AfrAsia Bank Limited and its Group Entities

Annual Report 2015

page 145

Product Development

The Bank’s aim is to be the preferred provider of Treasury

products in Mauritius and in the region and as such the Treasury

sales team spends a lot of time discussing with clients about

their FX needs and this approach has helped us gain around 15%

of FX volume in the local market. However, the banking sector is

becoming increasingly competitive and therefore it is important

to provide innovative solutions to clients to ensure that the

Bank remains ahead of the curve. While AfrAsia Bank Limited

continues to cater for the day-to-day FX spot volumes, the Bank

spends a lot of time understanding its clients’ FX exposures and

structuring the right FX derivatives products to help them. This

approach of providing tailor-made solutions has helped the Bank

become the preferred FX Derivatives provider in the market.

AfrAsia Bank Limited is now using its expertise to provide these

solutions to international clients.

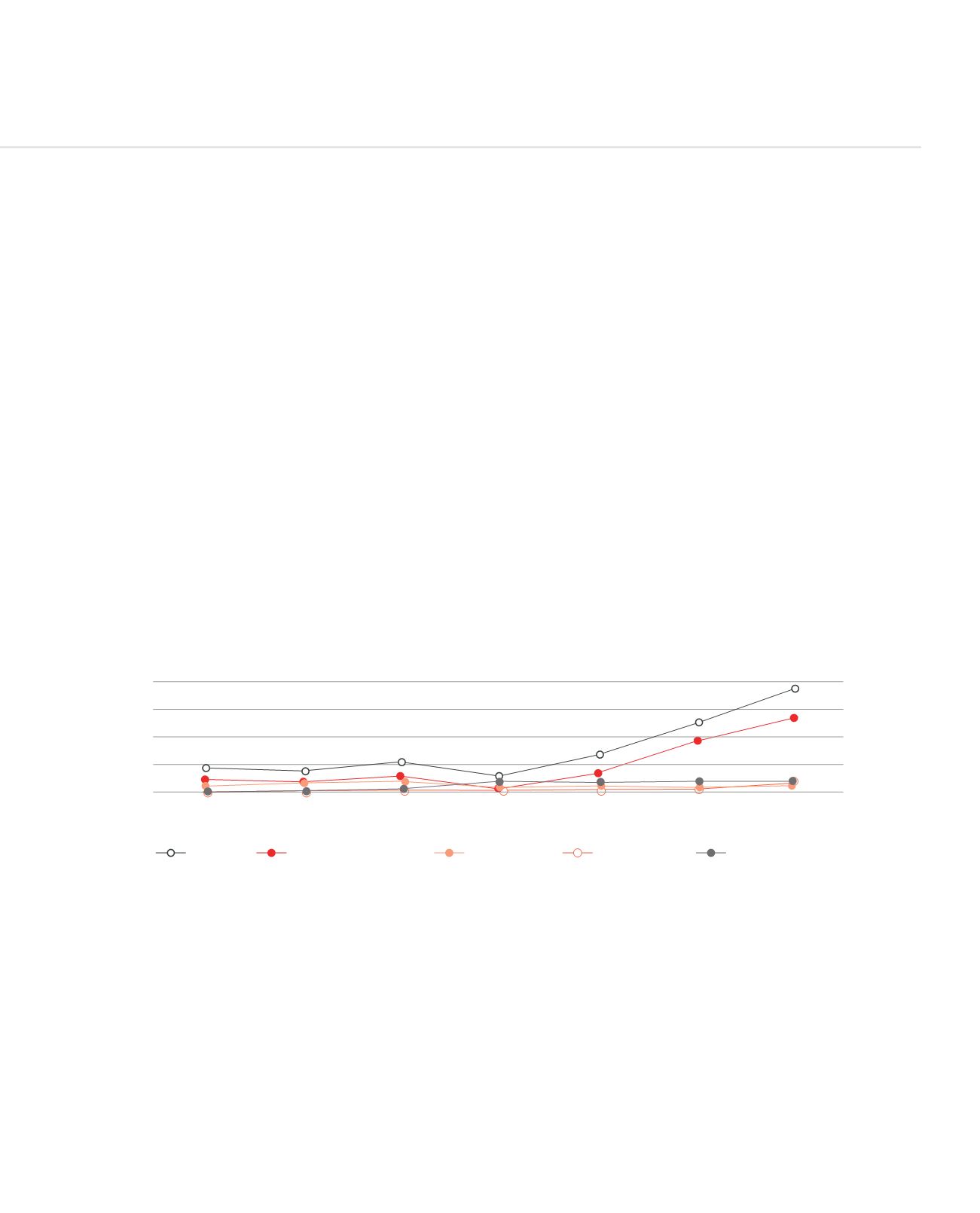

Our Treasury Business in Numbers

For the Financial Year ending 30

th

June 2015, our Trading

Income amounted to MUR 373m, a 52% year-on-year

growth. Revenue on FX Spots and Forwards amounted to

MUR 269m, representing a 47% increase from the previous year;

the main driver was the increase in FX volumes from the Global

Business segment, where the Bank has witnessed a 40% increase

in FX volume from FY 2013/14. The most significant increase

has been on the income generated from client FX derivatives

transactions which amounted to MUR 45m compared to

MUR 5m in 2013/14.

In terms of FX Turnover, the Bank has seen a steady increase in

its domestic banking volume to USD 1.1bn, representing a 10%

increase year-on-year; which has helped us achieve a market

share of 15% in the local market. The Bank has, however, seen

an increase of 40% in FX Volume on the Global Business side to

USD 638m, as a result of the fact that it can settle in more than

100 different currencies.

0

100

200

300

400

2008/2009 2009/2010 2010/2011

2011/2012

2012/2013

2013/2014 2014/2015

Total

FX spots and Fwds

Swaps

Other Trading

Derivatives

TRADING INCOME (MUR’ M)

Local Market Dynamics

Foreign Exchange

The dynamics of the FX business have drastically changed

since the beginning of 2015. The business has become more

competitive and challenging with the margin between the

bid and offer being significantly squeezed. The market saw a

depreciation of approximately 12% of the MUR from January

to March 2015 driven by the depreciation of the Euro on the

international market; the Euro being the currency in which most

of our exports are denominated. This prompted the Central Bank

to intervene in the market more regularly to keep the EUR/MUR

competitive while also curtailing the USD/MUR which was

overvalued; it is now trading at a fair value when compared to

the USD’s appreciation on the international market. Mauritius

is heavily dependent on the importation of basic necessities,

(e.g. dairy products, clothing, rice, etc.), however, a slowdown in

consumption has recently been seen. Importers are very vigilant

with regard to USD purchases and the Forward purchase market

has also dried up. There has also been a decline in the sale

of Foreign Currency, which is usually driven by the tourism and

textile manufacturing sectors.