AfrAsia Bank Limited and its Group Entities

Annual Report 2015

page 128

MANAGEMENT DISCUSSION AND ANALYSIS (CONTINUED)

…undermined by relatively slower growth in emerging markets…

Forecasts show that emerging market and developing economies would be recording in 2015 slower growth for the fifth year in a row.

This is even more prominent in the case of the larger emerging market economies and oil-exporting countries.

In emerging market economies, the continued growth slowdown reflects several factors, including lower commodity prices and tighter

global financial conditions, structural bottlenecks, rebalancing in China (as it seeks to achieve consumption-driven sustainable growth), and

economic distress related to geopolitical factors. Even if a rebound in activity in a number of distressed economies is expected to result in

a pickup in growth in 2016, most analysts reckon that growth prospects will differ markedly across countries, several of which face country-

specific shocks.

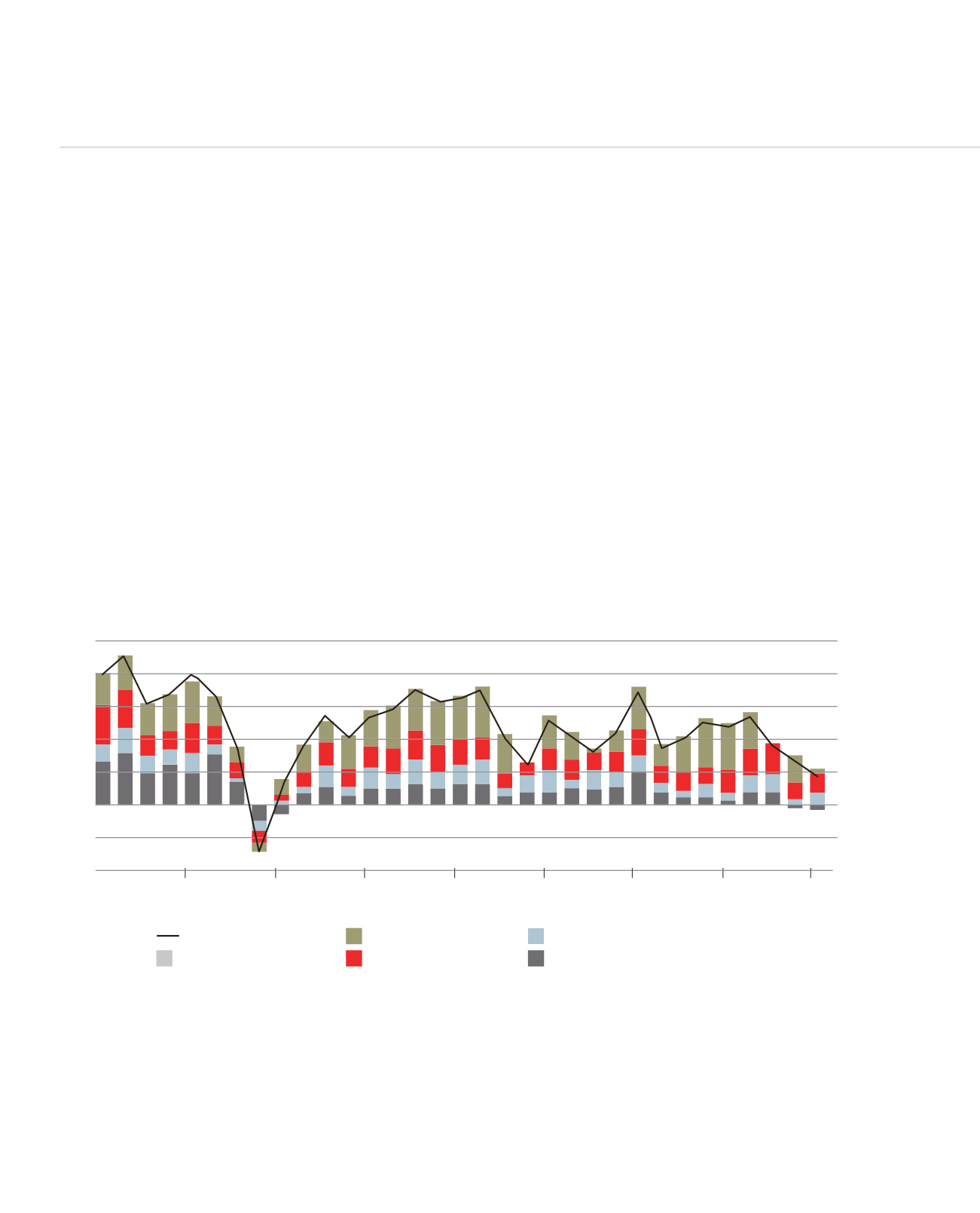

…and rapidly declining capital inflows to emerging market economies

Emerging market and developing economies as a group has started disposing of foreign exchange reserves in 2014 (to the tune of USD

100bn in foreign exchange reserves during both 2014Q4 and 2015Q1) amidst a sudden reduction in gross capital inflows, i.e., declining

purchases of domestic assets by non-residents. This is particularly significant for China, Russia, Saudi Arabia and Latin America, according

to the IMF. In parallel, given the relatively stable aggregate current account balances for this group of countries, the decline in inflows has

been offset by a corresponding decline in gross capital outflows.

Capital flows in emerging and developing economies

Source: “World Economic Outlook: Adjusting to lower commodity prices,” IMF, October 2015

15

12

9

6

3

0

-3

-6

2007

2008

2009

2010

2011

2012

2013

2014

2015

Emerging Europe

Emerging Asia excluding China

Latin America

China

Saudi Arabia

Total

CAPITAL INFLOWS (PERCENT OF GDP)