AfrAsia Bank Limited and its Group Entities

Annual Report 2015

page 83

One of the key missions of AfrAsia Bank Limited (the “Bank”)

is to identify, assess and manage the credit, operational,

market and liquidity risks to which the Bank is exposed, thereby

providing a sustainable environment to attract and promote

business opportunities whilst improving the risk/return profile

of its activities.

Through a robust internal control mechanism, together with

comprehensive and up-to-date risk policies, reliable decision

making support with strict adherence to the legal and regulatory

requirements, our goals remain to maintain the confidence of

the stakeholders by mitigating our risk through the management

of current and potential credit, operational, market and liquidity

risks.

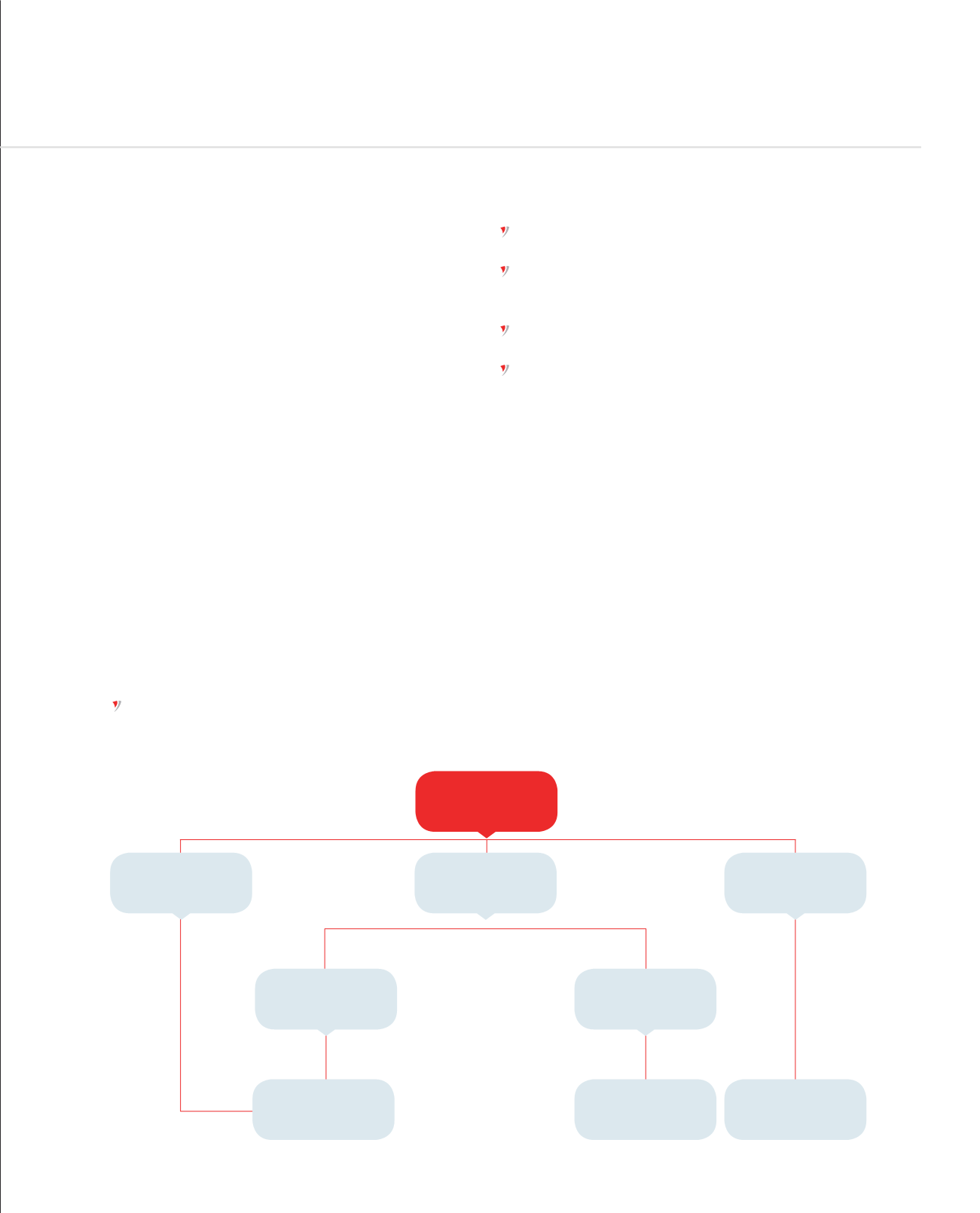

RISK MANAGEMENT STRUCTURE

AfrAsia Bank Limited has clear risk management objectives and

a well-established strategy to deliver them, through core risk

management processes.

At a strategic level, the Bank’s risk management objectives are to:

identify the significant risks to the Bank;

formulate the Bank’s risk appetite and to ensure that business

profiles and plans are consistent with it;

establish strong and independent reviews in a dynamic

structure; optimisation of risk and return decisions are taken

as closely as possible to be in line with our core business;

ensure business growth plans are properly supported by

effective risk infrastructure; and

ensure that the management of risk profile for specific

financial deliverables remain possible under a range of

adverse business conditions.

The Bank’s main approach is to establish a solid and effective

Risk Management infrastructure in terms of people, systems,

policies, procedures, control and compliance and to recommend

to the Board changes to meet the challenges of the dynamic

market.

The Bank also has a clear organisational structure and

comprehensive policies and procedures to identify, evaluate,

monitor and control risks across the organisation. Reviews and

modifications to these risk management policies and procedures

are regularly carried out to reflect changes in markets and

business strategies.

AUDIT

COMMITTEE

ASSET AND LIABILITY

COMMITTEE (ALCO)

MANAGEMENT

CREDIT COMMITTEE

(MCC)

CONDUCT

REVIEW

COMMITTEE

BOARD OF

DIRECTORS

BOARD RISK

COMMITTEE

COMPLIANCE

AND AUDIT

CREDIT AND

RISK COMMITTEE

FINANCE AND TREASURY

BACK OFFICE/MARKET

RISK DEPARTMENT

The Board has delegated some of its functions to a number of committees and departments as follows:

RISK MANAGEMENT REPORT