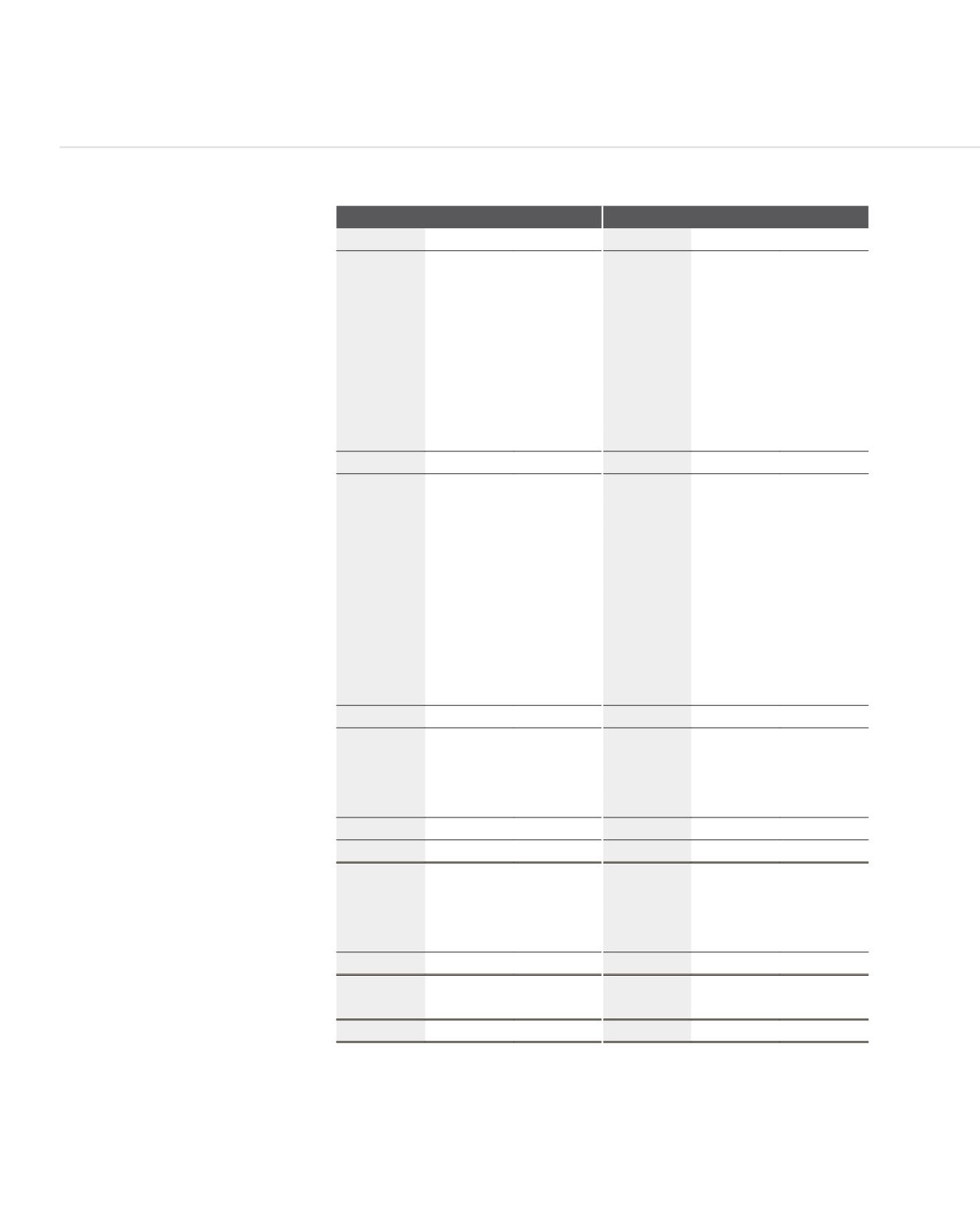

AfrAsia Bank Limited and its Group Entities

Annual Report 2015

page 190

THE GROUP

THE BANK

2015

2014

2013

2015

2014

2013

Notes

MUR

MUR

MUR

MUR

MUR

MUR

OPERATING ACTIVITIES

(Loss)/Profit before tax

(74,801,653)

400,517,945

240,713,475

254,238,613

289,211,743

340,087,597

Adjustments for:

Change in operating assets

34(b)

(12,738,312,383)

(8,182,496,447) (3,252,573,700)

(13,662,318,708)

(7,214,283,173) (3,151,902,485)

Change in operating liabilities

34(c)

25,007,791,177

16,126,764,207 8,699,014,329

25,017,056,326

14,702,515,768

8,677,131,579

Non-cash items included in profit before

tax

34(d)

606,032,212

186,165,231

205,464,727

1,150,817,452

329,478,856

43,861,873

Tax paid

(97,772,866)

(55,408,902)

(25,508,399)

(83,329,156)

(44,845,290)

(25,364,911)

Net cash flows from operating activities

12,702,936,487

8,475,542,034

5,867,110,432

12,676,464,527

8,062,077,904 5,883,813,653

INVESTING ACTIVITIES

Purchase of equipment

23

(48,857,517)

(46,704,683)

(19,964,487)

(46,867,164)

(44,733,223)

(19,964,487)

Purchase of investment in associates

22

-

(144,693,183)

(643,843)

-

-

-

Purchase of intangible assets

24

(19,110,619)

(29,383,716)

(4,039,565)

(19,081,035)

(28,869,891)

(4,039,565)

Investment in subsidiaries

18

-

-

-

-

(250,693,183)

(20,000,000)

Investment in joint venture

-

-

(500,000)

-

-

-

Purchase of available-for-sale financial

investments

(25,357,471)

(300,575,661)

(25,662,280)

-

-

-

Acquisition of subsidiaries, net of cash

acquired

19

-

(225,689,438)

-

-

-

-

Dividend income

-

-

23,413,740

-

-

-

Net cash flows used in investing activities

(93,325,607)

(747,046,681)

(27,396,435)

(65,948,199)

(324,296,297)

(44,004,052)

FINANCING ACTIVITIES

Issue of shares

820,436,380

1,453,290,254

296,135,926

820,436,380

1,439,290,254

296,135,926

Disposal/(acquisition) of treasury shares

31

405,776,236

(405,776,236)

-

405,776,236

(405,776,236)

-

Dividends paid

(185,649,039)

(116,027,201)

(88,068,022)

(185,649,039)

(116,027,201)

(88,068,022)

Net cash flows from financing activities

1,040,563,577

931,486,817

208,067,904

1,040,563,577

917,486,817

208,067,904

Net cash flows for the year

13,650,174,457

8,659,982,170

6,047,781,901

13,651,079,905

8,655,268,424

6,047,877,505

Movement in cash and cash equivalents

Cash and cash equivalents at 1 July

17,638,539,596

8,967,488,944

2,919,642,013

17,622,720,763

8,967,452,339

2,919,574,834

Net increase in cash and cash equivalents

13,650,174,457

8,659,982,170

6,047,781,901

13,651,079,905

8,655,268,424

6,047,877,505

Net foreign exchange difference

(683,056)

11,068,482

65,030

-

-

-

Cash and cash equivalents at 30 June

34(a)

31,288,030,998

17,638,539,596

8,967,488,944

31,273,800,668

17,622,720,763

8,967,452,339

Operational cash flows from interest

Interest paid

(695,169,298)

567,015,589

566,729,381

(687,472,519)

560,039,806

576,208,690

Interest received

1,506,180,943

1,311,305,734

725,408,056

1,511,987,727

1,302,179,715

725,410,605

The notes on pages 191 to 307 form an integral part of these financial statements.

Auditors’ report on page 185.

StatementS of CaSh flowS

for the year ended 30 June 2015