AfrAsia Bank Limited and its Group Entities

Annual Report 2015

page 122

MANAGEMENT DISCUSSION AND ANALYSIS (CONTINUED)

Source: Africa Economic Outlook 2015

FDI FLOWS

The World Investment Report 2015 indicates that Mauritius was amongst the top five host Small Island Developing States (SIDS) economies

in terms of FDI inflows in 2014.

Source: World Investment Report 2015, UNCTAD

Given its substantial network of DTAAs and IPPAs with over 40 countries and its strong global business sector, Mauritius is also used as a

platform for financial transactions and investments in the region. A significant amount of FDI to Mauritius is intended for other countries/

economies in the region. In 2014-2015, for instance, Mauritius regained the position as top source of FDI into India, outrivaling Singapore

to second slot. Mauritius accounted for about 29% of India’s total FDI inflows in fiscal year 2014-2015 (amounting to some USD 9bn, as

opposed to USD 6.74bn of FDI inflows from Singapore).

Performance of the Stock Exchange of Mauritius

The Official Market witnessed high level of trading during the first six months of 2015. Total value traded reached an all-time high of

MUR11.6bn, up 32% as compared with the first half of 2014. Total value traded (on both the Official Market and the DEM) stood at

MUR 12.5bn, which is in stark contrast with the 2014 figures (MUR 9.1bn)

Foreign Direct Investment (FDI) Flows in and out of Mauritius, 2009-2014

(USD million)

2009

2010

2011

2012

2013

2014

FDI Inflows

248

430

433

589

259

418

FDI Outflows

37

129

158

180

135

91

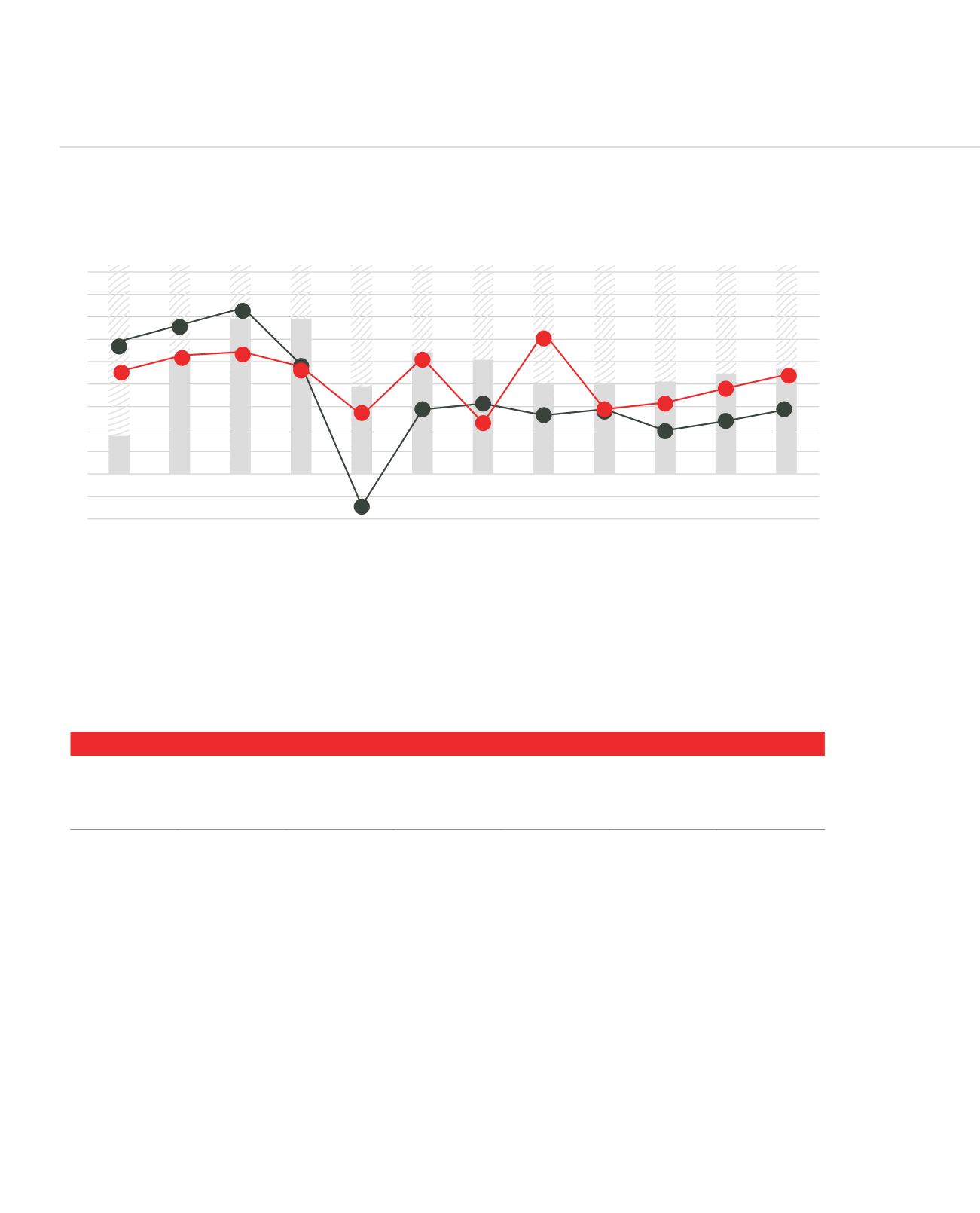

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014 (e)

2015 (p)

2016 (p)

-1

0

1

2

3

4

5

6

7

8

9

FORECAST REAL GDP GROWTH: MAURITIUS V/S AFRICA