AfrAsia Bank Limited and its Group Entities

Annual Report 2015

page 231

noteS to the finanCial StatementS

for the year ended 30 June 2015

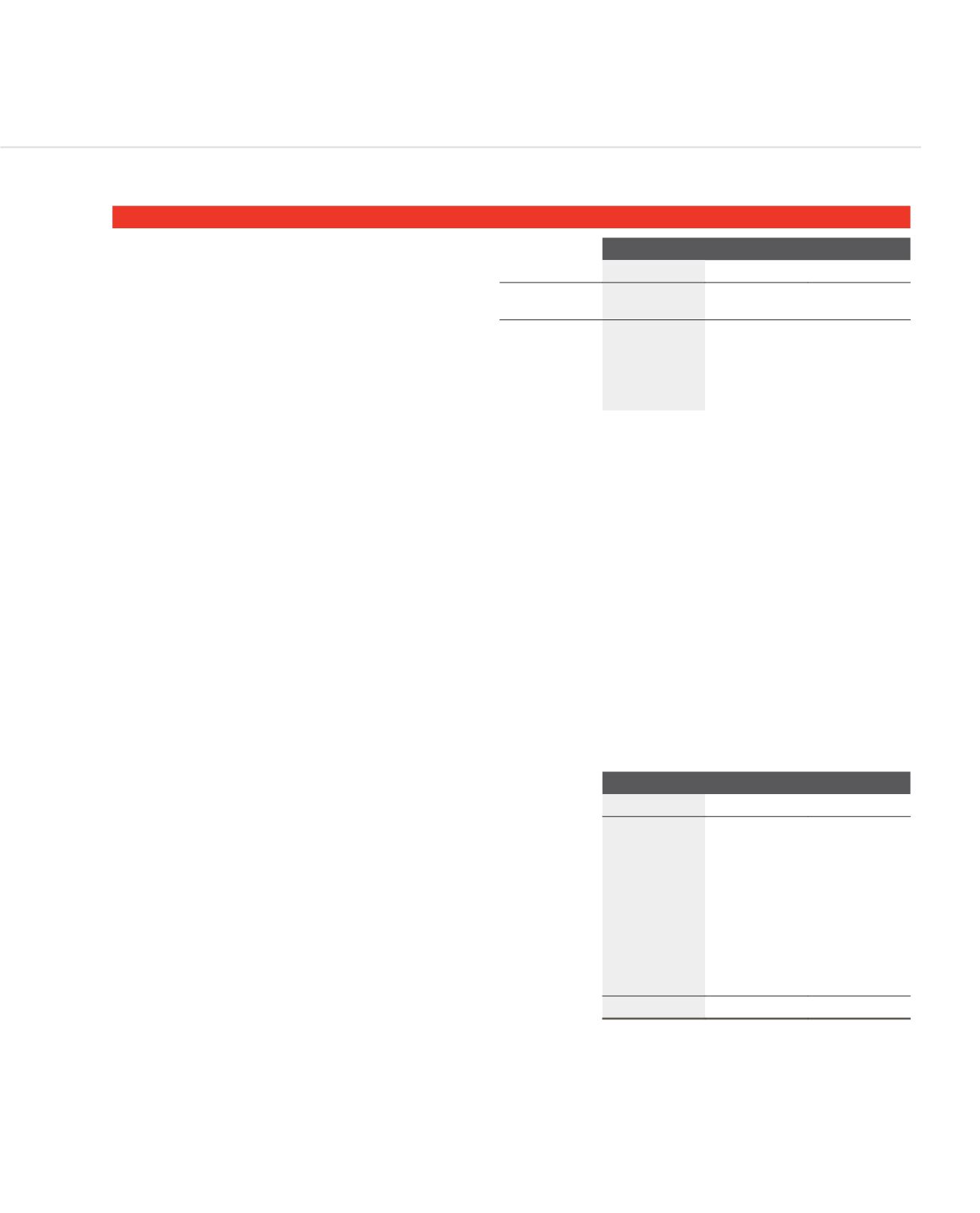

22. INVESTMENT IN ASSOCIATES

THE GROUP

THE GROUP

2015

2014

2013

The investment in associates are as follows:

Country of

incorporation

% Holding

% Holding

% Holding

AfrAsia Zimbabwe Holdings Limited (“AZHL”)

Zimbabwe

62.75

47.01

32.75

AfrAsia Corporate Finance (Africa) Ltd

Mauritius

100.0**

100.0**

50.0

AfrAsia Corporate Finance (Pty) Ltd

South Africa

100.0**

100.0**

50.0

AfrAsia Kingdom Holdings Limited (“AKHL”)

Mauritius

100.0**

52.0

52.0

AfrAsia Bank Limited does not consider AfrAsia Zimbabwe Holdings Limited as its subsidiary as it does not have the power to govern the financial and operating

activities of that company. Accordingly, the financial statements of this entity have not been consolidated in the group financial statements.

Since AZHL is being liquidated, the Group interest is no more accounted as an investment in associate. Refer to note 18 for further explanation as to those

factors that led to the impairment loss.

AKHL is a private limited company incorporated in Mauritius. Its principal activity is to act as an investment holding company.

In prior years, AfrAsia Bank Limited did not consider AKHL as its subsidiary as it was not exposed to or have rights to variability in returns from its involvement

with AKHL and did not have the ability to affect those returns through its power over the entity pursuant to the shareholder’s agreement with the other investor.

Accordingly, the financial statements of these entities were not consolidated in the group financial statements. During the year, the Group obtained control over

AKHL as the latter bought back the shares held by the other shareholder.

AfrAsia Corporate Finance (Pty) Ltd and AfrAsia Corporate Finance (Africa) Ltd are independent corporate finance advisers based in South Africa and Mauritius

respectively. Both are private entities and are not listed on any public exchange. Their advisory services include mergers and acquisitions, debt advisory,

restructuring, equity advisory and Black Economic Empowerment (‘BEE’) Advisory. The Group acquired the remaining 50% equity on 1 October 2013 and from

which date both entities became subsidiaries of the Group.

** Accounted under investment in subsidiaries.

The following table illustrates summarised financial information of the Group’s investment in the associates:

THE GROUP

2015

2014

2013

AfrAsia Zimbabwe Holdings Limited

MUR

MUR

MUR

Opening balance

118,564,966

179,688,223

376,826,129

Additions

-

144,693,183

643,843

Acquisition of subsidiaries

-

74,610,566

-

Share of loss after tax

-

(130,621,292)

(199,904,454)

Foreign exchange movement

-

(4,745,501)

-

Impairment loss

(118,564,966)

(144,246,639)

-

Share of other reserves

-

(813,574)

2,122,705

Closing balance

-

118,564,966

179,688,223