AfrAsia Bank Limited and its Group Entities

Annual Report 2015

page 129

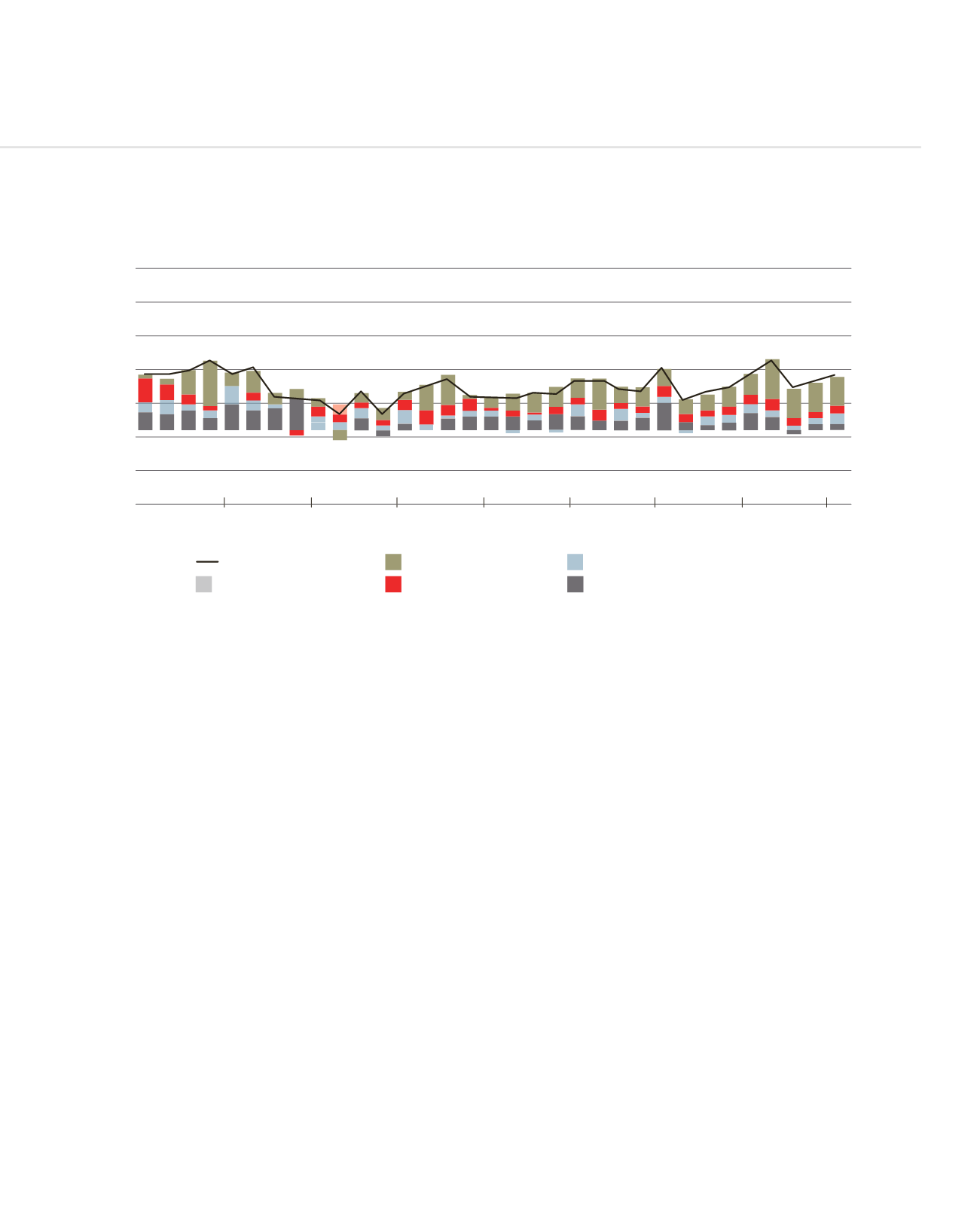

Capital flows in emerging and developing economies

Source: “World Economic Outlook: Adjusting to lower commodity prices,” IMF, Oct. 2015

Impact of dwindling commodity prices

As to the outlook in low-income developing economies, many of which are located in Africa, lower commodity prices, which have

declined sharply since 2011, pose significant risks after many years of strong growth. The risks are also real in emerging market

and developing economies which are net exporters of commodities. Commodity prices had experienced a sharp rise in the period

2000–2010 on account of sustained robust growth in emerging market economies, and have been a major driver of growth in

several of these countries. China alone absorbed in 2014 half the world’s aluminium, nickel and steel, and about a third of its cotton

and rice. It is now widely believed that China’s appetite for commodities could well have peaked in 2015. This implies bad news for

commodity-exporting countries where already the deterioration in their 2015 primary balance, on account of sharp price declines,

could represent as high as 5% of GDP on average, thus representing a huge reversal of the revenue windfall accrued during the boom

years 2000-2010.

15

12

9

6

3

0

-3

-6

2007

2008

2009

2010

2011

2012

2013

2014

2015

Emerging Europe

Emerging Asia excluding China

Latin America

China

Saudi Arabia

Total

CAPITAL OUTFLOWS EXCLUDING CHANGE IN RESERVES (PERCENT OF GDP)