AfrAsia Bank Limited and its Group Entities

Annual Report 2015

page 147

The Bank forecasts a correction in the current excess liquidity

situation with Bank of Mauritius intervention, while the Repo rate

is expected to remain unchanged. With the Work in Progress

paper on Primary Dealers Requirements due this year, the Bank

should expect a more active secondary market for Treasury Bills

and with the injection of fresh capital, its strategy going forward

will be to increase the Trading book portfolio and become the

most active Money Market and Fixed Income Trading house.

Balance Sheet Management

AfrAsia Bank Limited’s Money Market and Fixed Income desk

is in charge of managing the assets and liabilities of the bank.

The desk’s focus is as follows:

formulate ideas and strategies to take advantage of money

market movements.

work closely with other business units to identify deposits/

loans trends, and possible impact on the Bank’s liquidity.

constant follow-upofmarket changes, especially those related

to monetary and fiscal policies that would have impact on the

direction of interest rates in the major markets.

protect the Bank’s liquidity position in maintaining excellent

cash-flows reports, and adopting certain tolerance levels in

managing liquidity.

use Repos, Reverse Repos, Swaps and any other available

approved methods of funding to ensure the most efficient

way of funding the various activities of the bank.

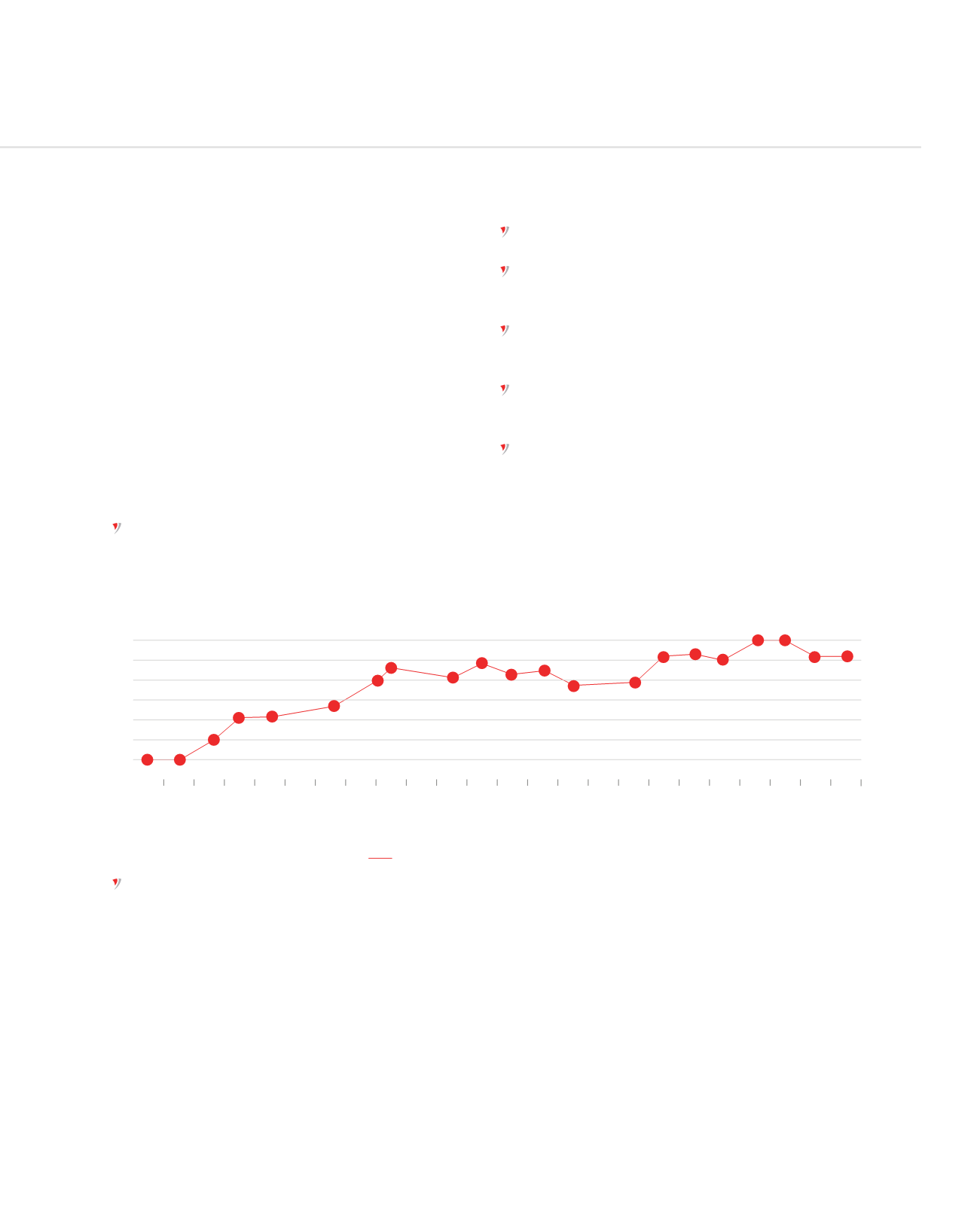

during FY 2014/2015, the Bank has actively sought to

maximised yields in the FCY Interbank (I/B) placements;

an illustration of progress for Interest received through

interbank placements is shown below:

I/B PLACEMENT- INTEREST RECEIVED

for the FY 14/15, Total interest from FCY Interbank placements amounted to USD 4.69Mio averaging USD 391k per month as

compared to USD 3.30Mio for FY 13/14 with an average monthly interest of USD 275k.

Going Forward

The Bank’s goal is to be a one-stop shop for Treasury requirements both for local as well as international clients. The Bank feels that

Mauritius has all the capabilities of being the funding centre for the rest of Africa. However, with the level of sophistication that the

Bank is bringing, it aims to become the centre of excellence in terms of Treasury and Financial Markets solutions for the continent.

2

4

6

8

10

12

14

16

18

Jul-14

Aug-13

Sep-13

Oct-13

Nov-13

Dec-13

Jan-14

Feb-14

Mar-14

Apr-14

May-14

Aug-14

Sep-14

Oct-14

Nov-14

Dec-14

Jun-14

Jul-14

Jan-15

Feb-15

Mar-15

Apr-15

May-15

Jun-15

I/B Placement - Interest Received