AfrAsia Bank Limited and its Group Entities

Annual Report 2015

page 131

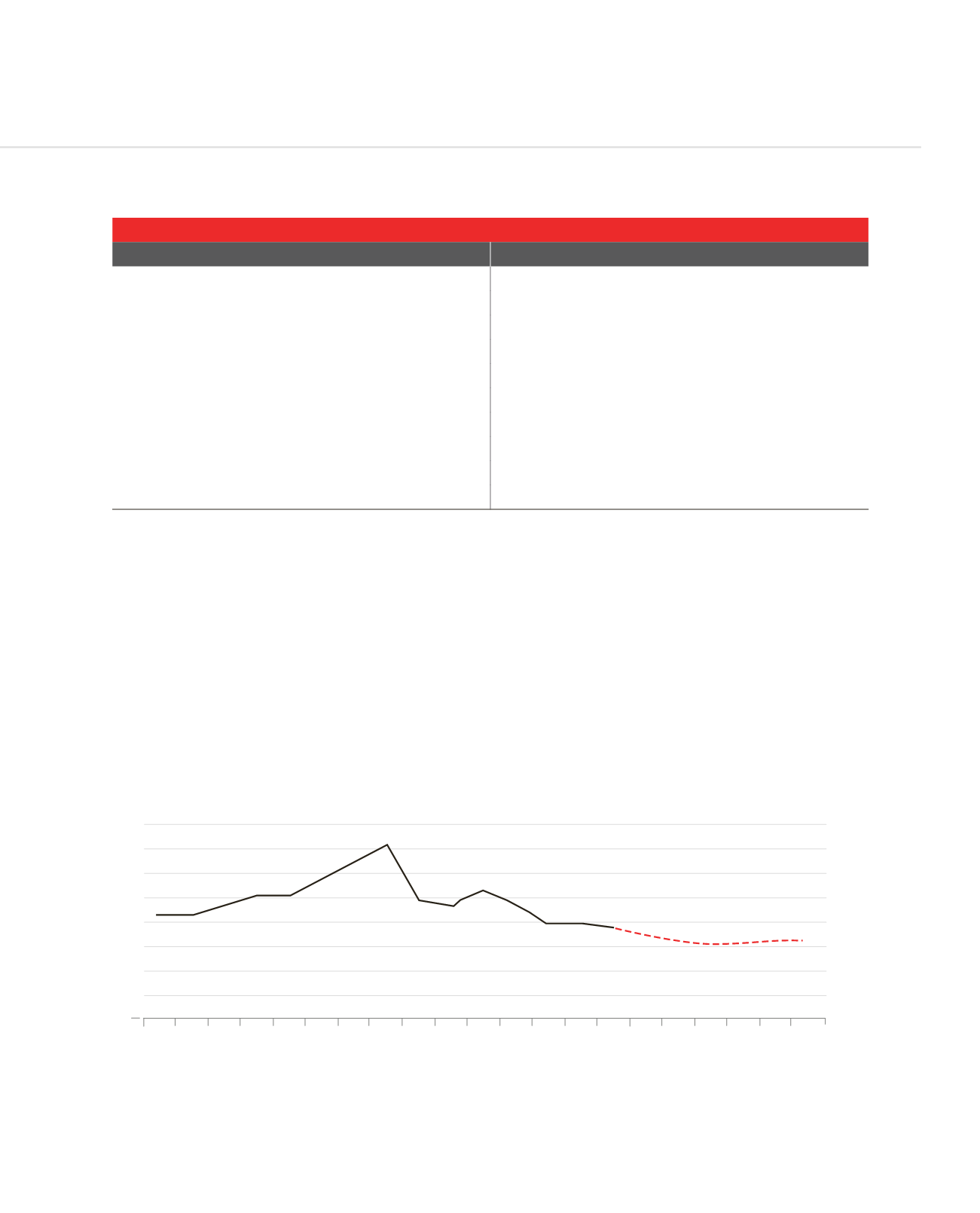

Top 10 destinations - H1 2015

Country

Capex ($bn)*

India

31

China

28

US

27

UK

16

Mexico

14

Indonesia

14

Vietnam

8

Spain

7

Malaysia

7

Australia

7

Prospects for India’s economy remain healthy though. FDI in the first half of 2015 amounted to some USD 31bn, putting the country

in the pole position in terms of foreign capital inflows, surpassing China (USD 28bn) and the US (USD 27bn), according to a report

in the Financial Times in September 2015. Since China’s stockmarket rout in August 2015, investment flows have increased further.

Several indicators also reveal that India’s economy is in better shape than China’s, including pace of growth, room for additional

stimulus, labour force participation rate, domestic consumption, levels of public debt, excess capacity, property prices and deflation

among others.

Most analysts forecast China’s growth engine would fail to generate the performance attained in the mid to late 2000’s in the

aftermath of the global financial crisis. The country is standing at the crossroads and calling for a rebalancing of the economy as

most of the key factors which led to two decades of double-digit growth begin to reach their potential.

Top 10 FDI destinations (first half of 2015)

Source: Financial Times, 29 September 2015

China’s growth rates – Past vs. future

6.3

6.0

6.8 6.3

7.4

7.8

14.2

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

0

2

4

6

8

10

12

14

16

8.4

10.4

9.2