AfrAsia Bank Limited and its Group Entities

Annual Report 2015

page 48

As a public company incorporated on 12 January 2007 and holder of a Banking Licence issued on 29 August 2007, AfrAsia Bank Limited

remains guided by the principles issued by the Mauritius Financial Reporting Council in its “Guidelines on Compliance with the Code of

Corporate Governance”, by the Bank of Mauritius in its “Guidelines on Corporate Governance” and by the provisions of the Mauritius

Companies Act 2001.

STATEMENT OF AFFAIRS AND REVIEW OF ACTIVITIES

The main activities of AfrAsia Bank Limited are that of lending and deposit taking for Corporate and Private Clients, Treasury Operations,

Investment Banking and Wealth Management.

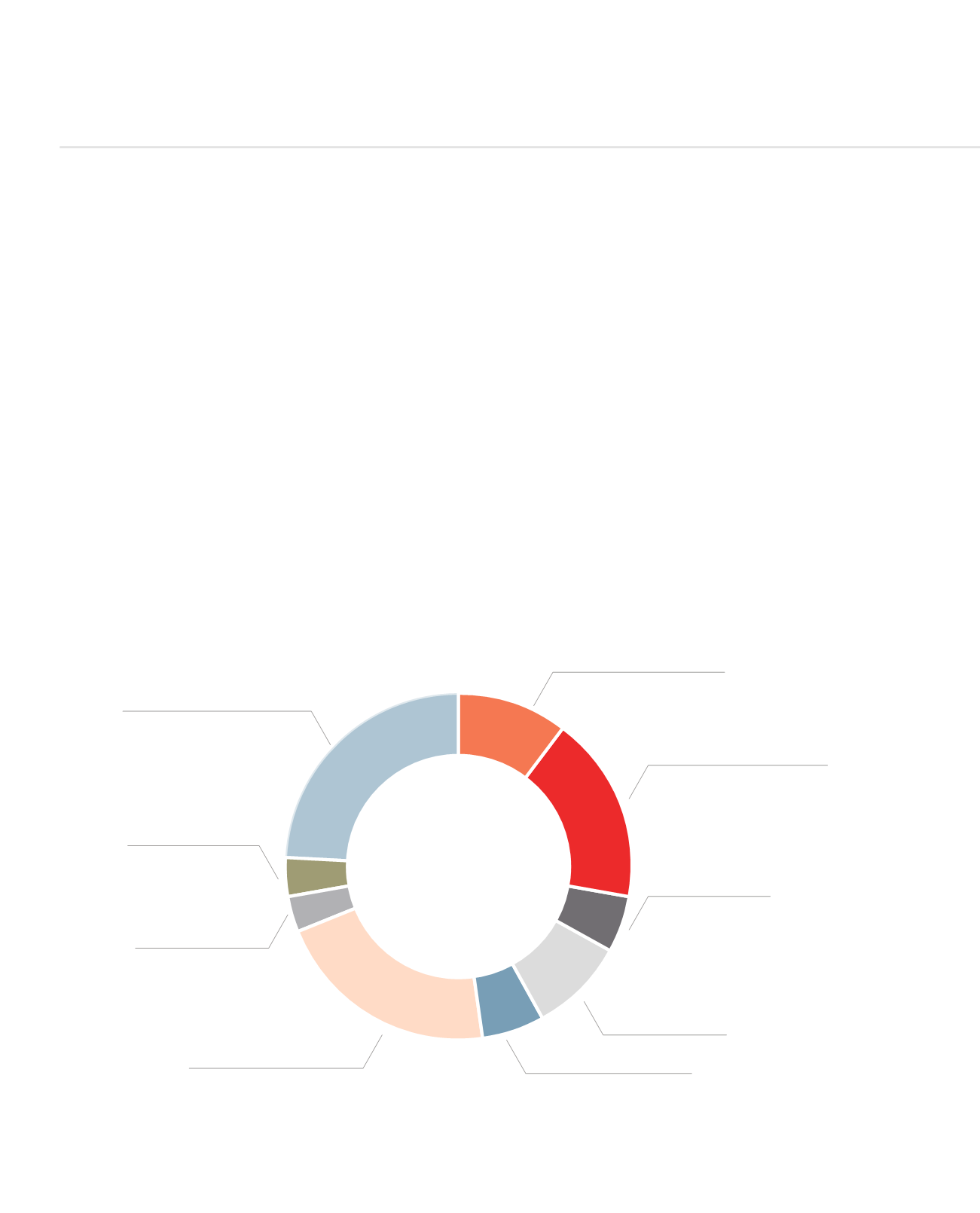

SHAREHOLDING STRUCTURE

AfrAsia Bank Limited has a good mix of local and foreign private institutional investors of renowned reputation across various continents,

contributing to a capital base of MUR 4.9bn as at 30 June 2015. The Bank’s aim is to ensure that there is proper and efficient information

dissemination to all of its shareholders and ensuring that the rights of minority shareholders are not neglected. We also highlight that

approximately 3.5% of the Bank’s shareholding structure is held by current staff.

The shareholding structure as at 30 June 2015 was as follows:

CORPORATE GOVERNANCE REPORT (CONTINUED)

GML Investissement Ltée,

24.1%

Companies less than 5%,

21%

Société de Promotion

et de la Participation

pour la Coopération

Economique S.A,

9%

National Bank of Canada,

17.5%

Mon Loisir Ltée,

5.2%

Belle Mare Holding Ltd,

5.9%

Individual less than 5%

current sta ,

3.5%

Individual less than 5%

except sta ,

3.4%

Intrasia Capital Pte Ltd,

10.4%