AfrAsia Bank Limited and its Group Entities

Annual Report 2015

page 143

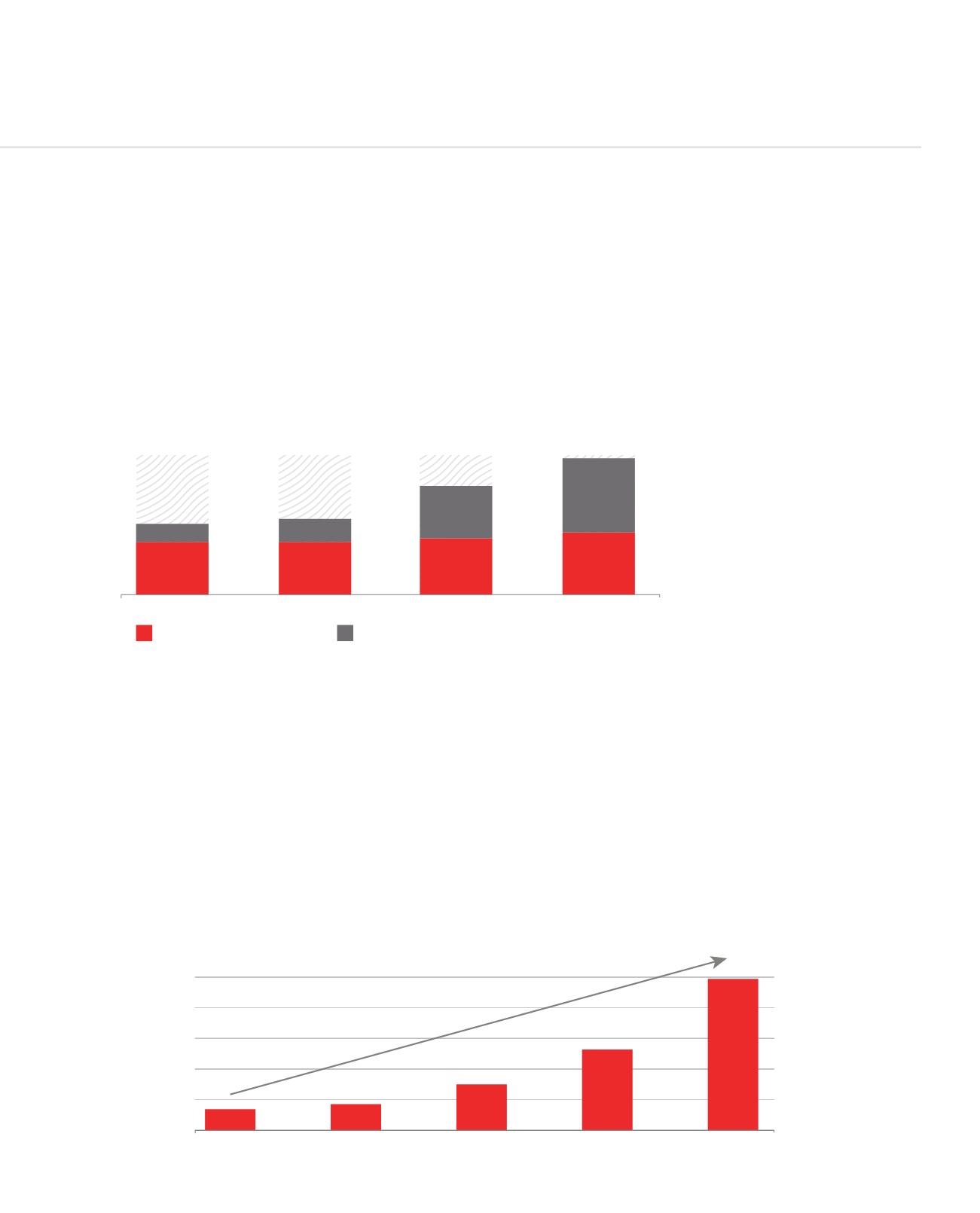

Domestic IMC

2012

2013

2014

2015

International IMC

35

50

117

164

113

115

121

134

2011

2012

2013

2014

2015

50,000,000

40,000,000

30,000,000

20,000,000

10,000,000

0

CARGR + 64.4%

MUR

During the year under review, the Global Business Desk

continued its international expansion strategy by tapping into

business opportunities primarily in chosen markets across Africa.

The Desk recorded a resilient performance across all key product

lines by reaping the benefits of on-going initiatives intended to

strengthen the Bank’s strategic position whilst diversifying its

exposures. For instance, increased regional market presence was

obtained through both organic client growth and participation

in loan syndications via funded deals in various segments of

the market. The Bank’s asset exposure is now well-diversified

covering targeted opportunities in property, oil and gas, telecom,

power, infrastructure, mining, institutional funds, multinationals,

agriculture, commodities and specialized finance. The year

under review has also seen considerable grounds covered in

terms of country based portfolio diversification with exposure

to new African countries such as Côte d’Ivoire and Ethiopia.

The East Africa framework remains a key target market for the

Bank with some exciting initiatives to come from that space in

the coming year. The Desk has also worked hard at developing

its DCM capabilities using the Mauritius financial market as a

hub for this activity, specifically lead mandate arrangements

co-facilitated by AfrAsia Corporate Finance business.

NEW INCORPORATION OF GB1, GB2 AND GLOBAL FUNDS

GBL companies and Global Funds are structures that are registered with the Mauritius Financial Services Commission and the

Registrar of Companies. As at February 2015, there was a total of 10,226 GBL1 companies, 10,855 GBL2 companies and 891 Global

Funds registered in Mauritius. From the above graph, it can be noted that the increase in the number of GBL1 companies and the

Global Funds is progressive. It will be interesting to follow the growth trend of the GBL2 companies over the year.

The Desk has diversified its referral base over the past few years and also actively works with some 100+ trust companies, corporate

services providers and other financial services providers, based outside Mauritius.

DEPOSITS FORM CUSTOMERS - SEGMENT B

RELATIONSHIP WITH INTERNATIONAL MANAGEMENT COMPANIES