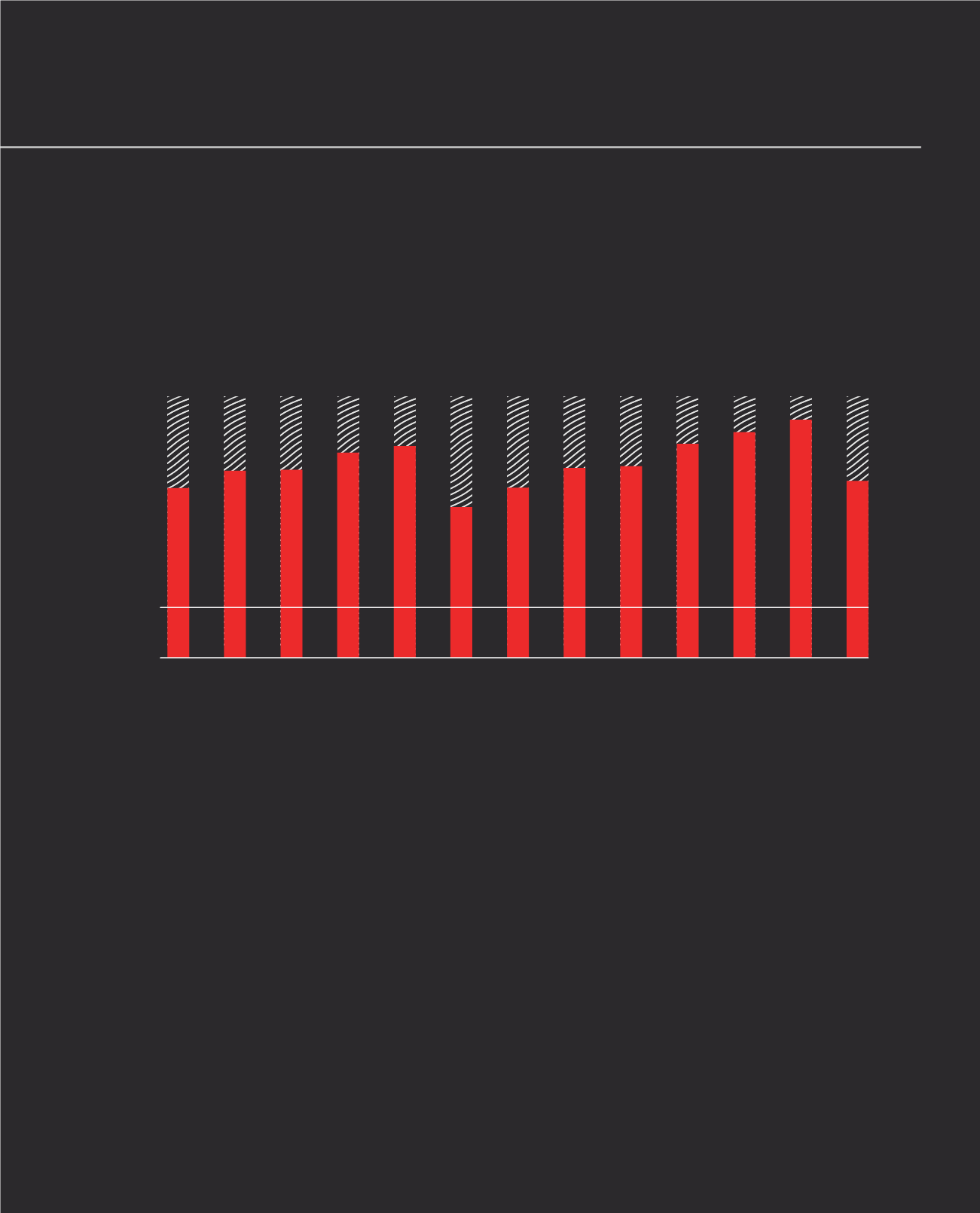

The liquidity ratio assesses the extent to which assets can be readily converted into cash or cash substitutes to meet financial

obligations. AfrAsia Bank Limited’s liquidity ratio reflects a strong liquidity position, adequate to absorb the impact of a stressed

liquidity and funding environment. The table on the following page shows the month end liquidity ratio maintained during the financial

year ended 30 June 2015 against the limit approved by the Board Risk Committee.

LIQUIDITY RATIO - JUNE 2014 TO JUNE 2015

OPERATIONAL RISKS INFORMATION

Operational risks include risks of losses resulting from defects in IT systems, legal disputes, inadequate or erroneous procedures

and fraud. The Bank limits its operational risks with business procedures and internal controls that are updated and adjusted to its

current business conditions on an on-going basis. The Bank has been computing its operational risks capital computation in line with

the Bank of Mauritius Guidelines under the Basel II Basic Indicator Approach where the capital charge for Operational Risk is taken

at 15% of average gross income over the past 3 years.

The Bank’s operational risk management process involves a structured and uniform approach across the Bank. It includes risk

identification and assessments, the monitoring of risk indicators, controls and risk mitigation plans for key operational risks.

0 %

20 %

40 %

60 %

80 %

120 %

100 %

140 %

June-14

92.5%

July-14

102.4%

August-14

102.2%

September-14

112.3%

October-14

115.5%

November-14

82.7%

December-14

93.5%

January-15

102.8%

March-15

115.9%

April-15

122.6%

May-15

129.0%

June-15

96.6%

February-15

104.6%