AfrAsia Bank Limited and its Group Entities

Annual Report 2015

page 134

Private flows are expected to play a non-negligible role in financing the post-2015 Development Agenda.

The economic and finance landscape on mainland Africa has been transformed during the past decade into one that attracts more and

more private flows such as FDI, portfolio investments and remittances, and less official development assistance.

In 2014, total external flows to Africa were estimated at USD 181bn, 6% lower in nominal terms than in 2013. One explanation for this

decrease was the sharp drop in portfolio flows and the slight decline in FDI flows, reflecting subdued global demand and weaker commodity

prices, especially for metals. This decline offset the slight increase in remittances (+2.1%) and official development assistance (+1.1%).

All in all, estimates for total external flows averaged 7.3% of GDP in 2014, compared to 8.2% in 2013.

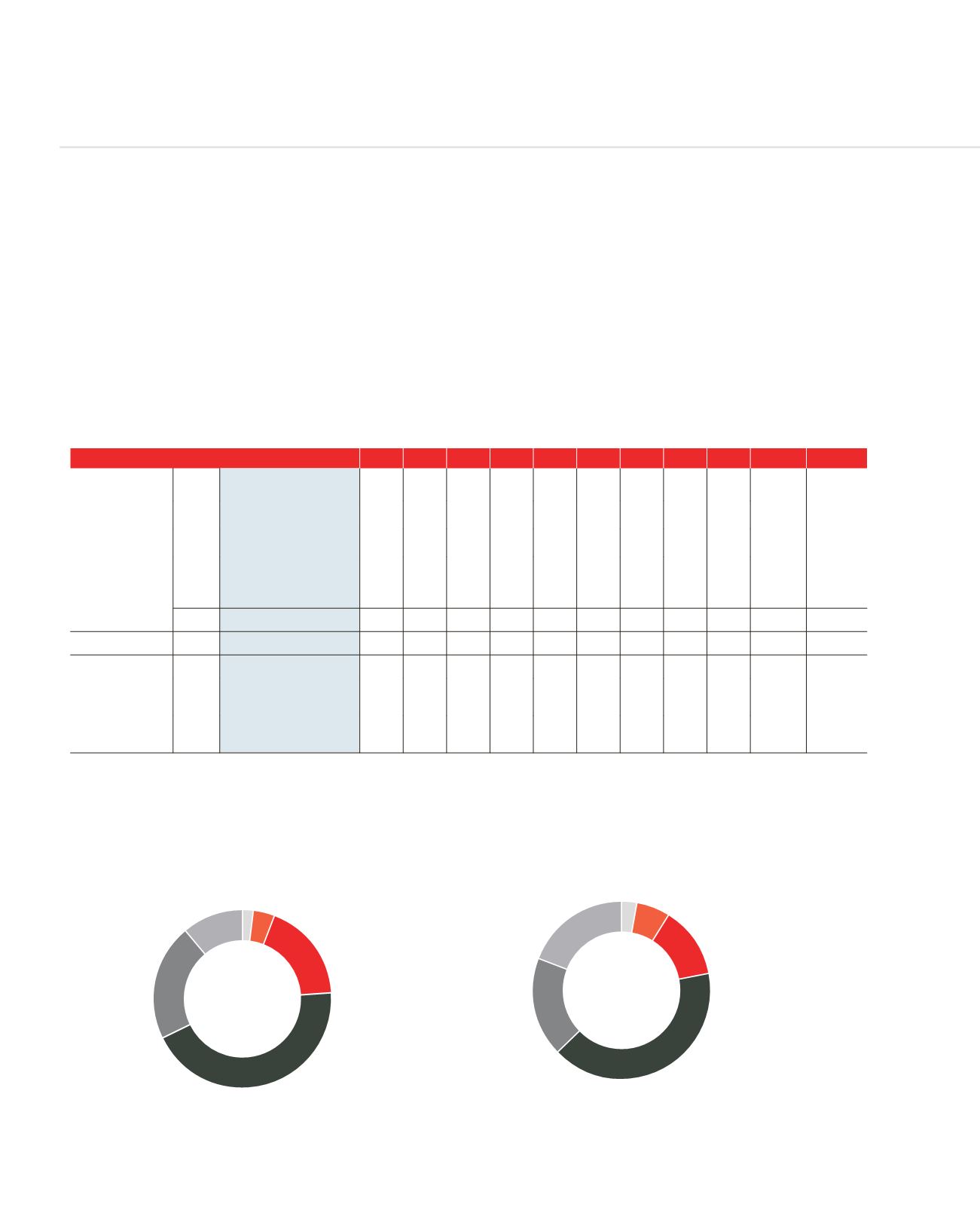

FINANCIAL FLOWS AND TAX REVENUES TO AFRICA (CURRENT USD, BILLION), 2005-2015

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 (e) 2015 (p)

Foreign

Private

Public

Inward Foreign Direct

investments

33.8 35.4 52.8 66.4 55.1 46.0 49.8 49.7 54.2 49.4 55.2

Portfolio Investments

6.3 22.5 14.4 -24.6 -0.3 21.5 6.8 25.7 21.5 13.5 18.4

Remittances

33.3 37.3 44.0 48/0 45.2 51.9 55.7 61.2 60.6 61.8 64.6

Official development

assistance (net total, all

donors)

35.8 44.6 39.5 45.2 47.9 48.0 51.8 51.3 55.8 56.3 54.9

Total Foreign Flows

109.2 139.7 150.6 135.0 147.9 167.3 164.0 187.9 192.0 181.1 193.0

Domestic

Tax Revenues

258.1 305.9 343.4 442.4 330.6 408.3 462.9 515.1 507.4

Total Foreign

Flows

Low-Income Countries

21.8 22.8 29.5 36.5 36.9 39.5 47.5 47.9 49.7 52.3 54.2

Low-Middle-Income

Countries

61.7 78.4 84.1 81.8 69.4 94.7 84.9 109.1 111.9 96.3 105.2

Upper-Middle-Income

Countries

23.2 35.6 33.2 11.9 35.9 28.1 26.5 25.6 26.0 26.9 26.6

Financial flows and tax revenues to Africa (current USD, bn), 2005-2015

Source: Africa Economic Outlook 2015

Sources of greenfield investment in Africa (by number of projects), 2003-2008 and 2009-2014

Source: Africa Economic Outlook 2015

SOURCES OF GREENFIELD INVESTMENT IN AFRICA (BY NUMBER OF PROJECTS), 2003-2008 AND 2009-2014

A. 2003-2008

B. 2009-2014

China

3%

India

6%

North

America

13%

Europe

41%

Africa

19%

Rest of

the world

18%

Europe

44%

China

2%

India

4%

North

America

18%

Rest of

the world

21%

Africa

11%

MANAGEMENT DISCUSSION AND ANALYSIS (CONTINUED)