AfrAsia Bank Limited and its Group Entities

Annual Report 2015

page 24

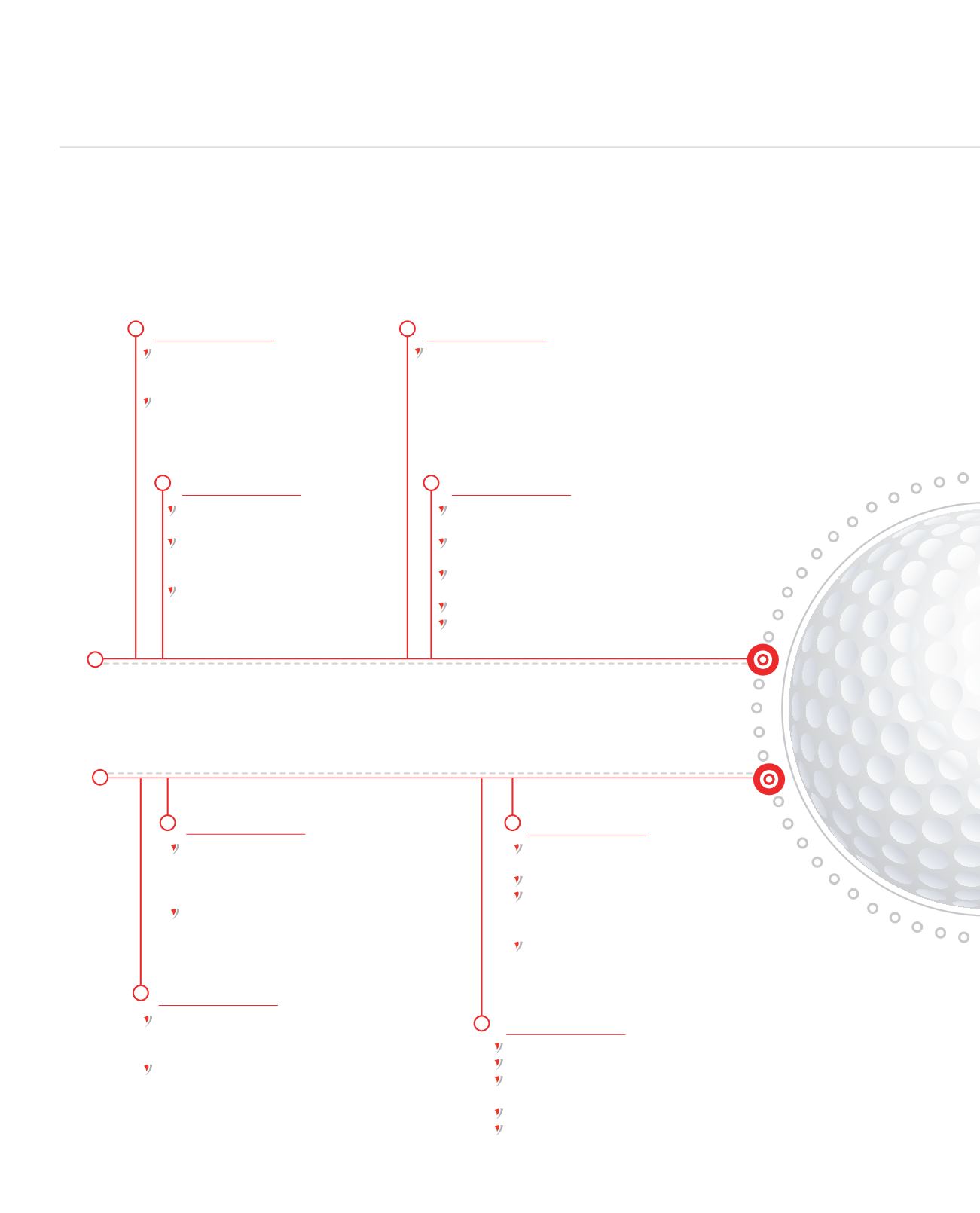

STRATEGIC INTENT - THE BANK’S CORE BUSINESS SEGMENTS

STRATEGY

OPPORTUNITIES

ACHIEVEMENTS

RISKS

GLOBAL BUSINESS

Geographic client diversification

in more than 121 countries

Presence at conferences and

roadshows to promote Mauritius

and AfrAsia Bank

Working with 164 intermediaries

in Mauritius and 134 based outside

Mauritius

To capture cross-border trade and

investment flows routed via the

Mauritius IFC

To be the reference bank for

intermediaries based in Mauritius

and other reputable IFCs

With Mauritius being the preferred jurisdiction

for cross-border investments, AfrAsia Bank

Limited will capture more of such flows by

working closely with Private Equity advisors,

lawyers, trade financiers, banks and others

Mauritius being ‘blacklisted’ by the OECD/

FATF/G20 countries

Existing Double Taxation Agreement (DTA)

renegotiation and amendments

Other IFCs extending their treaty network with

African countries

Changes in the legal and compliance framework

Country, Currency and Credit Risks

The number of clients increased by 30%

and deposits rose by 33% for this

Financial Year

The Bank was awarded ‘Best Wealth

Management Provider in Mauritius 2014’

and ‘Best Private Bank in Mauritius 2015’

by World Finance and Euromoney

respectively

To position AfrAsia Bank Limited as the

leading private bank for HNWI & UHNWI

locally and in the African region while

expanding its global reach

To craft tailor-made products and services

through the Bank’s open architecture

approach, all adapted to clients’ financial

aspirations

There is a growing number of HNWIs in the

region, including Africa

Tapping emerging middle-class in Africa

The risk aversion of foreign banks in the African

market creates prospects for Private Banks

highly regulated industry

Digitisation and mobile platform

Economic uncertainty prevailing

Political risks

Rapid technological advances resulting

into new competition

New products

Service levels

PRIVATE BANKING & WEALTH MANAGEMENT

RISKS

ACHIEVEMENTS

STRATEGY

OPPORTUNITIES

CORPORATE PROFILE AND STRATEGY (CONTINUED)