AfrAsia Bank Limited and its Group Entities

Annual Report 2015

page 186

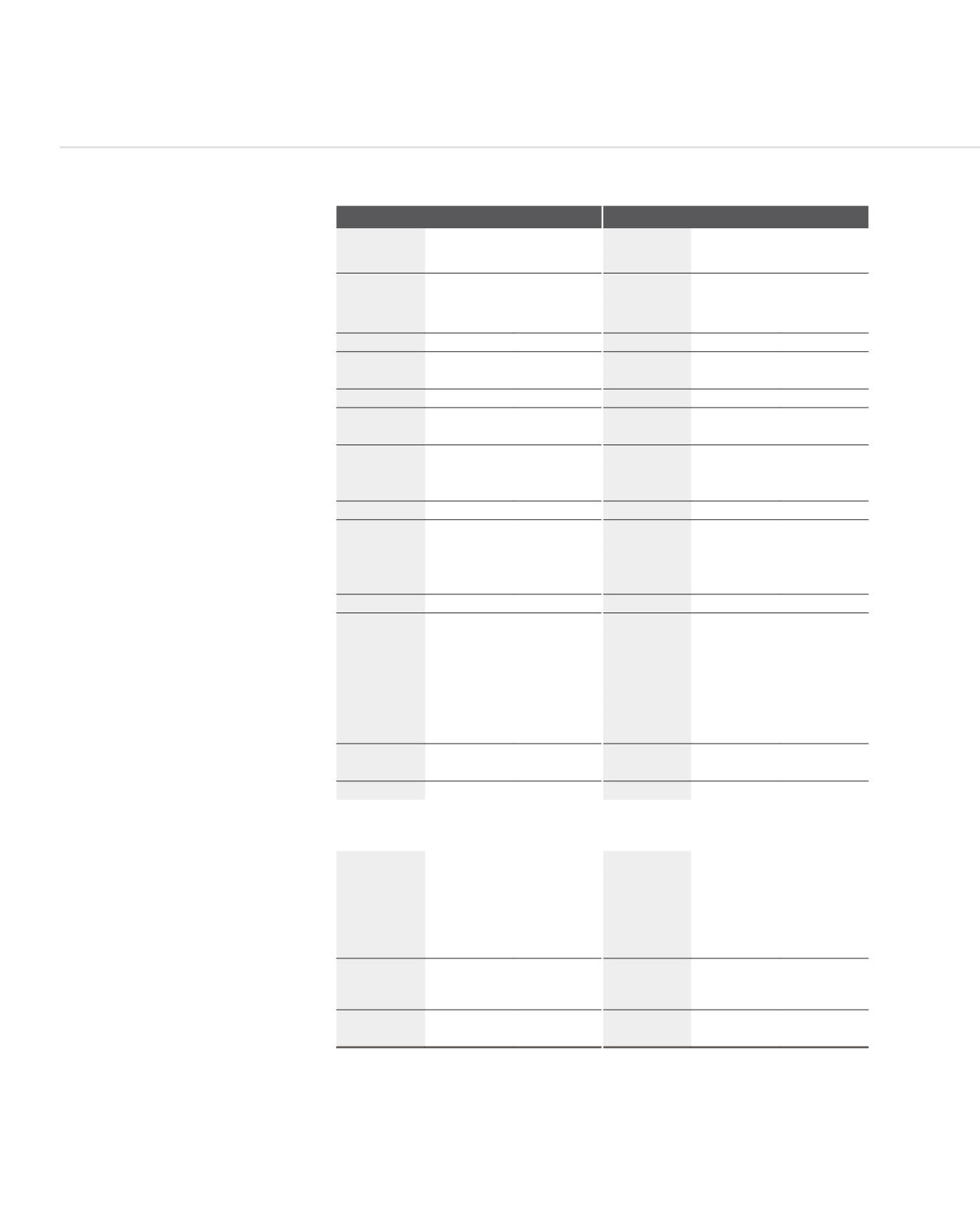

THE GROUP

THE BANK

Year ended

Year ended

Year ended

Year ended

Year ended

Year ended

30 June 2015

30 June 2014 30 June 2013

30 June 2015

30 June 2014 30 June 2013

Notes

MUR

MUR

MUR

MUR

MUR

MUR

Interest income

3

1,603,346,016

1,362,483,541

986,611,615

1,609,152,800

1,353,357,522

986,614,164

Interest expense

4

(756,260,493)

(701,314,270)

(620,362,470)

(748,563,714)

(694,338,487)

(620,367,037)

Net interest income

847,085,523

661,169,271

366,249,145

860,589,086

659,019,035

366,247,127

Fees and commission income

5

508,817,561

330,712,409

179,492,120

285,987,554

196,663,870

176,526,845

Fees and commission expense

5

(73,070,643)

(36,193,075)

(21,367,222)

(72,768,301)

(38,043,390)

(20,730,461)

Net fees and commission income

5

435,746,918

294,519,334

158,124,898

213,219,253

158,620,480

155,796,384

Net trading income

6a

7,485,446

248,816,151

193,093,707

471,081,684

245,815,180

132,453,791

Other operating income

6b

100,027,593

20,594,390

9,336,696

101,863,180

113,104,430

9,336,696

Total operating income

1,390,345,480

1,225,099,146

726,804,446

1,646,753,203

1,176,559,125

663,833,998

(Net allowance for credit impairment)/

Reversal of impairment charge

7

(236,979,654)

(67,710,745)

1,152,052

(500,278,533)

(175,710,745)

1,152,052

Net operating income

1,153,365,826

1,157,388,401

727,956,498

1,146,474,670

1,000,848,380

664,986,050

Personnel expenses

8

(371,876,577)

(341,433,820)

(197,632,225)

(294,044,111)

(288,876,808)

(197,632,225)

Depreciation of equipment

23

(15,888,206)

(8,591,580)

(4,695,949)

(13,535,822)

(6,877,644)

(4,694,856)

Amortisation of intangible assets

24

(64,546,070)

(48,458,634)

(5,714,166)

(8,729,435)

(6,623,537)

(5,714,166)

Other operating expenses

9

(329,644,606)

(213,474,417)

(118,000,522)

(273,372,535)

(192,258,648)

(116,857,206)

Total operating expenses

(781,955,459)

(611,958,451)

(326,042,862)

(589,681,903)

(494,636,637)

(324,898,453)

Operating profit

371,410,367

545,429,950

401,913,636

556,792,767

506,211,743

340,087,597

Share of profit of joint venture

21

-

2,664,054

16,283,494

-

-

-

Fair value gain on acquisition of subsidiaries

19

-

125,845,708

-

-

-

-

Impairment loss on subsidiary

18

-

-

-

(302,554,154)

(217,000,000)

-

Impairment loss on associate

22

(118,564,966)

(144,246,639)

-

-

-

-

Impairment of available-for-sale investment

17

(327,647,054)

-

-

-

-

-

Share of loss of associate

22

-

(129,175,128)

(177,483,655)

-

-

-

(Loss)/Profit before tax

(74,801,653)

400,517,945

240,713,475

254,238,613

289,211,743

340,087,597

Tax expense

10

(101,266,632)

(75,994,166)

(37,678,683)

(79,207,295)

(66,566,545)

(37,491,675)

(Loss)/Profit for the year

(176,068,285)

324,523,779

203,034,792

175,031,318

222,645,198

302,595,922

Other comprehensive income to be

reclassified to profit or loss in subsequent

period:

Share of associates other reserves

-

(813,574)

2,122,705

-

-

-

Net gain on available-for-sale investments

1,998,535

1,977,927

-

-

-

-

Exchange differences on translation of

foreign operations

(677,597)

(9,630,208)

527,011

-

-

-

Net gain on hedge of a net investment

-

7,007,543

48,401

-

-

-

Total other comprehensive income to be

reclassified to profit or loss in subsequent

period

1,320,938

(1,458,312)

2,698,117

-

-

-

Total comprehensive (loss)/income for

the year

(174,747,347)

323,065,467

205,732,909

175,031,318

222,645,198

302,595,922

The notes on pages 191 to 307 form an integral part of these financial statements.

Auditors’ report on page 185.

StatementS of profit or loSS and other ComprehenSive inCome

for the year ended 30 June 2015