AfrAsia Bank Limited and its Group Entities

Annual Report 2015

page 132

Africa outlook and developments

Africa’s impressive economic turnaround during the 2000s saw average GDP growth more than double from just above 2% during the 1980s

and 1990s to above 5% between 2001 and 2014. Even though it was higher than global world growth, (slightly above 4%) and Latin America

and the Caribbean (just above 3%), it was lower than for emerging and developing Asia at about 8%. Africa’s growth pace has been hampered

because of a number of reasons including: subdued global growth; political and ethnic conflicts; weak prospects in export markets such as

EU and China; an unforeseen drop of oil and other commodity prices; and the outbreak of the Ebola virus, with Guinea, Liberia and Sierra

Leone at the epicenter, killing thousands of persons at a high economic cost. The 54 countries of the African continent have had various

democratic experiences, with some countries facing stabilisation and growth while others have remained mired in social conflicts.

GDP growth of Africa is expected to strengthen to 4.5% in 2015 and 5% in 2016 after subdued expansion in 2013 (3.5%) and 2014 (3.9%).

The 2014 growth was about one percentage point lower than that predicted by analysts, as the global economy remained weaker and some

African countries saw severe domestic problems of various natures. However, the world economy in 2015 seems to be improving. This could

impact positively on growth trends across Africa. According to the Africa Economic Outlook 2015, if the predictions materialize, Africa could

“soon be closing in on the impressive growth levels seen before the 2008/09 global economic crisis.”

* Fiscal years, ending March, 2011-12 base year from 2012 onwards

Source: economist.com (9 February 2015)

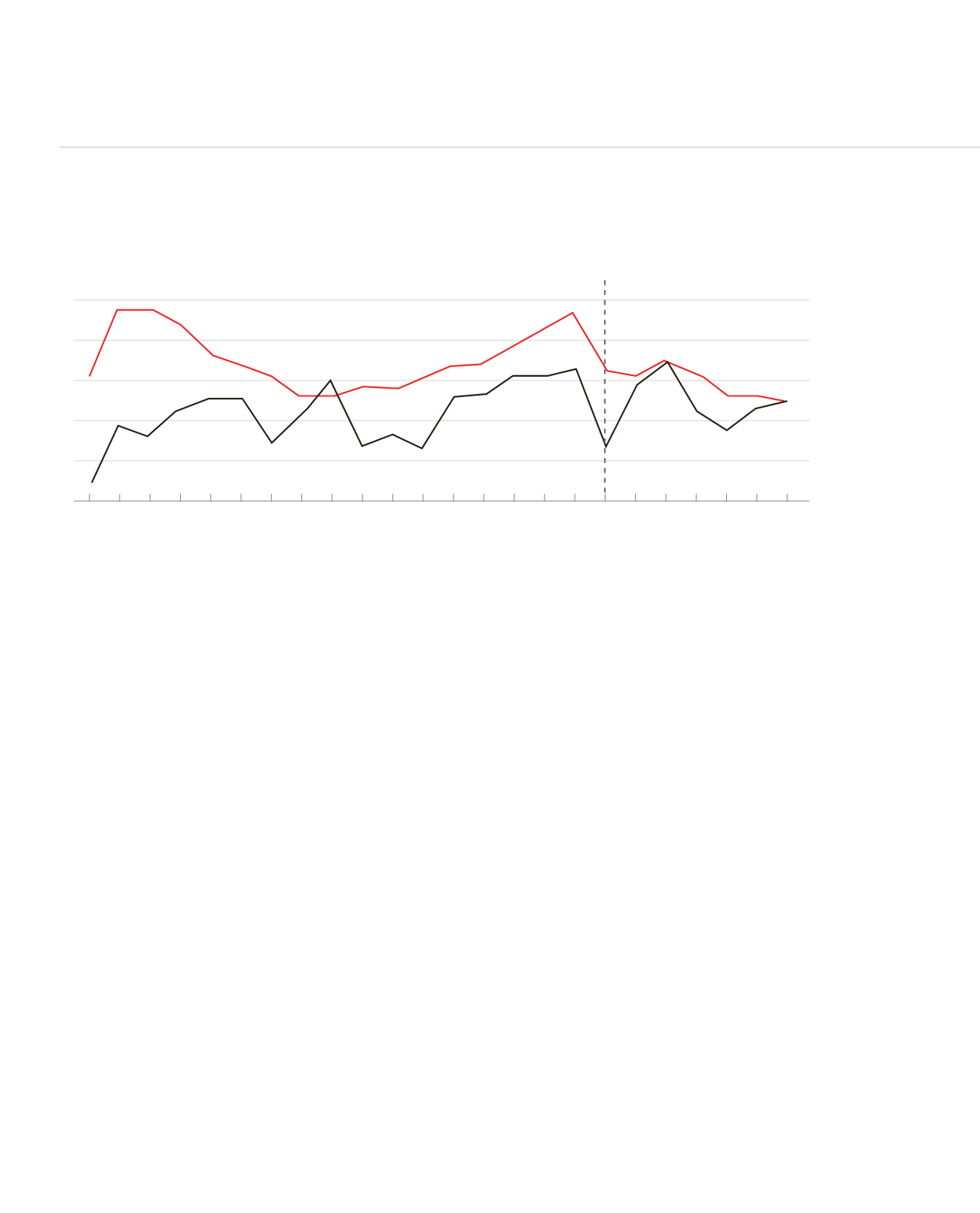

CHINA’S GDP GROWTH RATES VS. INDIA’S RECENTLY REVISED RATES (FOLLOWING A “REBASING” EXERCISE)

Financial Crisis

15

12

9

6

3

0

1991 92 93 94 95 96 97 98 99 2000 01 02 03 04 05 06 07 08 09 10 11 12 13 14

China

India*

MANAGEMENT DISCUSSION AND ANALYSIS (CONTINUED)