AfrAsia Bank Limited and its Group Entities

Annual Report 2015

page 110

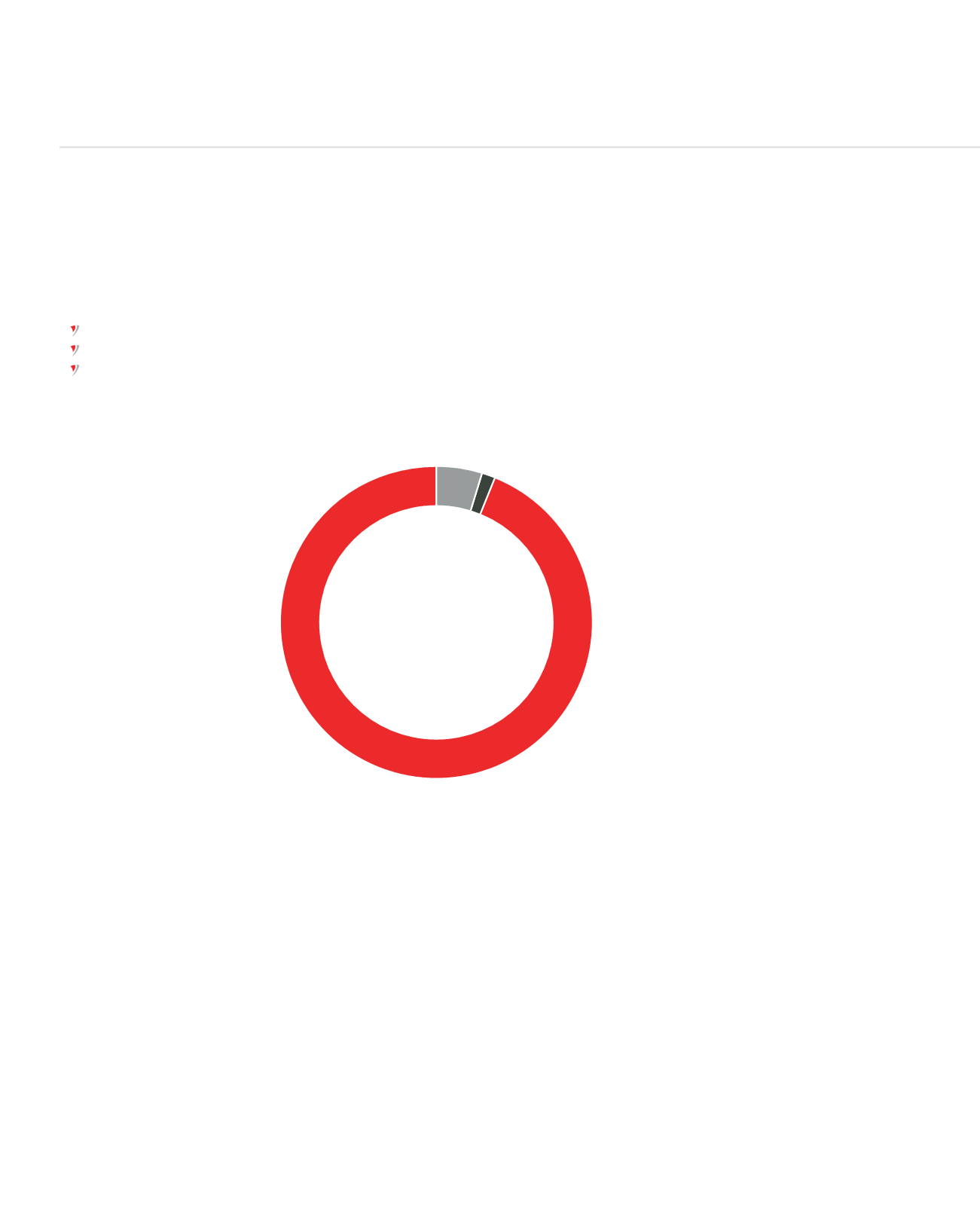

RISK WEIGHTED ASSETS

Total Risk Weighted Assets as at 30 June 2015 was at MUR 35,881,489,346 versus capital base of MUR 4,913,306,315.

Analysis by risk type:

Credit Risk

MUR 33,646,596,314

Market Risk

MUR 491,319,869

Operational Risk

MUR 1,743,573,163

Market Risk

1.3%

Operational Risk

4.9%

Credit Risk

93.8%

SUPERVISORY REVIEW PROCESS AND STRESS TESTING

In line with the Bank of Mauritius Guideline on Supervisory Review Process, stress tests are performed on AfrAsia Bank’s risk portfolio at

least annually in order to assess the impact of possible adverse events on key profit and loss and statement of financial position ratios

as well as on the Bank’s ability to meet capital requirements at distinct stages of the economic cycle. The Supervisory Review Process

recognises the responsibility of the Bank’s management in developing a sound Internal Capital Adequacy Assessment Process (ICAAP) and

setting up capital targets that are commensurate with the Bank’s risk profile.

Stress testing is oneof themainelements of the ICAAPand is performedonamonthly basis viaALCOtomeasure the impact of changes on interest rate

(negative and positive interest rate shocks of 100bps across all maturity buckets), foreign currency (5% variance in exchange rates)

and liquidity position. On at least an annual basis, stress tests are done on the Bank’s portfolio to assess any impact on key performance

indicators such as asset downgrade, decline in specific sectors, deposit withdrawal and defaulting counterparties as well as on the Bank’s

ability to meet capital requirements on the targeted plans. The ICAAP process is to ensure that the capital base reflects the risk and return

profile of its business operations while adhering to all regulatory and statutory requirements and good corporate governance.

RISK WEIGHTED ASSETS

RISK MANAGEMENT REPORT (CONTINUED)