AfrAsia Bank Limited and its Group Entities

Annual Report 2015

page 88

CREDIT RISK

Credit Policies

The Board has ultimate control and oversight of the credit risk policies for the Bank and these policies are reviewed on at least an annual

basis. The policies are designed to provide effective internal control within the Bank. Any development in the customers’ financial situation

is closely monitored by the Bank, thus enabling it to assess whether the basis for granting the credit facility has changed. However,

a new review is triggered when changes happen in regulations and guidelines. Credit facilities are generally granted on the basis of an

understanding of customers’ individual financial circumstances, cash flow assessment of market conditions and security procedures. The

facilities should match the customers’ creditworthiness, capital position and assets to a reasonable degree, and customers should be able

to substantiate their repayment ability. In order to reduce credit risk, the Bank generally requires collateral that corresponds to the risk for

the product segment.

Credit Rating

As per Basel II Capital Accord, a Rating System must have 2-Dimensions and provide for a separate assessment of borrower and transaction

characteristics to provide for a meaningful differentiation of risk. In that respect, over the reporting financial period, the Bank implemented

CRISIL Risk Solutions which provide a suite of software that is critical for ensuring compliance with regulatory guidelines, such as Basel

II. CRISIL’s Risk Assessment Model (RAM) is the largest deployed internal risk rating solution in India. This model as well as CRISIL Retail

Scoring Solution (CRESS) has been implemented to assist the Bank in complying with the requirements under the internal ratings-based

approach of the Basel II Accord. Both models now facilitate credit risk appraisal of a borrower through a judicious mix of objective and

subjective methodologies and act as a comprehensive database for all borrower-specific information.

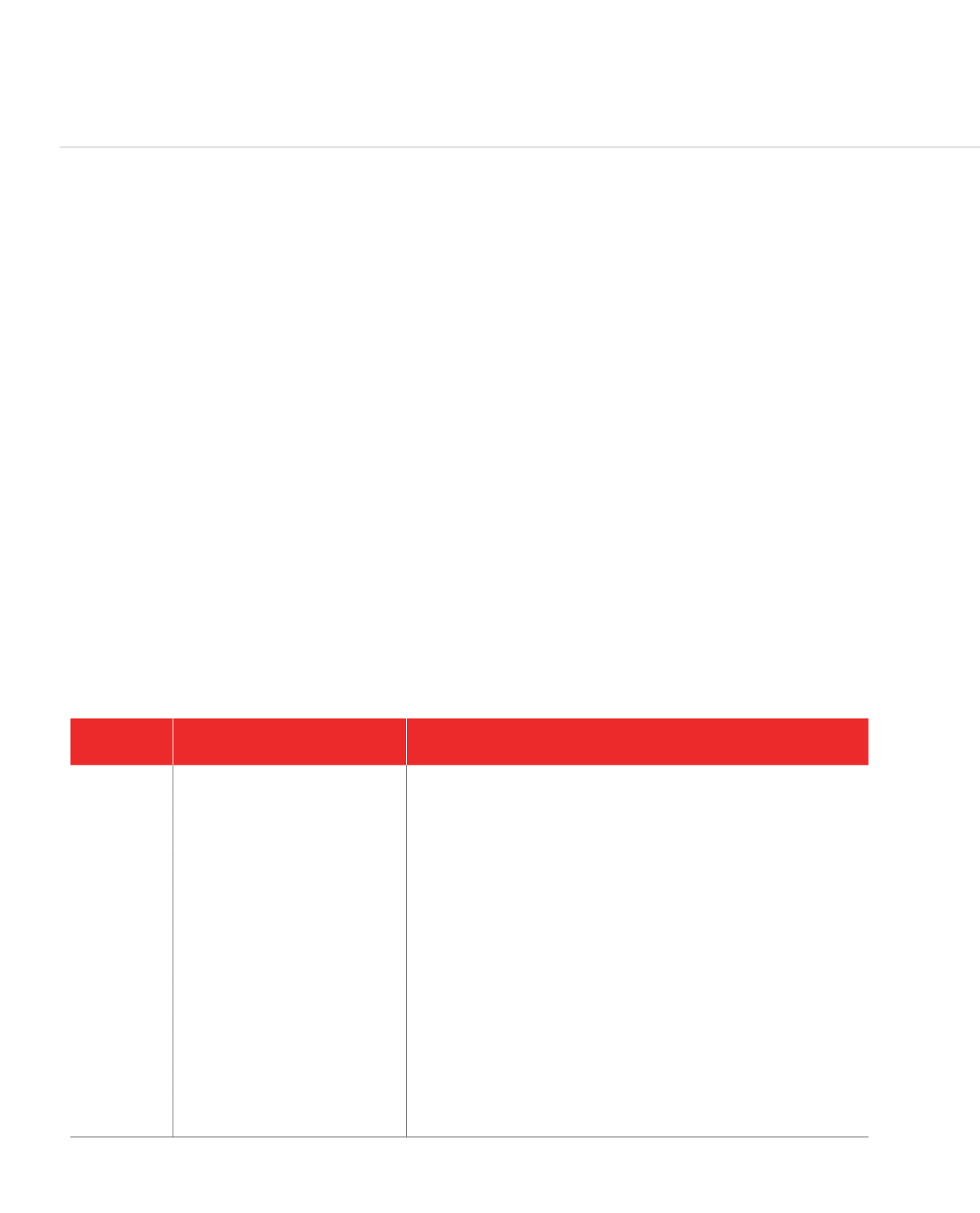

CRISIL’s rating grades and description for each grade are as follows:

Rating

Grades

Description

Definition

AAA

Investment Grade - Highest safety

Borrowers rated AAA are judged to offer highest safety of timely payment.

AA+

Investment Grade - High safety

Borrowers rated AA+ are judged to offer high safety of timely payment.

AA

Investment Grade - High safety

Borrowers rated AA are judged to offer high safety of timely payment.

They differ in safety from AA+ only marginally.

A

Investment Grade - Adequate safety Borrowers rated A are judged to offer adequate safety of timely payment.

BBB

Investment Grade - Moderate safety Borrowers rated BBB are judged to offer moderate safety of timely payment

of interest and principal for the present.

BB

Investment Grade - Moderate safety Borrowers rated BB are judged to offer moderate safety of timely payment of

interest and principal for the present. There is only a marginal difference in

the degree of safety provided by borrowers rated BBB.

B

Investment Grade - Minimum safety Borrowers rated B are judged to carry minimum safety of timely payment

of interest and principal for the present.

CC

Sub-Investment Grade - Inadequate

safety

Borrowers rated CC are judged to carry inadequate safety of timely payment.

C

Sub-Investment Grade - High risk

Borrowers rated C have a greater susceptibility to default.

D

Highly susceptible to Default/Default Borrowers rated D are in default or are expected to default on maturity.

RISK MANAGEMENT REPORT (CONTINUED)