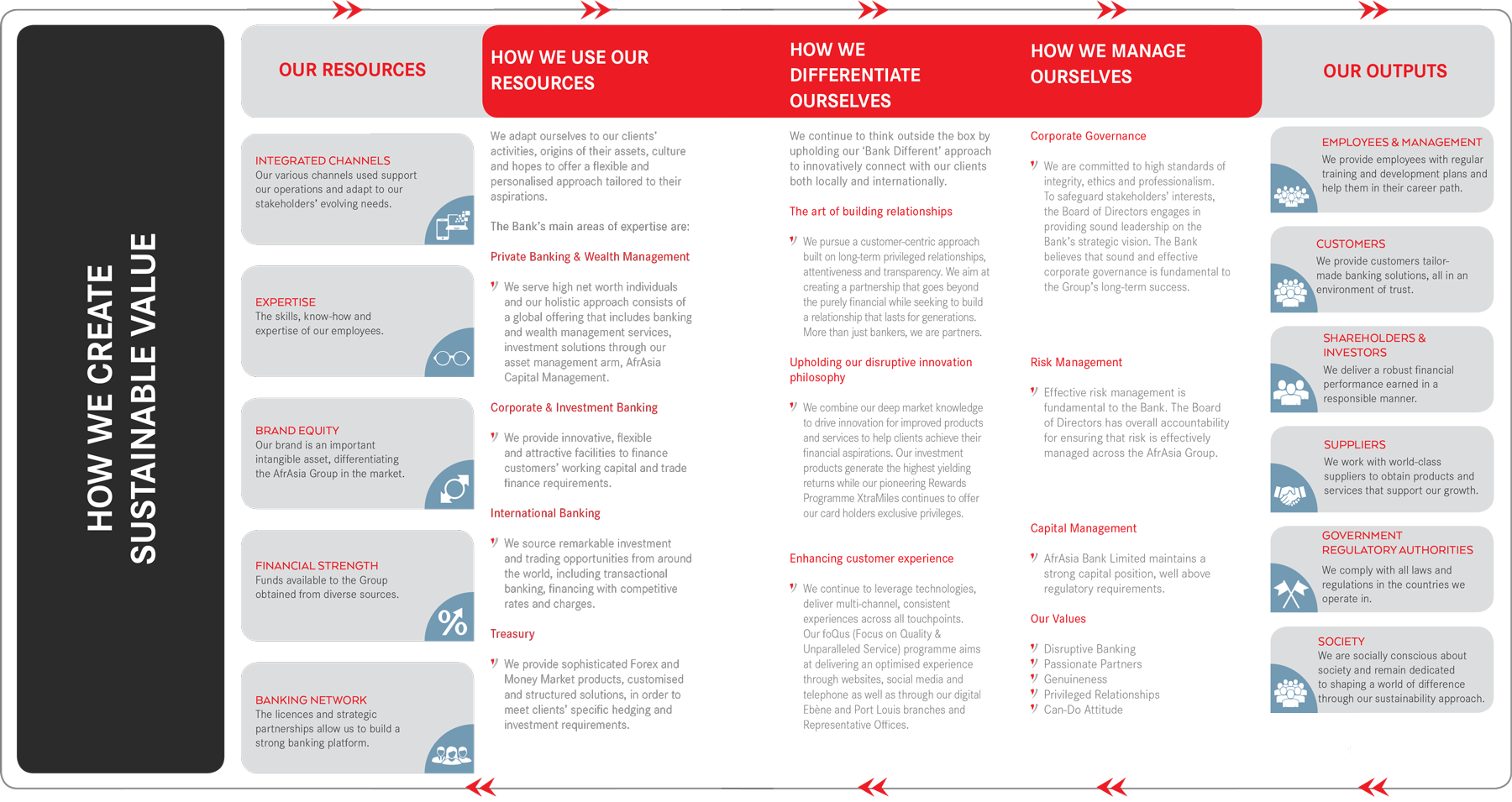

The Bank continues to gain experience and insight in its core markets which have contributed to increased revenue as well as prompted timely bold decisions:

- The unique business model and significant business growth have attracted international shareholder NBC (National Bank of Canada), now the second largest shareholder.

- Our African specialists continue to explore opportunities in the 'Hopeful Continent', connecting people, places, products and possibilities.

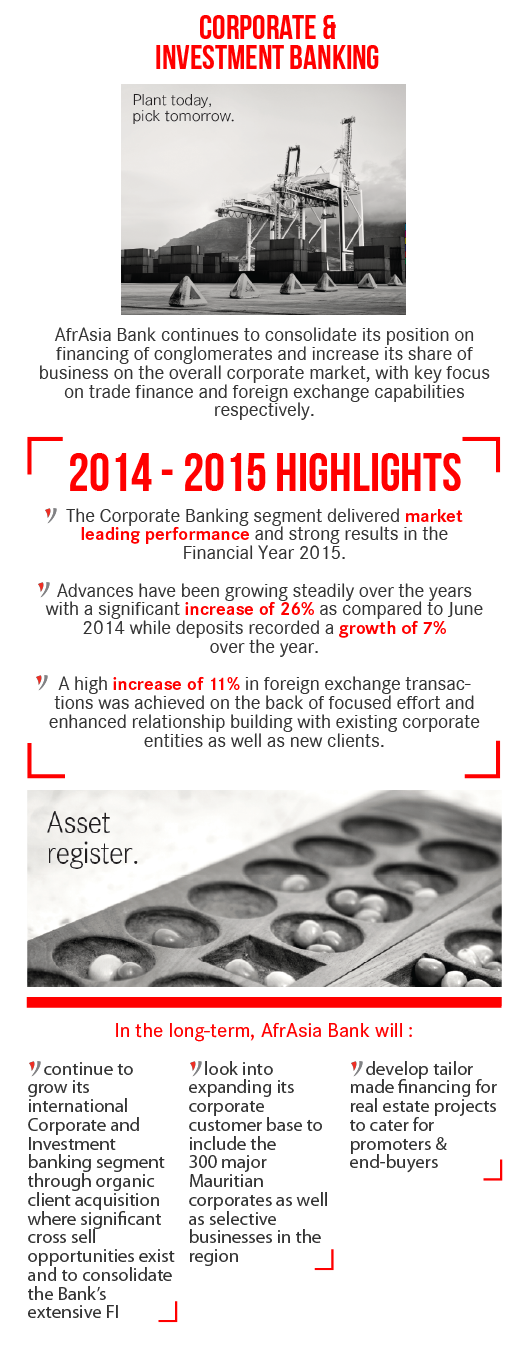

- Following macro-economic constraints in Zimbabwe, the Bank ceased its operations in the country in February 2015 from which time it had been working diligently to shore up liquidity and capital to provide tangible and sustainable solutions.

The Bank has continued to build upon its 'disruptive innovation' philosophy to achieve several milestones in this financial year:

- AfrAsia Bank Mauritius Open, first worldwide tri-sanctioned tournament between the European, Sunshine & Asian Tours.

- Deep-diving into the digital era at the Ebène branch (Mauritius).

- Launching the VISA prepaid card in Mauritius, a first in Central and Eastern Europe, Middle East and Africa (CEMEA).

The Bank continues to tell a successful brand story, resulting in customer storytelling, loyalty and strategic alliances:

- First to implement initiatives that mattered to our stakeholders, creating a unique experience in the market, generating meaningful differentiation from our competitors.

- Inspiring employees to become brand advocates and increasing the reach of our brand's messages.