AfrAsia Bank Limited and its Group Entities

Annual Report 2015

page 146

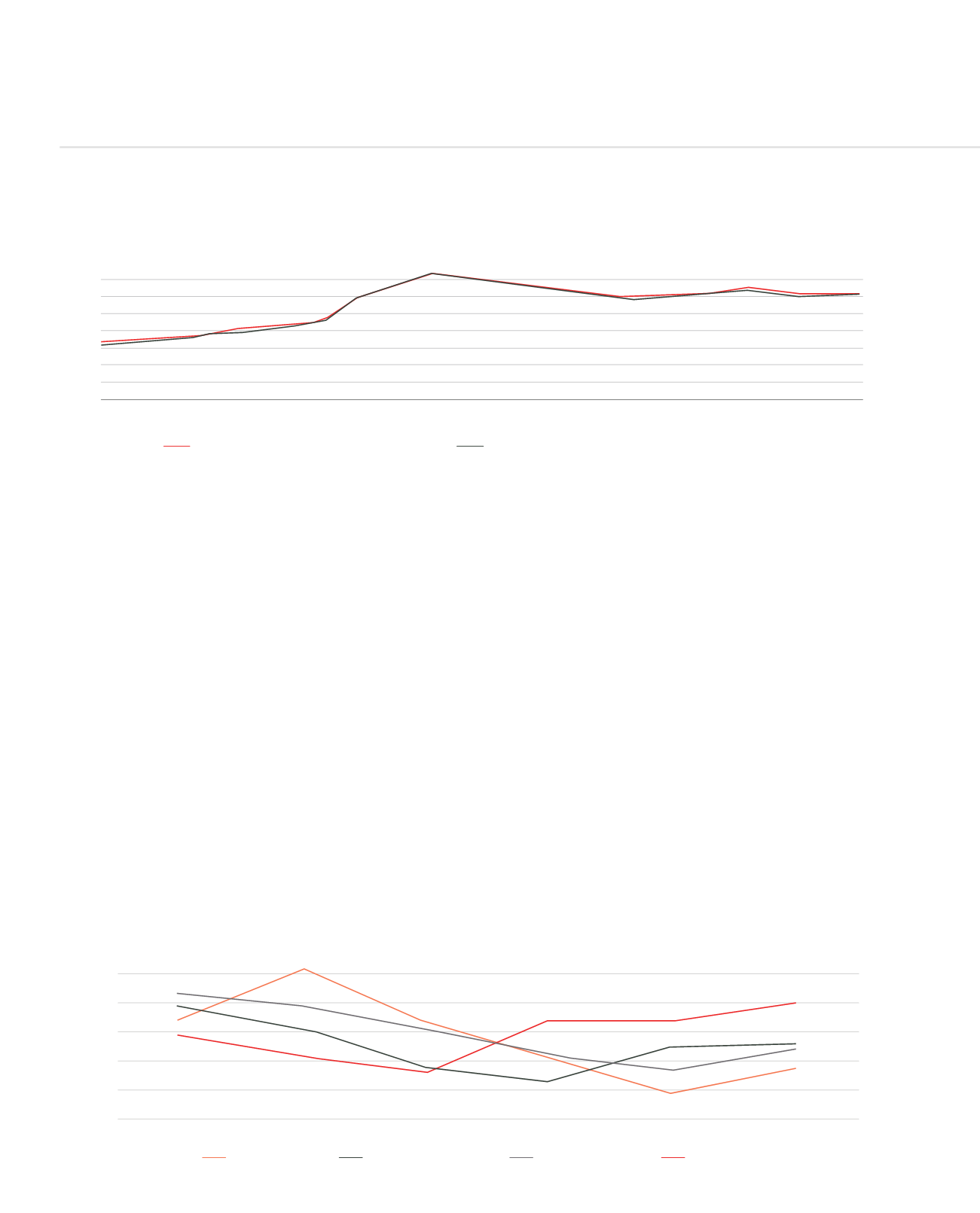

EVOLUTION OF USD/MUR

Although being an emerging bank, AfrAsia Bank Limited has been able to gain a strong foothold in the local Foreign Exchange market by

maintaining a 15% market share for the past year. The Bank prides itself in providing a solution-driven service to its clients, which is not only

focused on providing them with the most competitive rates but also sharing the Bank’s views and readings of the local and international

markets.

Going forward, the Bank thinks that more clients will embrace product sophistication. Local Corporates have naturally evolved from doing

only spot transactions to doing FX Forwards and Swaps. However, the market evolves, players will get more accustomed to Structured

Forwards (derived from options and forwards) in USD/MUR and EUR/MUR, which gives them more flexibility. The Bank thinks that based

on the current economic environment and in periods of high volatility that we have witnessed in both the local and the international market.

Importers and exporters have realised that the use of options together with forwards gives them more leeway and flexibility to hedge their

FX exposures.

Interest Rates

Excess liquidity in the Banking system at beginning of 2015 was MUR 6.9bn and gradually increased to MUR 12.83bn in early June

2015, after peaking at MUR 16.54bn mid-April 2015. On 21 May 2015, The Bank of Mauritius announced that it will sterilize around

MUR 20bn of liquidity by the end of December 2015. Treasury Bills Yields during the year reached their all-time lows in the range of 0.93%

- 1.31% as compared to the range of 2.17% - 2.85% at the beginning of 2015. Faced with the Eurozone Crisis, and a sector wise weighted

average Cost of Funds of 2.84% (As at May 2015), It was highly challenging for Banks to disburse quality assets and as a result the excess

liquidity was chasing Treasury Papers at rates even lower than Banks’ Cost of funds explaining the drastic increase in excess liquidity and

fall in Treasury paper rates.

MANAGEMENT DISCUSSION AND ANALYSIS (CONTINUED)

TBILLS EVOLUTION : LAST 6 ISSUES

15-Jan-15

15-Feb-15

15-Mar-15

15-Apr-15

15-May-15

15-Jun-15

29

30

31

32

33

34

35

36

37

Intervention BOM

ABL MID RATE

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

1

2

3

4

5

6

3Mths Tbills

6Mths Tbills

9Mths Tbills

12Mths Tbills