AfrAsia Bank Limited and its Group Entities

Annual Report 2015

page 142

Moreover, the Desk collaborated with internal stakeholders and

supported the implementation of selected projects and the Bank’s

products and services line-up:

January – launch of the Global Custody online platform and safe

lockers to Private Clients

March - the Bank launched the VISA prepaid card

April – the Bank carried out a revamping of the Internet Banking platform

with the objectives of offering quicker access to information, enhanced

security features and SMS alerts, broadening the operationmandates

for using the Platform, inter alia.

The Desk also contributed in refining the operational and client on

boarding processes as well as fostering effective harmonisation of

the representative offices.

In October 2014, the Bank had an addition to its already strong

existing shareholder base, namely the Toronto-listed, National Bank

of Canada. This addition has enhanced the institutional profile of the

Bank, giving more comfort to its foreign, non-resident client base.

The global landscape affecting IFCs is changing rapidly, with a

stronger focus on transparency and fair taxation system. Initiatives

like the US FATCA have already been implemented worldwide.

More than 65 countries have agreed publicly to implement the

automatic exchange of information under the Common Reporting

Standard, starting as from the year 2017 for the early adopters.

The OECD Base Erosion Profits Sharing program is also forthcoming.

Mauritius welcomes the above initiatives as the Jurisdiction has

always positioned itself as an IFC fostering transparency.

Recently, Mauritius has had 2 of its important double taxation

agreements (DTAs), namely those with South Africa and India,

renegotiated and, its name appearing on an EU blacklist. Obviously,

the future of the Island as an IFC depends a lot on certainty of the

DTAs and the comfort of international investors that they are able

to mitigate their taxation, legal and investment risks by investing

through an economically and fiscally stable jurisdiction. The Country

needs to expand its network of DTAs and Investment Promotion and

Protection Agreements, more specifically with the African countries.

The DTAs that have been signed but not yet ratified also need to

be finalized as soon as possible so as to provide a comparative

advantage. Moreover, the Country needs to decry the inclusion of

its name in the EU blacklist in order to uphold the reputation of

Mauritius as a transparent and fully compliant IFC.

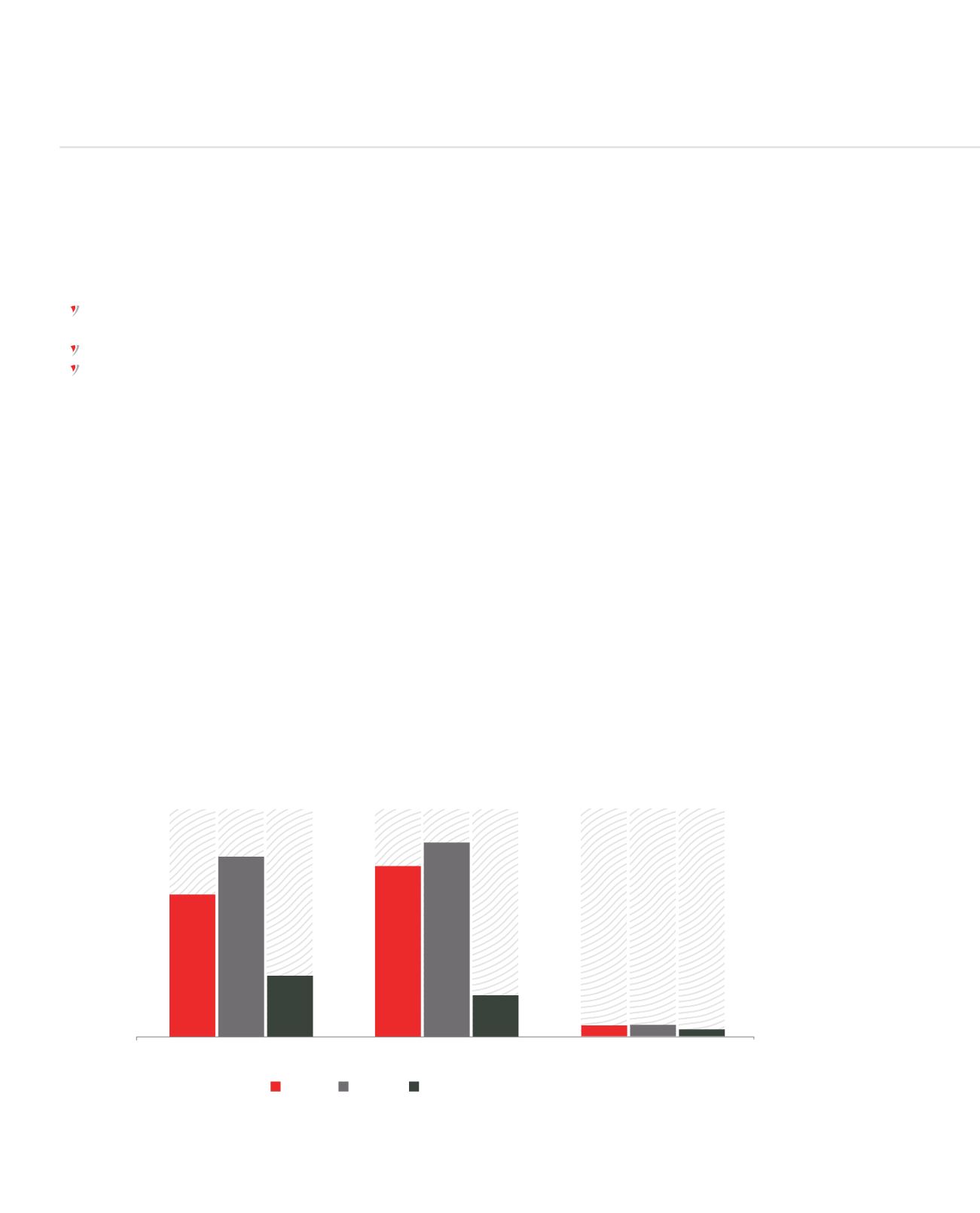

Liability Analysis

The main source of introduction is through the approved

intermediaries operating in the Mauritius Global Business sector,

which include some 125+ International Management Companies

(IMCs). The activities of the Global Business sector in the Mauritius

International Financial Centre (IFC) are mainly reflected in the

evolution of the number of Global Business companies which,

as per the Financial Services Commission statistics, was as follows:

0

200

400

600

800

1000

1200

1400

1600

GBL1

GBL2

GLOBAL FUNDS

Types of Companies

Number of Companies

2013

2014

2015 ( As at Apr 15 )

1001

1259

424

1191

1366

284

70

77

47

MANAGEMENT DISCUSSION AND ANALYSIS (CONTINUED)