AfrAsia Bank Limited and its Group Entities

Annual Report 2015

page 105

the near future be in a position to provide relevant stakeholders of the Bank with more value added solutions, insight and innovative

approach to help the organisation accomplish its objectives.

*Internal auditing is an independent, objective assurance and consulting activity designed to add value and improve an organisation’s

operations. It helps an organisation accomplish its objectives by bringing a systematic, disciplined approach to evaluate and

improve the effectiveness of risk management, control and governance processes.

COMPLIANCE

The Bank’s Compliance Function is responsible for the identification and management of Compliance and Money Laundering Risk.

Internal control and risk mitigation measures are put in place and implemented to ensure compliance with the relevant laws,

regulations and internal policies and procedures.

As per the approved Compliance Plan, Compliance reviews of departments are conducted and reports are duly submitted to Senior

Management, the Compliance Committee, Audit Committee of the Board and the Board of Directors.

With the implementation of a fully automated Anti-Money Laundering Software, the Compliance Department independently reviews

transactions and the Anti-Money Laundering alerts generated based on agreed parameters, transaction amounts and frequency.

The transaction monitoring system in place also assists in the independent investigations of suspicious cases. Consequently,

appropriate decisions and actions are taken by the Money Laundering Reporting Officer.

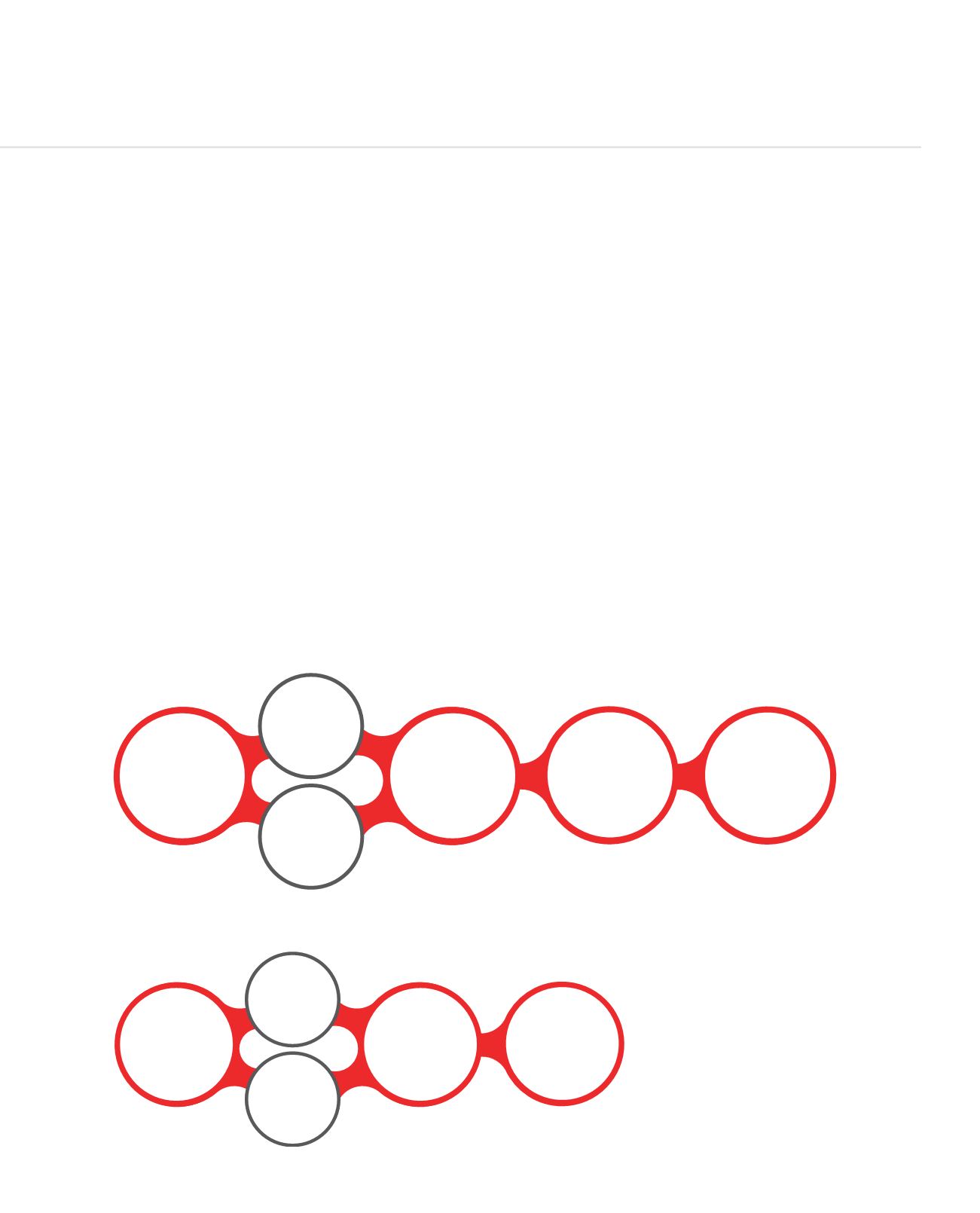

All Transactions

conducted by

customers of

the Bank

AML

Software

Scenarios/

Parameters

Alerts generated

as per set

scenarios/

parameters

Independently

reviewed by

Compliance

Department

Alert closed

or suspicious

transaction

reported

Furthermore the Know Your Customer software in place allows KYC profiling, which is improved through enhanced due diligence,

customer identification, screening and customer risk scoring.

All customers

of the bank

are screened

KYC

Software

Parameters

Customers

classified as

High, Medium

or Low

Where required,

enhanced due

diligence is

conducted